Crypto Stocks Retreat on Bitcoin's Dip as Macroeconomic Concerns Linger

Cryptocurrency-related stocks dropped Friday as bitcoin lost momentum along with the broader set of risk assets on macroeconomic fears.

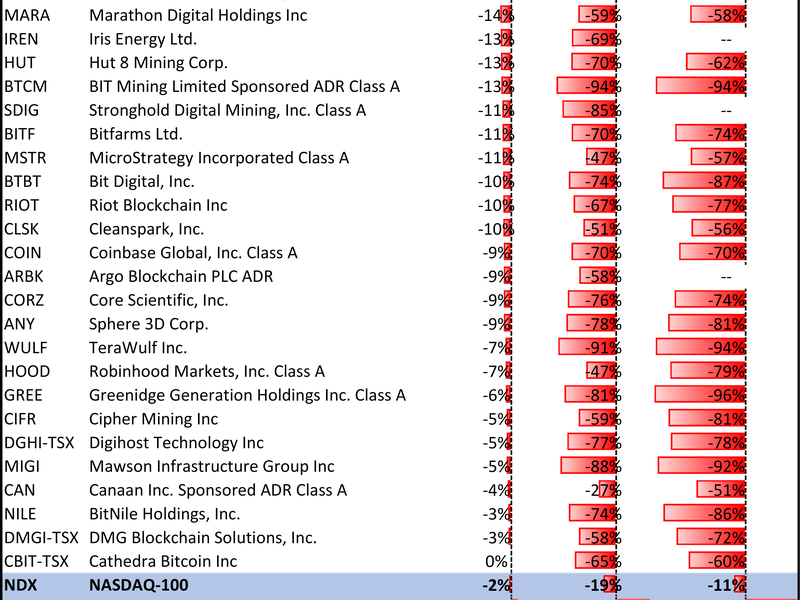

Hive Blockchain (HIVE), Marathon Digital (MARA) and Hut 8 Mining (HUT) led the group downward, with each falling at least 14%. Shares of crypto exchange Coinbase (COIN) were down about 10%, while MicroStrategy (MSTR), a software company that holds billions of dollars worth of bitcoin, fell over 10%.

Bitcoin's (BTC) drop below $22,000 Friday reversed recent gains spurred by the softer-than-expected U.S. inflation figure released last week. Sentiment worsened, however, after the Federal Reserve pushed back against expectations that inflation has peaked and that the central bank would slow the pace of interest-rate increases in the U.S. and adopt looser monetary policies in 2023.

Read more: Bitcoin Plunges Most in 2 Months, Dashing Recovery Hopes

Meanwhile, the Nasdaq Composite Index fell 2% while the S&P 500 dropped about 1.2% on Friday.

Friday's market lull comes after the strong performance in tech and crypto-linked stocks since mid-July. "We've seen a strong recovery in risk assets recently and perhaps we're seeing signs of exhaustion which some may argue is long overdue," Craig Erlam, senior markets analyst at Oanda, said in a note to clients Friday.

Crypto-exposed equities have been trading alongside tech stocks over the last year, impacting crypto names, according to Sylvia Jablonski, CIO of Defiance ETFs. "What happens in equity markets then bleeds down lately to crypto markets," she said Friday morning on CoinDesk TV.

Jablonski thinks the Fed needs to do more work to lower inflation, though she said harsh recessionary fears may not transpire. "Things are really OK for corporate America at the moment, so the fears are a little bit overblown," she said. Jablonski added that late summer is a tricky time for traders and market, though long-term investors can dabble in the market, whether it be owning cryptocurrencies or equities.

"It's definitely reasonable to buy these various asset classes on the dip," she said, while urging investors not to overextend themselves in owning one asset class.

Institutional investment continues to enter crypto, adding to a sign of optimism for some amidst the broader market worries. "Despite the macro economic downturn resulting in lower prices in the short term, the most adopted crypto projects won’t stay cheap for long," Marcus Sotiriou, analyst at digital asset broker GlobalBlock said in a note Friday.

UPDATE (Aug. 19 16:25): Updates to include market commentary, performance and adds chart of stocks.

Yahoo Finance

Yahoo Finance