Current Conditions Challenging for Pound

The British currency is approaching critical support levels. Risk management is necessary for the coming days.

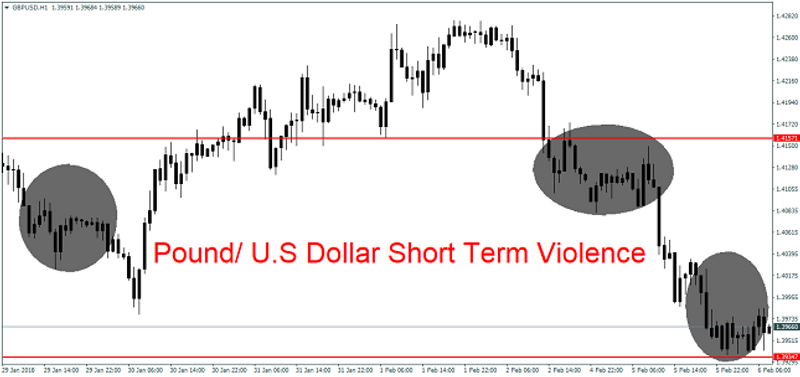

Pound Approaching Key Support Levels

Current market conditions are testing all traders and the value of the Pound has been confronted too. The British currency is trading below 1.40 against the U.S Dollar.

Important support for the Pound is near 1.38, which is above its September highs, and it is still above its recent relaunch upwards which began in earnest mid-December.

Pound is U.S Centric as Broad Markets Rattle

The Bank of England will be announcing their monetary policy summary on Thursday, but the Pound is trading in a U.S centric mode. Having made significant gains the past month and a half, some of the decline being experienced should have been expected.

The question is what will happen next in the volatile broad markets? The Pound remains valued well and may see more tests as its range searches for equilibrium. And risk management is essential for those who choose to trade in the coming days.

In the short term, we believe the Pound may be negative. The mid-term and Long term we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire

More From FXEMPIRE:

Market Snapshot – Bloodbath In Cryptos But Rebound Closeby, Stocks Fall

Natural Gas Price Fundamental Daily Forecast – Could Strengthen Over $2.810; Weather No Help

Technical Outlook of EUR/USD, GBP/USD, AUD/USD & USD/CAD: 06.02.2018

E-mini S&P 500 Index (ES) Futures Technical Analysis – February 6, 2018 Forecast

Yahoo Finance

Yahoo Finance