Our current pension system is unfair and unsustainable – here's how we can fix it

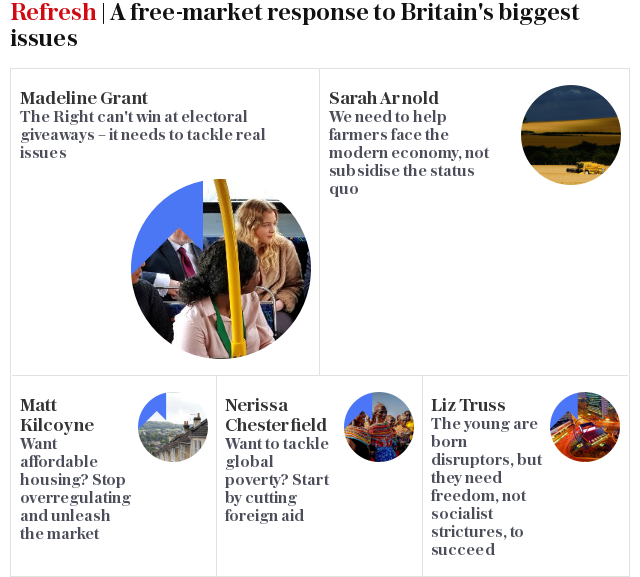

Welcome to Refresh – a series of comment pieces by young people, for young people, to provide a free-market response to Britain's biggest issues

Capitalism has, and continues, to deliver rising living standards across the globe. And with those higher living standards come longer and healthier lives.

This progress is absolutely something to be celebrated. However, it means there will be an increasing number of older people in our society: the proportion of people aged 85 and over is projected to double over the next 25 years.

This poses significant public policy challenges which, if left unaddressed, will deny today’s workers the comfortable and secure retirement they deserve – and place increasing burdens on the younger generation through higher taxes and less secure public services.

In a recent essay for the "New Blue" collection by the Centre for Policy Studies, I argued that we need a fair and sustainable system, which rewards people for doing the right thing and does not divert an ever-larger share of public spending away from other priorities.

Policy ideas are needed which make state support for the elderly more flexible and better targeted, and private pensions need further reform to ensure people are saving adequately for their retirement.

The system is regressive, with around three quarters of tax relief on pensions going to those earning upwards of £50,000

Since coming to power in 2010, the Conservatives have made great strides. The introduction of the new state pension will mean that many of those who got a bad deal out of the old system will be better off – including women, low earners and the self-employed. Automatic enrolment has led millions more people to start saving into a workplace pension. We need to build on this progress.

The current minimum contribution rates for auto-enrolment are nowhere near enough to deliver decent retirement outcomes. The Government should increase contribution rates to 12 per cent of salary in the 2020s. Median earners saving at this level could expect an annual retirement income of around £15,000 (including the state pension) – still a modest standard of living, but a big improvement.

To guard against opt-outs the government should consider raising minimum employer contributions beyond the minimum for employees. Lower earners could be given a third-way option of making a lower contribution without any corresponding reduction in their employer’s contribution.

The way we incentivise saving through the tax system also needs to change.

We currently spend around £41 billion each year on income tax and National Insurance relief for pension contributions – more than the budgets for schools in England or defence. The system is regressive, with around three quarters of tax relief on pensions going to those earning upwards of £50,000. It is a colossal misuse of public money.

A better system would be to have a simple flat-rate bonus system for both employer and employee contributions, regardless of income tax band. This could, for example, involve a 50 per cent bonus on the first £2,000 saved, with a further 25 per cent available on any additional contributions up to a maximum annual limit.

Similarly, we need to grasp the nettle of universal pensioner benefits.

Too many people do not know how much they need in retirement to achieve the standard of living they want

The system should provide generous support for vulnerable pensioners, and that support should be properly targeted. However, the current system means precious public funds are being spent on well-off pensioners. In fact, the richest fifth of pensioners on average receive a higher weekly income from benefits (including state pension) than the poorest fifth. This would be a shocking statistic even without the context of strained public finances.

If we are serious about addressing intergenerational fairness, we must recognise the unfairness of allowing higher-income pensioners to retain these entitlements while workers on an equivalent income lose their child benefit and their marriage allowance (to give just two examples).

We must also look at the £1 billion plus the Government foregoes in National Insurance contributions by exempting everyone above the state pension age.

To deliver the best possible living standards for tomorrow’s pensioners, we need to ensure people are saving enough, partly through giving them the right incentives and frameworks, and partly through better information and advice.

Too many people do not know how much they need in retirement to achieve the standard of living they want. So we need to create a system of retirement income targets, linked with the pensions dashboard, so savers can consider their personal retirement goals alongside information about all their current pension pots, with easy access to information and advice on what the options are for meeting those goals.

The experience of the 2017 election could easily lead the Conservative Party to conclude that, having had its fingers burnt on many of these issues, it should steer clear in future. That would be a betrayal of the next generation.

The Conservatives should be making the case for a sensible and just approach to pensions and retirement savings policy, which does right by young and old alike. It is an argument we need to be willing to have, and one I firmly believe we can win.

Paul Masterson is the Conservative MP for East Renfrewshire

For more from Refresh, including debates, videos and events, join our Facebook group and follow us on Twitter @TeleRefresh

Yahoo Finance

Yahoo Finance