CVS Health Corp (CVS) Reports Q1 2024 Earnings: Misses Analyst Forecasts Amid Medicare Challenges

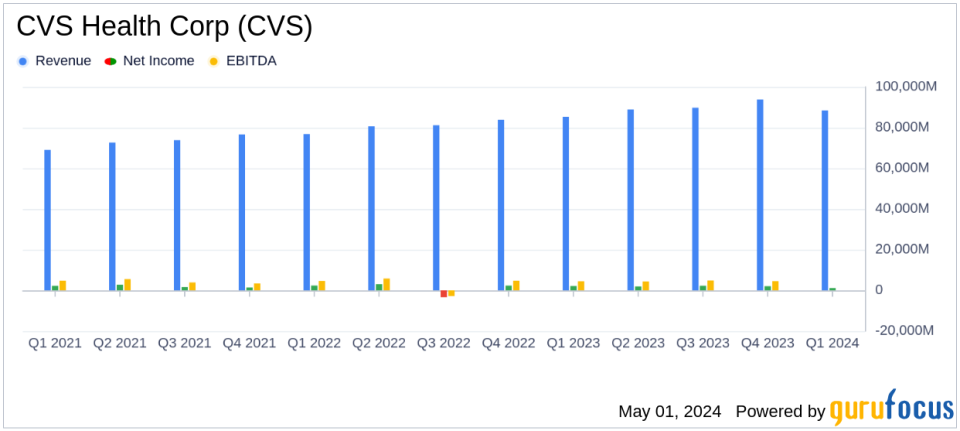

Revenue: Reached $88.4 billion, up 3.7% year-over-year, surpassing estimates of $89.21 billion.

Net Income: Reported at $1.124 billion, significantly below the estimated $2.168 billion.

Earnings Per Share (EPS): GAAP diluted EPS was $0.88 and Adjusted EPS was $1.31, both falling short of the estimated $1.69.

Operating Income: Decreased by 34.1% to $2.271 billion from the previous year's $3.446 billion.

Guidance Revision: Full-year GAAP diluted EPS guidance revised down to at least $5.64 from $7.06, and Adjusted EPS to at least $7.00 from $8.30.

Cash Flow: Generated $4.9 billion from operations, with revised full-year guidance reducing expected cash flow to at least $10.5 billion from $12 billion.

Segment Performance: Health Care Benefits and Pharmacy & Consumer Wellness segments showed growth, while Health Services segment declined due to loss of a large client and price improvements.

On May 1, 2024, CVS Health Corp (NYSE:CVS) disclosed its first-quarter financial results through its 8-K filing, revealing earnings that fell short of analyst expectations. The company reported a significant revision in its full-year earnings guidance, attributing the adjustment to ongoing challenges in its Medicare business.

Company Overview

CVS Health operates a comprehensive healthcare services platform, managing over 9,000 retail pharmacy stores across the U.S., and is the largest pharmacy benefit manager through its Caremark unit. It also runs a leading health insurance provider, Aetna, and recently expanded into primary care services with the acquisition of Oak Street Health. This diverse portfolio positions CVS Health uniquely in the healthcare sector, aiming to leverage synergies across its businesses to enhance service delivery and customer value.

Q1 Financial Performance

For the quarter ended March 31, 2024, CVS Health posted total revenues of $88.4 billion, a 3.7% increase year-over-year, driven by growth in the Health Care Benefits and Pharmacy & Consumer Wellness segments. However, this was overshadowed by a decline in the Health Services segment. The company's GAAP diluted earnings per share (EPS) was $0.88, down from $1.65 in the prior year, while adjusted EPS came in at $1.31, significantly below the analyst estimate of $1.69 and last year's $2.20.

The reduced earnings reflect heightened utilization pressure in the Medicare business, impacting the Health Care Benefits segment's performance. Operating income also saw a sharp decline to $2,271 million from $3,446 million in the previous year, a 34.1% decrease.

Revised Full-Year 2024 Guidance

Amid ongoing challenges, CVS Health revised its full-year 2024 guidance. The company now expects GAAP diluted EPS to be at least $5.64, down from the previous forecast of $7.06, and adjusted EPS to be at least $7.00, reduced from $8.30. Additionally, the forecast for cash flow from operations was adjusted to at least $10.5 billion from $12.0 billion previously anticipated.

Segment Performance and Challenges

The Health Care Benefits segment reported a 24.6% increase in revenues but faced a 59.9% drop in adjusted operating income due to increased Medicare utilization and the impact of lower Medicare Advantage star ratings. The Pharmacy & Consumer Wellness segment, however, saw a modest revenue increase of 2.9% and a slight improvement in adjusted operating income.

The Health Services segment experienced a 9.7% revenue decline, primarily due to the loss of a large client and ongoing price pressures in pharmacy services. This segment's challenges underscore the competitive and dynamic nature of the pharmacy benefits management industry.

Management Commentary

CEO Karen S. Lynch commented on the results, emphasizing the company's strategic assets and long-term potential despite near-term challenges. She stated:

The current environment does not diminish our opportunities, enthusiasm, or the long-term earnings power of our company. We are confident we have a pathway to address our near-term Medicare Advantage challenges. We remain committed to our strategy and believe that we have the right assets in place to deliver value to our customers, members, patients, and shareholders.

Investor and Analyst Perspectives

While CVS Health's first-quarter results and revised forecasts reflect significant operational and market challenges, particularly in its Medicare-related activities, the company's diversified business model and strategic acquisitions like Oak Street Health provide avenues for growth and stability. Investors and analysts will likely watch closely how CVS navigates the evolving healthcare landscape, especially in light of the pressures on its Medicare Advantage plans.

For detailed financial tables and further information, refer to the full 8-K filing by CVS Health Corp.

Explore the complete 8-K earnings release (here) from CVS Health Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance