If I’d put £5,000 into Nvidia stock at the start of June, here’s what I’d have now

There has been much media talk about a correction in Nvidia (NASDAQ: NVDA) stock recently. This is a decline of 10% or more in a share price from its most recent peak.

Normally, that wouldn’t be newsworthy material given that stocks ‘correct’ all the time. But in the case of Nvidia, due to its sheer size, its 13% dip equated to more than $500bn being shaved off its market value at one point in June.

That’s the market cap equivalent of three HSBCs and a Tesco!

Would this have been enough to wipe out gains for an investment made at the start of June?

Rising even higher

Amazingly, no. The share price started the month at a split-adjusted price of $109. As I write, it’s on course to end it at $124, representing a very respectable gain of 13.75%.

So, five grand invested around four weeks ago would now be worth £5,685 on paper. And the much-hyped correction? Well, that just put the stock back where it was in mid-June.

In other words, the recent pullback claimed approximately two weeks’ worth of gains. Nvidia stock is still up about 26,280% in a decade. So this drop was brief and insignificant in the grand scheme of things.

Warren Buffett says, “If you aren’t thinking about owning a stock for ten years, don’t even think about owning it for ten minutes.” Nvidia demonstrates why.

Mind-blowing margins

ChatGPT was released in November 2022, kicking off a tidal wave of spending on Nvidia’s graphics processing unit (GPUs). A significant portion of this has been from deep-pocketed cloud platforms like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud.

They’re investing massive sums to handle the increasing demand for cloud-based, AI-driven applications, which rely on the powerful processing capabilities of GPUs.

This huge demand has shown up dramatically in Nvidia’s financial statements. Revenue and profits have absolutely skyrocketed, demolishing Wall Street’s already lofty expectations along the way.

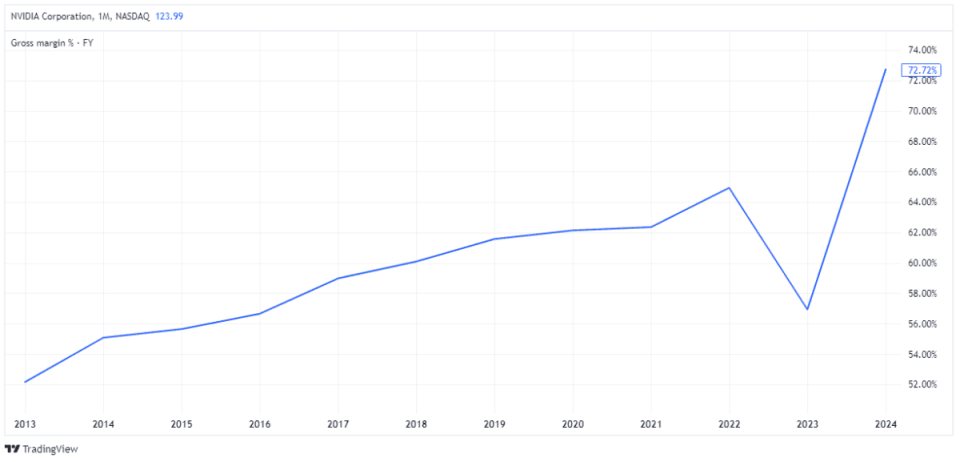

One metric that stands out to me is the incredible expansion in the company’s gross margin as demand has taken off. This rose above 72% in FY24!

As a reminder, gross margin is the percentage of revenue remaining after deducting the cost of goods sold. This figure not only highlights that costs are under control but also showcases Nvidia’s pricing power. Companies are paying top dollar to get their hands on these golden GPUs.

Competition is coming

However, we know this won’t always be the case, at least not on this scale. Supply will catch up with demand and Nvidia’s red-hot rate of growth will cool dramatically.

Moreover, large cloud providers (its biggest customers) are increasingly designing their own AI chips to reduce reliance on Nvidia. Though I expect the company will remain a major player, this is likely to create a trickier competitive landscape moving forward.

AI bubble?

We’ll only know with the benefit of hindsight whether we’re in an AI bubble right now. If we are, then I’d expect a massive fall in Nvidia stock over the next few years as the bubble deflates or even pops.

Right now, I’d rather get Nvidia exposure through tech-focused investment trusts or simply invest in cheaper AI-related stocks. There are plenty to choose from.

The post If I’d put £5,000 into Nvidia stock at the start of June, here’s what I’d have now appeared first on The Motley Fool UK.

More reading

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. HSBC Holdings is an advertising partner of The Ascent, a Motley Fool company. Ben McPoland has positions in Alphabet and HSBC Holdings. The Motley Fool UK has recommended Alphabet, Amazon, HSBC Holdings, Microsoft, Nvidia, and Tesco Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance