D.R. Horton (DHI) Q2 Earnings & Revenues Top, Lifts View

D.R. Horton, Inc. DHI came up with yet another solid performance in the second quarter of fiscal 2018. Earnings and revenues surpassed the Zacks Consensus Estimate, courtesy of a solid housing market scenario. Shares of the homebuilder have increased more than 2% in the pre-market trading session after the earnings release..

Earnings & Revenues Discussion

The company reported earnings of 91 cents per share, surpassing the Zacks Consensus Estimate of 86 cents by 5.8%. Earnings increased from the year-ago profit level of 60 cents.

Total revenues (Homebuilding, Forestar and Financial Services) were $3.79 billion. The figure beat the Zacks Consensus Estimate of $3.75 billion and increased 16.7% year over year.

Home Closings and Orders

Homebuilding revenues of $3.7 billion increased 16% from the prior-year quarter. Home sales increased 16.3% year over year to $3.67 billion, aided by higher home deliveries. Land/lot sales and other revenues were $13.6 million, up from $6.3 million a year ago.

Home closings increased 15% to 12,281 homes and 16.3% to $3.7 billion in value. The company registered growth across all regions comprising East, Midwest, Southeast, South Central, Southwest and West.

Net sales orders increased 13% to 15,828 homes on continued improvement. Orders increased across all operating regions. The value of net orders grew 13% to $4.7 billion. The cancellation rate was 19%, compared with 20% in the prior-year quarter.

Quarter-end sales order backlog (under contract) increased 8.4% to 15,841 homes. Backlog value increased 9% to $4.8 billion.

Revenues at the Financial Services segment increased 9.2% to $94.9 million. Forestar contributed $22.6 million to the quarterly revenues.

Margins

The company’s consolidated pre-tax profit margin expanded 80 basis points to 11.7% in the quarter.

Balance Sheet

D.R. Horton’s cash, cash equivalents and restricted cash totaled $1,010.8 million as of Mar 31, 2018 compared with $1,007.8 million as of Sep 30, 2017.

Fiscal 2018 Guidance

The company has increased its consolidated revenue guidance to the range of $15.9-$16.3 billion from the prior expectation of $15.5-$16.3 billion. Homes closing are now expected to fall between 51,500 and 52,500 units (versus 50,500-52,500 units expected earlier). Homebuilding SG&A expenses, as a percentage of homebuilding revenues, are reaffirmed at around 8.7%.

D.R. Horton has updated its home sales gross margin forecast to 20.5-21% (versus 20.5-21% expected earlier).

Consolidated pre-tax profit margin is now expected to be approximately 12.1-12.3% (compared with 11.8-12% expected earlier).

Cash flow from operations is expected to be at least $800 million, excluding Forestar (versus previous expectation of $700).

D.R. Horton expects income tax rate of approximately 25% and share count increase of less than 1%.

Zacks Rank

D.R. Horton carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

PulteGroup Inc. PHM reported impressive first-quarter 2018 results, wherein both earnings and revenues surpassed the Zacks Consensus Estimate.

NVR, Inc. NVR also reported solid first-quarter 2018 results, wherein both earnings and revenues surpassed the Zacks Consensus Estimate.

Lennar Corporation LEN surpassed earnings and revenues expectations in the first quarter of fiscal 2018. Its top and bottom line grew considerably primarily on higher orders, along with improved gross margins and SG&A expenses.

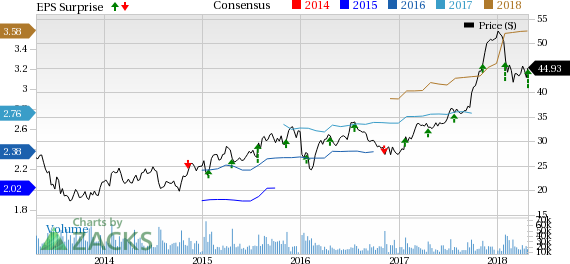

D.R. Horton, Inc. Price, Consensus and EPS Surprise

D.R. Horton, Inc. Price, Consensus and EPS Surprise | D.R. Horton, Inc. Quote

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance