Danaher (DHR) Stock Rises 38% YTD: What's Driving the Rally?

Price performance of Danaher Corporation DHR has been impressive year to date, which is evident from 37.8% gain in its shares. Healthy fundamentals, solid growth opportunities and impressive financial performances supported positive market sentiments for this stock.

The Washington-based company belongs to the Zacks Diversified Operations industry. It currently carries a Zacks Rank #3 (Hold). The company’s earnings in the next five years are predicted to rise 11.6%, way higher than the industry’s 9.6% growth.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Year to date, Danaher has outshined its industry’s growth of 15% and the S&P 500’s improvement of 15.4%.

It is worth mentioning here that the company has reported better-than-expected results for three quarters in a row so far in 2019. Average positive earnings beat for these three quarters (including the fourth quarter of 2018 and the first two quarters of 2019) was 3.4%. Notably, its earnings in the last reported quarter surpassed estimates by 3.48%.

Factors Driving the Stock

We believe that rising global demand for air travel, demand from defense and governmental fronts, infrastructure development, technological upgrade in manufacturing processes, and changes in tax policies are benefiting the industry players. Such tailwinds placed the industry in top 11% (with the rank of 28) of more than 250 Zacks industries.

Healthy operating conditions in the industry along with company-specific factors are benefiting Danaher. The zeal for innovation and focus on product quality are aiding the company. Further, solid demand for products, including iCELLis bioreactor system, DxH 900 analyzer, Esko, X-Rite, ChemTreat and others, are among prime top-line drivers. Also, the company gains from the effective implementation of Danaher Business System (“DBS”).

In addition, shareholder-friendly policies raise the stock’s attractiveness. Dividend payment is a popular way of boosting stakeholders’ wealth. Notably, the quarterly dividend rate has been hiked by 6% in March 2019.

The acquisitive nature of Danaher has been boosting growth opportunities. In January 2019, the company acquired Labcyte Corporation, thus strengthening its automation capabilities. It also agreed to acquire General Electric Company's GE BioPharma business in February. Upon completion in fourth-quarter 2019, the BioPharma buyout will add value to Danaher’s biologics workflow solutions of the Life Sciences segment. Further, the divestment of the dental business into an independent publicly-trading company will work in the best interest of shareholders.

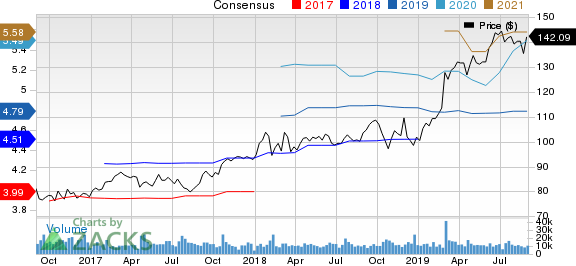

Earnings estimates for Danaher have been raised in the past 60 days, reflecting positive sentiments about its growth prospects. Currently, the Zacks Consensus Estimate for its earnings is pegged at $4.79 for 2019 and $5.49 for 2020, reflecting growth of 0.4% and 0.7% from the respective 60-day-ago figures.

Danaher Corporation Price and Consensus

Danaher Corporation price-consensus-chart | Danaher Corporation Quote

Danaher’s Performance Versus Three Peers

Danaher has outperformed many industry peers so far in 2019. Two such stocks are Honeywell International Inc. HON and United Technologies Corporation UTX, with respective year-to-date gains of 24.6% and 22.3%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Danaher Corporation (DHR) : Free Stock Analysis Report

United Technologies Corporation (UTX) : Free Stock Analysis Report

Honeywell International Inc. (HON) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance