Danaher Gains From Rising Product Demand Despite High Costs

We issued an updated research report on Danaher Corporation DHR on Aug 19.

The conglomerate, with a market capitalization of $100.7 billion, currently carries a Zacks Rank #3 (Hold).

Below we discussed why it will be prudent for investors to hold on to this stock for now.

Factors Favoring Danaher

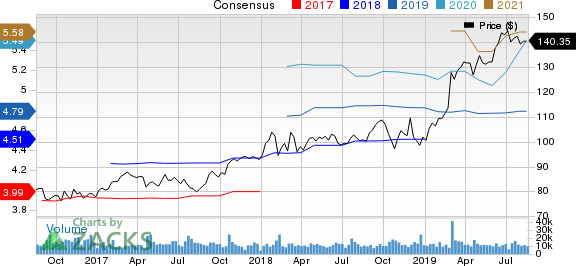

Share Price Performance & Earnings Estimates: The company reported better-than-expected results in the last four quarters, the average positive earnings surprise being 3.25%. In the last reported quarter, its earnings of $1.19 surpassed the Zacks Consensus Estimate of $1.15.

In the past three months, the company’s share price has gained 7.7% against the industry’s decline of 3.2%.

Danaher anticipates gaining from its focus on product innovation, superior product quality, building efficient workforce and enhancing shareholder value. Also, elevated demand for products — including iCELLis bioreactor system, DxH 900 analyzer, Esko, X-Rite, ChemTreat and others will be beneficial. For 2019, the company has risen its earnings guidance from $4.72-$4.80 to $4.75-$4.80 per share. It predicts the bottom line at $1.12-$1.15 per share in the third quarter, whereas it witnessed $1.10 in the year-ago quarter.

Also, the Zacks Consensus Estimate for the company’s earnings for 2019 and 2020 has been raised in the past 30 days. Earnings estimates are pegged at $4.79 for 2019 and $5.49 for 2020, reflecting growth of 0.2% and 0.5% from the respective 30-day-ago figures.

Danaher Corporation Price and Consensus

Danaher Corporation price-consensus-chart | Danaher Corporation Quote

Shareholders-Friendly Policies: Danaher uses capital for product development, capacity expansion, acquisitions and rewarding shareholders handsomely. The company paid out dividends of $233.9 million in the first half of 2019, up from $209.3 million paid out in the year-ago comparable period.

Notably, Danaher raised its quarterly dividend rate by 6% to 17 cents in March 2019. On an annualized basis, the dividend payout rose to 68 cents per share.

Buyouts: The company has been fortifying its product portfolio and leveraging business opportunities through the addition of assets. It used $326.6 million on acquisitions in the first half of 2019. Also, buyouts boosted its sales by 1% in the second quarter.

In January 2019, Danaher agreed to buy General Electric Company's GE BioPharma business and acquired Labcyte Corporation. The BioPharma buyout is predicted to be completed in the fourth quarter of 2019. This buyout is expected to strengthen Danaher’s biologics workflow solutions of the Life Sciences segment.

Factors Working Against Danaher

Over-Valued Stock: The company’s shares currently seem overvalued compared with the industry, using the P/E (TTM) valuation method. The stock’s three-month P/E multiple is 30.25x, higher than the industry’s multiple of 19.94x. Also, the stock is currently trading higher than the industry’s three-month multiple of 20.90x. This makes us cautious about the stock.

Forex Woes: Geographical diversification is reflective of a flourishing business of the company. However, this diversity exposed it to headwinds arising from geopolitical issues and unfavorable movements in foreign currencies. In the second quarter of 2019, forex woes adversely impacted its sales growth by 3%. Persistence of such issues might be concerning for the company.

Costs and Other Woes: Danaher has been suffering from risks arising from higher costs and expenses. In the first half of 2019, its cost of sales rose 5.3% year over year while both selling, general and administrative, and research and development expenses grew 3.6%. High costs and expenses, if uncontrolled, might be detrimental to the company’s margins.

Dilutive impact of funds raised through the issuance of common and preferred shares for funding the BioPharma buyout might also impact Danaher’s earnings. Further, high debts, roughly $10.1 billion at the end of second-quarter 2019, increased financial obligations and impact the company’s profitability.

Stocks to Consider

Two better-ranked stocks in the industry are Griffon Corporation GFF and Carlisle Companies Incorporated CSL. While Griffon currently sports a Zacks Rank #1 (Strong Buy), Carlisle Companies carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for the two stocks have improved for the current year. Further, average earnings surprise for the last four quarters was 51.66% for Griffon and 17.16% for Carlisle Companies.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

General Electric Company (GE) : Free Stock Analysis Report

Danaher Corporation (DHR) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance