Daniel Loeb's Strategic Embrace of Apple Inc in Q2 2024

Insight into Loeb's Latest 13F Filings and Major Portfolio Adjustments

Daniel Loeb (Trades, Portfolio), the founder of Third Point LLC, is renowned for his sharp investment strategies and influential public letters that often challenge the status quo of major corporations. With a focus on activist investing, Loeb seeks to unlock value by advocating for significant changes within companies. His latest 13F filing for the second quarter of 2024 reveals a series of calculated moves, prominently featuring a substantial new stake in Apple Inc.

Summary of New Buys

Daniel Loeb (Trades, Portfolio)'s recent acquisitions include 11 new stocks, highlighted by significant investments in high-profile companies:

Apple Inc (NASDAQ:AAPL) leads as the top new entry with 1,950,000 shares, making up 4.7% of the portfolio, valued at $410.71 million.

Amphenol Corp (NYSE:APH) follows with 2,800,000 shares, representing 2.16% of the portfolio, totaling $188.64 million.

KB Home (NYSE:KBH) rounds out the top three, with 2,100,000 shares or 1.69% of the portfolio, valued at $147.38 million.

Key Position Increases

Loeb has also strategically increased his holdings in several companies, with notable expansions in:

Taiwan Semiconductor Manufacturing Co Ltd (NYSE:TSM), where an additional 850,000 shares were purchased, increasing the total to 2,025,000 shares. This adjustment marks a 72.34% increase in share count and impacts the portfolio by 1.69%, with a total value of $351.97 million.

Uber Technologies Inc (NYSE:UBER) saw an addition of 1,600,000 shares, bringing the total to 2,100,000 shares. This represents a 320% increase in share count, with a total value of $152.63 million.

Summary of Sold Out Positions

The second quarter also saw Loeb exiting positions in six companies, including:

S&P Global Inc (NYSE:SPGI), where all 335,000 shares were sold, impacting the portfolio by -1.82%.

Marvell Technology Inc (NASDAQ:MRVL), with all 1,525,000 shares liquidated, resulting in a -1.38% portfolio impact.

Key Position Reductions

Reductions were made in several key holdings, notably:

Alphabet Inc (NASDAQ:GOOGL) saw a reduction of 1,020,000 shares, a 34% decrease, impacting the portfolio by -1.96%. The stock traded at an average price of $168.57 during the quarter.

Microsoft Corp (NASDAQ:MSFT) was reduced by 185,000 shares, a 10.48% decrease, impacting the portfolio by -0.99%. The stock's average trading price was $422.32 during the quarter.

Portfolio Overview

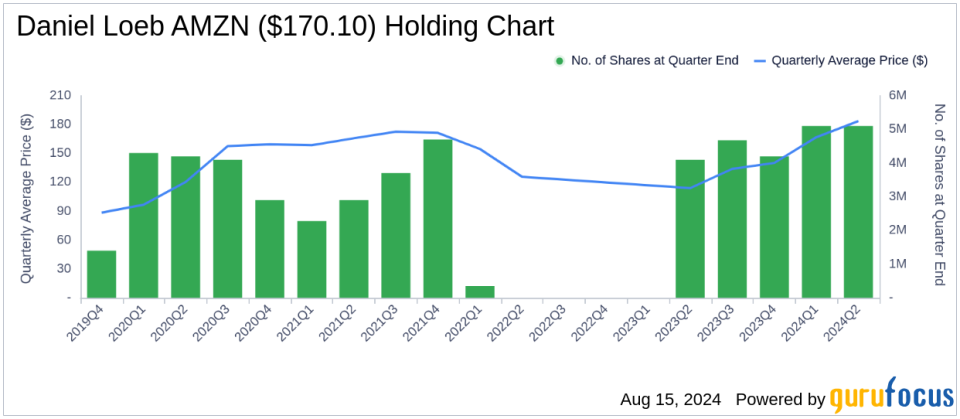

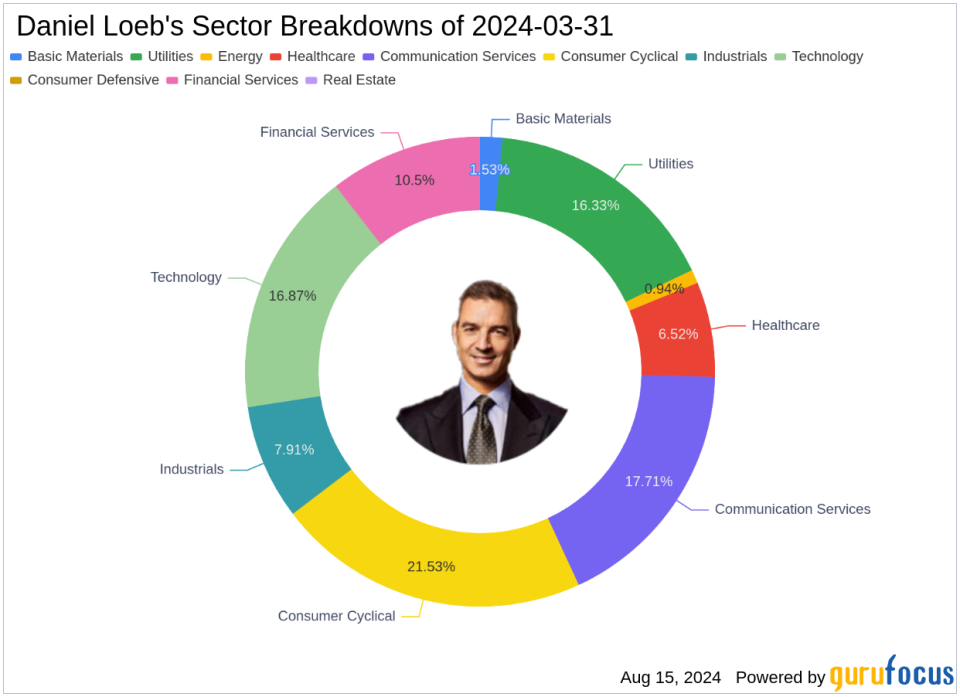

As of the second quarter of 2024, Daniel Loeb (Trades, Portfolio)'s portfolio comprises 44 stocks. The top holdings include 11.28% in Amazon.com Inc (NASDAQ:AMZN), 10.74% in PG&E Corp (NYSE:PCG), and 8.08% in Microsoft Corp (NASDAQ:MSFT). The portfolio shows a strong concentration in sectors such as Technology, Consumer Cyclical, and Communication Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.