Datadog (DDOG) to Report Q1 Earnings: What's in the Cards?

Datadog DDOG is set to release its first-quarter 2023 results on May 4.

For the first quarter of 2023, Datadog anticipates revenues between $466 million and $470 million. The Zacks Consensus Estimate for the same is currently pegged at $468.29 million, suggesting 28.99% growth from the year-ago period.

Non-GAAP earnings are expected in the range of 22-24 cents per share. The Zacks Consensus Estimate for earnings has remained unchanged at 23 cents per share over the past 30 days, indicating a decline of 4.17% from the year-ago period.

Markedly, Datadog’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average being 69.95%.

Let’s see how things have shaped up prior to this announcement.

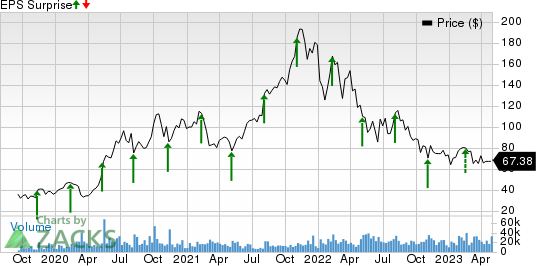

Datadog, Inc. Price and EPS Surprise

Datadog, Inc. price-eps-surprise | Datadog, Inc. Quote

Factors to Consider

Datadog’s quarterly performance is likely to have benefited from increased adoption of its cloud-based monitoring and analytics platform, owing to the accelerated digital transformation and cloud migration across organizations.

Significant investments in sales and marketing to engage customers, increase brand awareness and drive adoption of its platform and products are likely to have resulted in a growing customer base in the to-be-reported quarter.

In the fourth quarter of 2022, Datadog had about 2,780 customers with an annual run rate of $100K or more, up from 2,010 in the year-ago quarter.

As of the end of the fourth quarter, 81% of customers used two or more products, up from 78% in the year-ago quarter. Additionally, 42% of customers utilized four or more products, up from 33% in the year-ago quarter.

Datadog’s dollar-based retention rate was above 130% for the 22nd consecutive quarter, driven by the mission-oriented nature of the platform.

Datadog now has more than 600 integrations, which include latest products like AWS, GCP and Azure.

The company launched services like Observability Pipelines for customers to collect and change data from any source to any destination and Audit trail for compliance and governance goals. These platforms are expected to have boosted clientele growth in the to-be-reported quarter.

What Our Model Indicates

According to the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Datadog has an Earnings ESP of +2.86% and a Zacks Rank #4 (Sell) at present. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are some stocks worth considering, as our model shows that these have the right combination of elements to beat on earnings this season.

Carvana CVNA has an Earnings ESP of +19.16% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

CVNA is scheduled to release its first-quarter 2023 results on May 4. The Zacks Consensus Estimate is pegged at a loss of $1.91 per share, suggesting an increase of 33.91% from the prior-year quarter’s reported figure.

Jack In The Box JACK has an Earnings ESP of +4.09% and a Zacks Rank #2 at present.

JACK is set to report second-quarter fiscal 2023 results on May 17. The Zacks Consensus Estimate for JACK’s earnings is pegged at $1.16 per share, flat year over year.

Shift Technologies SFT has an Earnings ESP of +33.75% and a Zacks Rank #2 at present.

SFT is scheduled to release its first-quarter fiscal 2023 results on May 11. The Zacks Consensus Estimate is pegged at a loss of $3.22 per share, suggesting an increase of 54% from the prior-year quarter’s reported figure.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Janus Henderson Sustainable & Impact Core Bond ETF (JACK) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report

Datadog, Inc. (DDOG) : Free Stock Analysis Report

Shift Technologies, Inc. (SFT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance