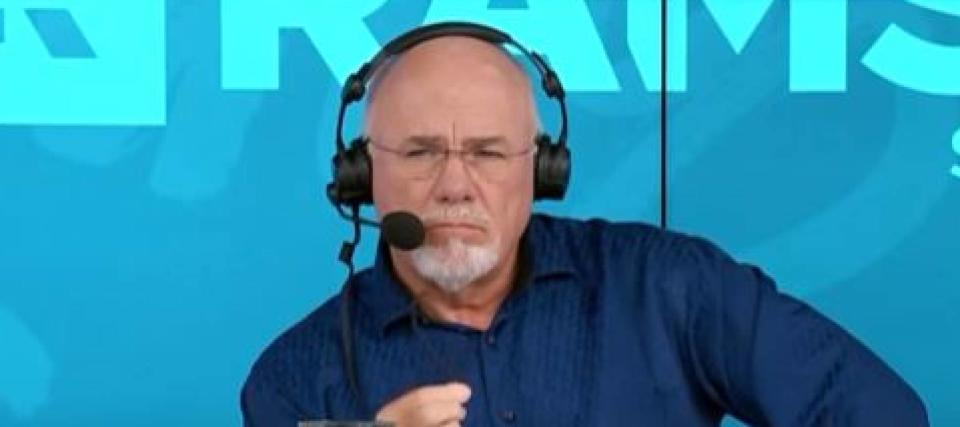

Dave Ramsey got slapped with a $150M lawsuit over his promotion of a timeshare-exit firm — by a group of his own listeners. Here are the 5 top risks of a timeshare 'investment'

Dave Ramsey and his company Ramsey Solutions have been sued for $150 million over their endorsement of a timeshare-exit company that allegedly “defrauded” people desperate to shed their timeshare shackles.

The lawsuit, filed in April by some listeners of The Ramsey Show in the U.S. District Court for the Western District of Washington, accuses the personal finance guru of negligent misrepresentation and promoting “deceptive, incomplete and false information” in violation of consumer protection laws.

Don't miss

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2023

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

You could be the landlord of Walmart, Whole Foods and CVS (and collect fat grocery store-anchored income on a quarterly basis)

Ramsey — who has long branded timeshares a “scam” and has warned people to “stay far, far away” — previously told listeners who’ve bought into a timeshare (but wish they hadn’t) there was a way out.

He's accused of endorsing a Washington state-based company called Timeshare Exit Team — now operating as Reed Hein & Associates — which promised to help customers terminate their timeshare contracts or get their money back if unsuccessful.

Trusting Ramsey’s advice, the plaintiffs in the lawsuit claim to have spent between $4,000 and $72,000 for “illusory services” from the timeshare-exit firm — and they say they never got out of their timeshare contracts or got their money back.

The lawsuit also accuses Ramsey of unjust enrichment, claiming that the personal finance guru raked in more than $30 million between 2015 to 2021 by promoting the company.

Aside from the fact that it’s almost impossible to cut ties with your timeshare, here’s four more reasons why you might think twice before investing one.

Low investment value

The average price of buying into a weekly timeshare is $23,940, according to the American Resort Development Association (ARDA).

Aside from a guaranteed week of vacation at the property every year, what does that significant investment get you? Not much when compared to the advantages of owning a vacation property outright.

When you own your second home or vacation property, you can build equity in your home as you pay off your mortgage and you can generate positive cash flow by renting your property out.

You can’t build equity in a timeshare. Instead, what you’re buying is a right to use a vacation property for a specific amount of time.

Also, as you share ownership of your holiday unit with other investors, you’re not free to do whatever you please with the unit. You can’t rent it out when you’re not staying there — and if you want to rent the property during your allotted time slot, there are a lot of hoops you’ll have to jump through first.

Financing can be pricey

If you don’t have thousands of dollars stashed away in cash to purchase your timeshare, you’re not alone. Many people have to borrow money and fall into debt to make this happen.

There are multiple financing options available to you, including short-term personal loans and financing through the timeshare company — but it’s important to remember that you’ll also pay interest on those loans.

Personal loan interest rates typically start as low as 4% APR but can go up to 36% — the rate you get will depend on your credit score, income and other factors.

Some people may also use a credit card or a home equity line of credit (HELOC) to purchase a timeshare — but again, this strategy can be risky if you’re unable to meet your principal and interest payments.

Read more: 3 big mistakes people make with cash back credit cards that cost them every time they swipe

Annual fees

When you buy into a timeshare, you also commit to paying annual dues to cover the cost of maintaining the property — and timeshare maintenance fees can increase over time, sometimes faster than inflation.

Timeshare maintenance fees are about $1,000 per year on average, according to research published by ARDA — but this will vary depending on the size of the property in question and other factors.

On top of that, you may have to cover extra costs or special assessments if the home needs upgrades or repairs that can’t be paid for using reserve funds from timeshare owners’ annual fees.

If owners can’t afford these costs, the quality of the timeshare resort may decline — dragging the value of your investment down with it.

Little or no resale value

Timeshares typically decrease in value, even if they’re in a highly desirable location.

The Timeshare Consumer Association (TCA) states: “Realistically, timeshares lose all monetary value from the moment they are bought.”

They're also notoriously hard to resell because the market is saturated and more timeshares are being built and offered all the time. This means supply outweighs demand, which does not work in favor of the seller.

“Even if you do manage to sell off a timeshare eventually, expect a price considerably lower than what you paid,” the TCA explains.

That’s a tough pill to swallow when you consider the thousands of dollars somebody shelled out for maintenance fees over the years, on top of the initial investment.

Timeshares are long-term commitments that are hard to back out of. Some owners are so desperate to shed their timeshares that they end up giving them away for as little as $1 — hurting other owners’ chances of selling at a profit or breaking even.

What to read next

Worried about the economy? Here are the best shock-proof assets for your portfolio. (They’re all outside of the stock market.)

Americans are paying nearly 40% more on home insurance compared to 12 years ago — here's how to spend less on peace of mind

It's going to be ugly': This CEO issued a dire warning about U.S. real estate, saying areas will be 'destroyed' — but he still likes 1 niche. What it is, and more smart ways to invest

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.