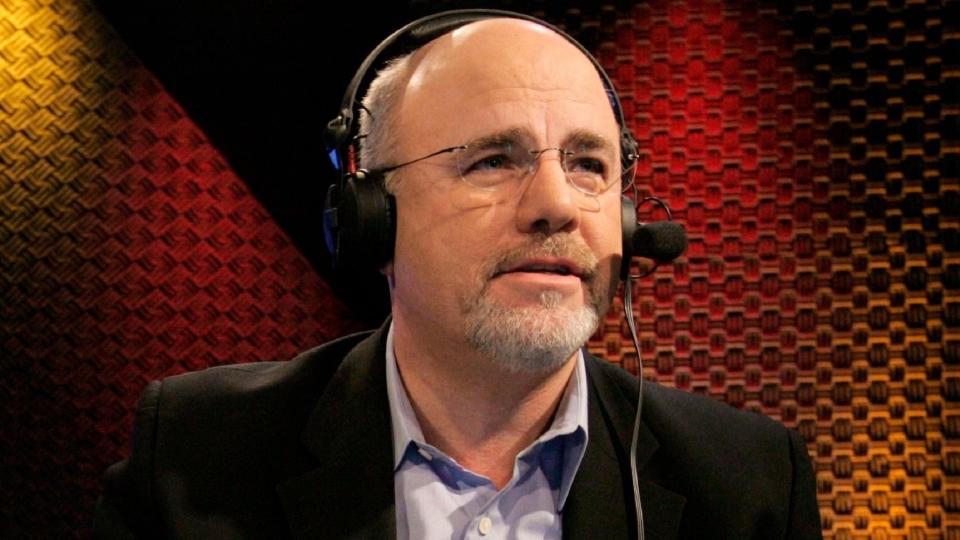

Dave Ramsey Says These 12 Lies Keep People in Debt

A recent Federal Reserve Bank of New York report showed that households had $212 billion in debt during the last quarter of 2023. Whether you’re struggling with credit cards, student debt or auto loans, you might believe several misconceptions that keep you stuck. On his blog, the financial guru Dave Ramsey debunked these 12 common lies about debt.

Check Out: I’m Part of the Upper Middle Class: Here’s What My Finances Look Like

Read Next: Owe Money to the IRS? Most People Don’t Realize They Should Do This One Thing

1. A Debt-Free Lifestyle Is Scary

Living without borrowing money might appear uncomfortable, but drowning in debt is scarier. Ramsey explained that you could still use cash and a debit card for everyday purchases.

2. Debt Is No Big Deal

While monthly payments might seem affordable, the long-term costs include interest, fees and missed opportunities. To see the big deal, consider the total borrowing cost versus the return you could receive by investing the cash instead.

3. Budgeting Limits Your Freedom

Rather than feeling like a budget limits you, consider that the plan gives you better control and can even help you find spare cash. Ramsey highlighted how budget apps can make the task more convenient.

4. Debt Is Normal or Maybe Helpful

Although the majority of Americans are in debt, Ramsey disagreed that this is normal or financially beneficial. By changing your lifestyle to avoid debt, you’ll avoid the stress and financial dangers.

5. You Can’t Afford to Live Without Debt

Your current income shouldn’t stop you from getting rid of debt. Ramsey suggested seeking a promotion or pay increase at your current job or taking on side hustles to speed up the payoff process.

6. There’s Plenty of Time to Prepare Your Finances for the Future

Delaying decisions to prepare for your future and manage money responsibly will only keep you stuck. Ramsey suggested using his 7 Baby Steps program immediately to tackle debt, save and invest.

7. Making Sacrifices Isn’t Worth It

Saying “no” to nonessentials, selling possessions or cutting overall spending can seem frustrating in the short term. However, Ramsey agreed it’s worth it to escape debt and free up your income.

8. You Need to Keep Up Appearances

Spending cash to keep with others often just leaves you broke. Ramsey wrote, “If you want to stop being in debt, then don’t let people who are in debt be your role models.”

9. Your Spouse Doesn’t Need To Be on the Same Page

Ramsey advised that you should always consider your and your partner’s finances to be combined. Because of that, you both should commit to and work toward getting rid of debt.

10. “I Want It, and I Want It Now!”

Insisting on buying things outside your budget is an easy path toward burdensome monthly payments and interest. Ramsey wrote, “Here’s the deal: If you can’t pay cash for it, you can’t afford it.”

11. A Credit Card Is Essential for Emergencies

While convenient, using a credit card for emergencies can lead to long-term financial trouble plus high-interest costs. Ramsey suggested a hefty emergency savings fund is what you really need.

12. Becoming Debt-Free Is Impossible

Although it requires major effort, getting out of debt is achievable with the right attitude and strategies. Start with budgeting wisely and consider the debt snowball method that Ramsey suggests.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey Says These 12 Lies Keep People in Debt

Yahoo Finance

Yahoo Finance