David Herro's Strategic Moves in Q1 2024 Highlight CNH Industrial NV's Impact

Insight into Herro's Latest Portfolio Adjustments and Key Stock Performances

David Herro (Trades, Portfolio), a seasoned investment manager at Harris Associates and a recognized figure in international equity investments, has recently disclosed his N-PORT filing for the first quarter of 2024. Herro, who has been at the helm of the Oakmark International Fund since 1992, is known for his strategic investment philosophy that focuses on purchasing undervalued companies with strong management teams poised for growth. His approach has earned him accolades such as Morningstars International Stock Fund Manager of the Year in 2006 and Manager of the Decade for 2000-09.

Summary of New Buys

David Herro (Trades, Portfolio) added a total of 4 stocks to his portfolio this quarter. Notably, he made significant investments in:

CNH Industrial NV (NYSE:CNH), purchasing 54,394,603 shares, which now represent 3.65% of his portfolio and are valued at approximately $704.95 million.

Smith & Nephew PLC (LSE:SN.), acquiring 6,049,900 shares, making up about 0.39% of the portfolio with a total value of 75.72 million.

Brambles Ltd (ASX:BXB), with 4,967,400 shares, accounting for 0.27% of the portfolio and valued at A$52.28 million.

Key Position Increases

Herro also strategically increased his stakes in 23 stocks, with significant boosts in:

Bayer AG (XTER:BAYN), adding 7,418,400 shares, bringing his total to 21,623,082 shares. This increase of 52.23% in share count had a 1.18% impact on his current portfolio, totaling 663.22 million.

Prudential PLC (LSE:PRU), with an additional 16,641,000 shares, bringing his total to 62,476,675 shares, valued at 585.89 million.

Summary of Sold Out Positions

During the first quarter of 2024, David Herro (Trades, Portfolio) completely exited his position in:

CNH Industrial NV (MIL:1CNHI), selling all 60,303,299 shares, which had a -3.71% impact on his portfolio.

Key Position Reductions

Herro reduced his holdings in 35 stocks, with notable reductions in:

Capgemini SE (XPAR:CAP), reducing his stake by 632,300 shares, a -40.56% decrease, impacting the portfolio by -0.67%. The stock traded at an average price of 209.8 during the quarter.

Daimler Truck Holding AG (XTER:DTG), cutting back by 2,727,000 shares, a -24.46% reduction, impacting the portfolio by -0.52%. The stock's price averaged 37.62 during the quarter.

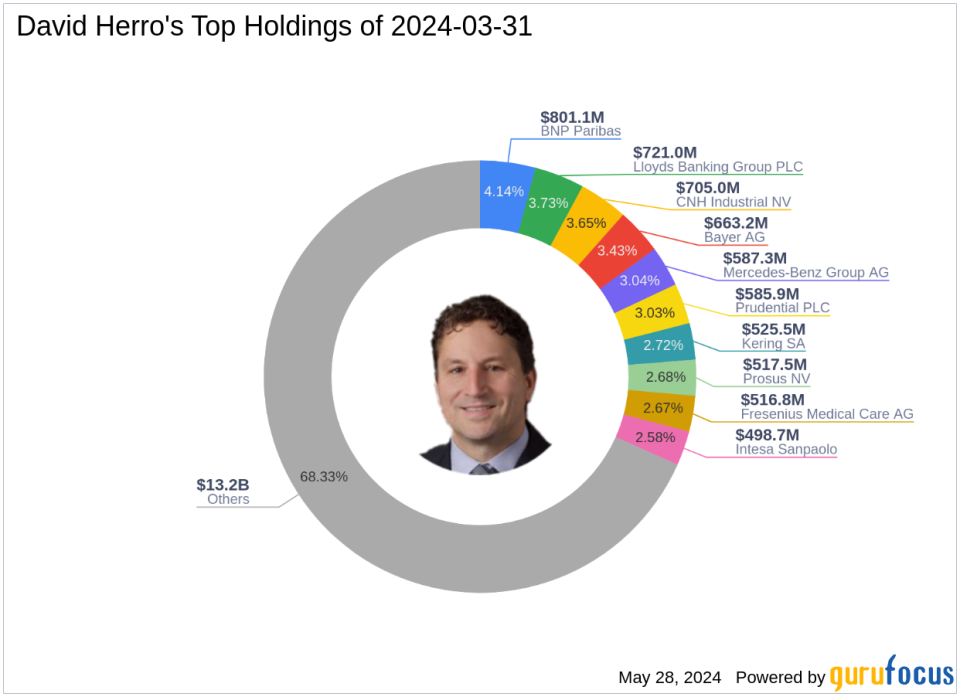

Portfolio Overview

As of the first quarter of 2024, David Herro (Trades, Portfolio)'s portfolio included 66 stocks. The top holdings were:

4.14% in BNP Paribas (XPAR:BNP)

3.73% in Lloyds Banking Group PLC (LSE:LLOY)

3.65% in CNH Industrial NV (NYSE:CNH)

3.43% in Bayer AG (XTER:BAYN)

3.04% in Mercedes-Benz Group AG (XTER:MBG)

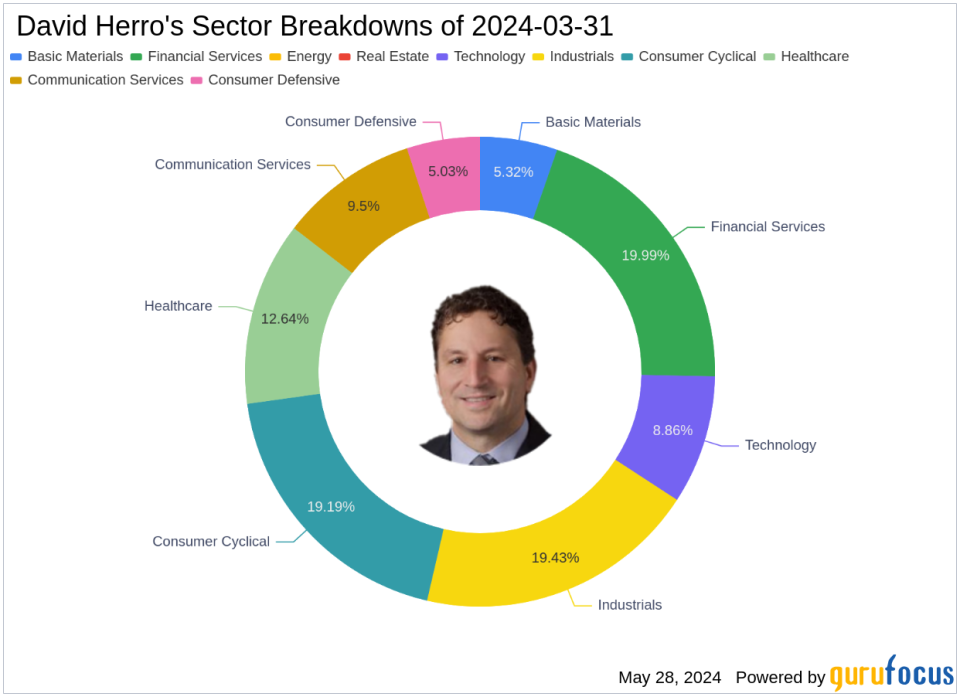

The investments are primarily concentrated in eight industries: Financial Services, Industrials, Consumer Cyclical, Healthcare, Communication Services, Technology, Basic Materials, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance