DAX Index Consolidates and Awaits ECB

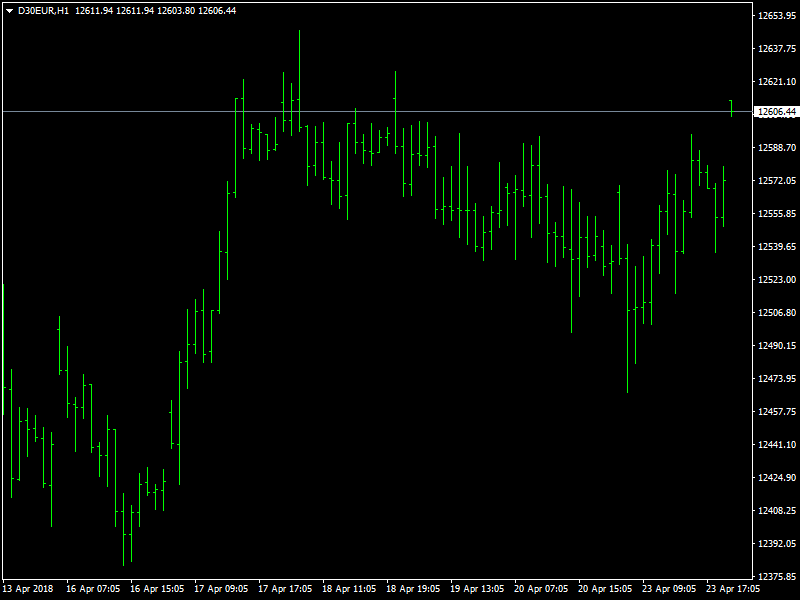

The DAX index corrected a bit lower yesterday but towards the end of the day, the market recovered as the dollar gained all across the board and the day ended almost at the same place where it all began. It is likely that the consolidation that we saw yesterday is going to continue today as well.

DAX Likely to Wait for ECB

The market is waiting in anticipation of the ECB rate announcement and statement later in the week. The rates are expected to be kept on hold, as it has been done over the many months but it is the view of the ECB about the Eurozone economy that is going to impact the markets as the traders would be watching it very closely. The incoming data from the region has not been strong as the ECB would have expected and this could force a rethink from the ECB about the tapering and ending of the QE and the timeline for the same.

It is expected that the ECB would tone down the hawkishness that we had seen from it last month and it is likely that the ECB would signal an extension of the timeline for the end of QE. If that happens, the DAX is expected to get a boost as this would mean that extra funds would be available for the markets and this would give a boost to the bulls. This could even lead to a break higher in the range that the DAX is currently in and the market is waiting in anticipation of the same.

Looking ahead to the rest of the day, we do not have any major economic news or data from Germany or the Eurozone and hence we can safely say that the consolidation with a negative bias is likely to continue for the rest of the day today.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance