DAX Index Daily Fundamental Forecast – March 22, 2018

The DAX index moved lower as the dollar went on the backfoot post the FOMC rate announcement and the press conference as well. The Fed hiked rates for the first time this year and this was something that was widely expected by the traders and already priced into the markets. The new Fed Chief also expressed confidence in the way the US economy was growing though he would not commit to any specific timeline for the future rate hikes.

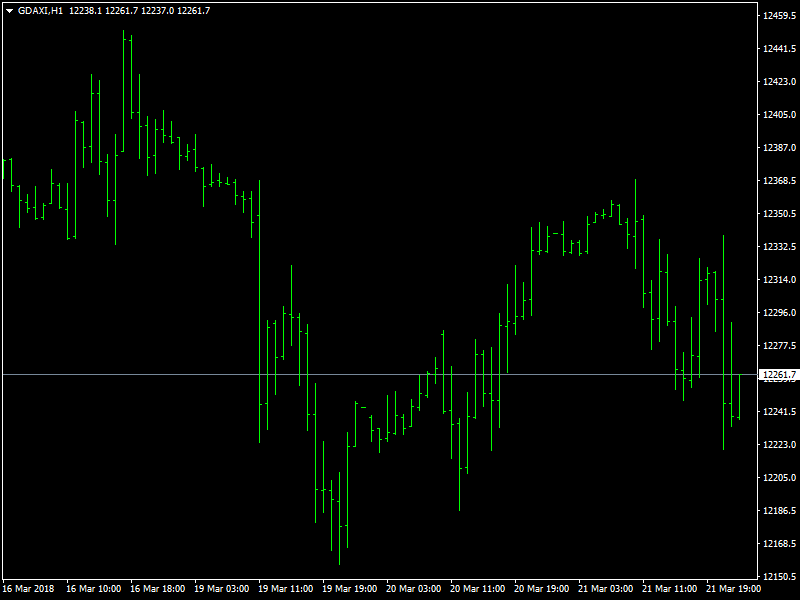

DAX Still Under Pressure

This led to a dollar sell off but we believe that all this has had only a minimal effect on the DAX. The index continues to trade within a larger range and this is something that has been going on over the last few weeks. While the previous weeks were more about the incoming data from the ECB and also the threat of the QE being tapered off and ended pretty quickly, the last couple of weeks have been more about geopolitical tensions and trade wars.

It is likely that the US administration under Trump is likely to announce fines and tariffs on Chinese goods and this is likely to affect the trade between the US and China and also affect the global trade balance. This is further to the policy of the US government to pursue more of nationalism than globalism and this could lead to a global trade war and affect the exports of Germany directly. This is what seems to be worrying the DAX traders and investors and that is why we have been seeing the index trade under a lot of pressure and any sort of a bounce in the markets is quickly met with a lot of selling.

The index now trades below the 12300 region as of this writing and it is likely to continue to be under pressure in the short term in the absence of any major economic data or new from either the Eurozone or Germany during the day.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance