DAX Index Daily Fundamental Forecast – January 18, 2018

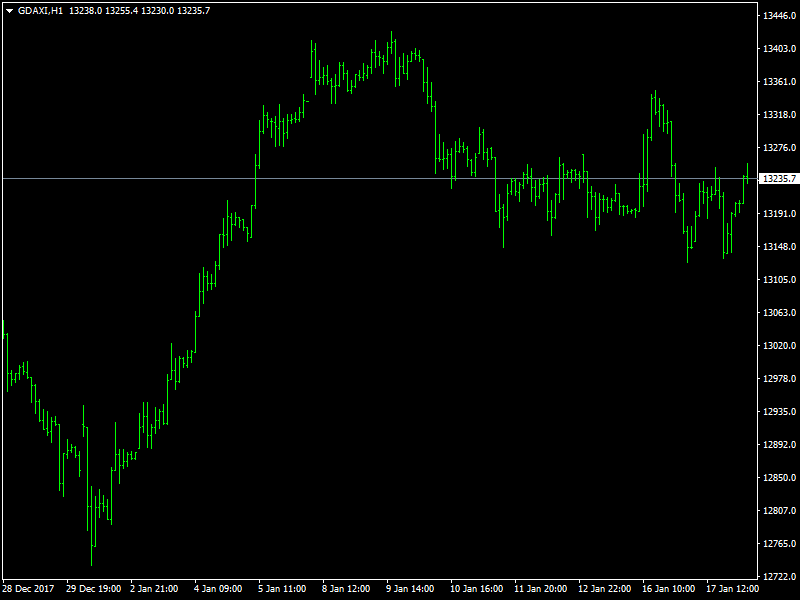

The DAX index continued to be volatile as it moved lower in the early half of the day and then recovered during the second half of the day to end the day above the 13200 region, continuing to give some hope for the bulls in the short term. The bulls seem to have skidded to a stop and taken a break in their buying and that is one of the reasons why we are seeing the index consolidate with a bearish bias.

DAX In Consolidation Mode

The index has not had much to do during this week as a combination of the bulls feeling tired and the possibility that the QE would come to an end by the end of the year has ensured that the index is kept under tight control for much of this week. The action has been limited to a tight range as the developments within Germany and the rest of the eurozone has been having a strong bearing on the markets. There has not been much data around but the action in the political and economic circles has been enough to keep the traders busy.

There still does not seem to be much headway in the formation of a coalition in Germany as the talks continue between the party of Merkel and SPD. All sides realise that this is the last chance before a re-election is called and that is why the negotiations are being done on a long and hard basis in the hopes of thrashing out a deal at all costs. On the other hand, the ECB is on a firefighting mode as the markets have realised that the QE is coming to an end and the ECB is wary of the markets crashing and the euro pushing still higher and hence the ECB has been issuing statements to calm the markets.

It is a combination of all this that has been keeping the DAX index choppy since the beginning of the week and with no end in sight for any of the events listed above, we expect the ranging and the consolidation to continue for today as well.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance