DAX Index Daily Fundamental Forecast – January 16, 2018

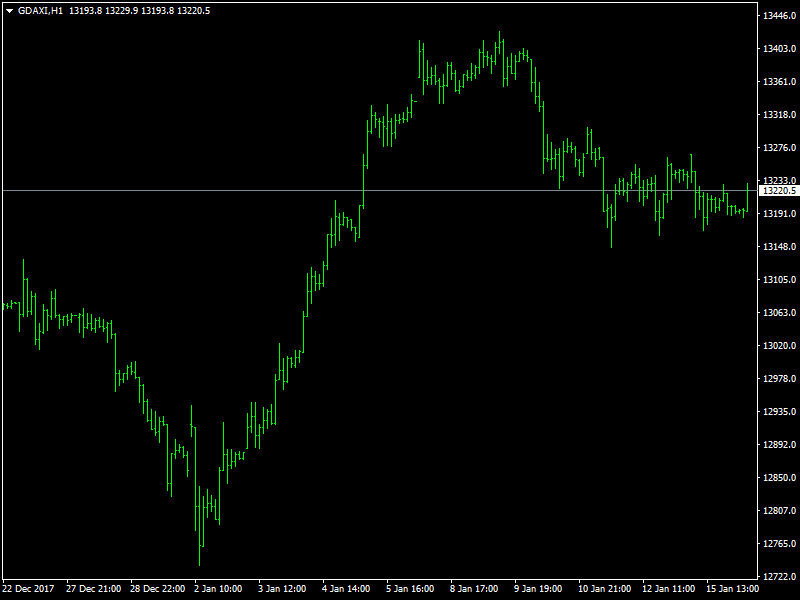

The DAX index continues to consolidate over the last 24 hours and this is set to continue in the short term. Ideally, we believe that the index should be under the control of the bears due to the fact that the euro has been going up, driven by some fundamental factors, but so far the index has been able to hold up and credit needs to be given to the bulls for managing to do this.

Choppy Trading in the DAX

The bulls are fighting a very hard battle with the support of the incoming data and also with the support of the political developments which favor a continuation of Merkel at the helm for the next few years. Both these factors should give a fillip to the German economy and push the index higher but the irony of the whole development is that the better the data gets, the more likely is the QE going to be reduced soon enough.

Reduction of the QE and the total removal of the same, something that is on the agenda of the ECB during the course of this year and which has been confirmed by them in the minutes of their meeting from December, it likely to keep the index under pressure. There is a feeling among the traders and the investors that the removal of the QE would mean drying up of the funds on the buying side in the European stock markets and this could cause pressure on the buy side in the markets which would lead the prices lower. This is the reason why we are seeing the index dilly dallying at this point.

Looking ahead to the rest of the day, we do not have any major news from Germany or the Eurozone and hence expect a slightly weak opening for the index when the market opens today and expect the weakness to continue during the course of the day.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance