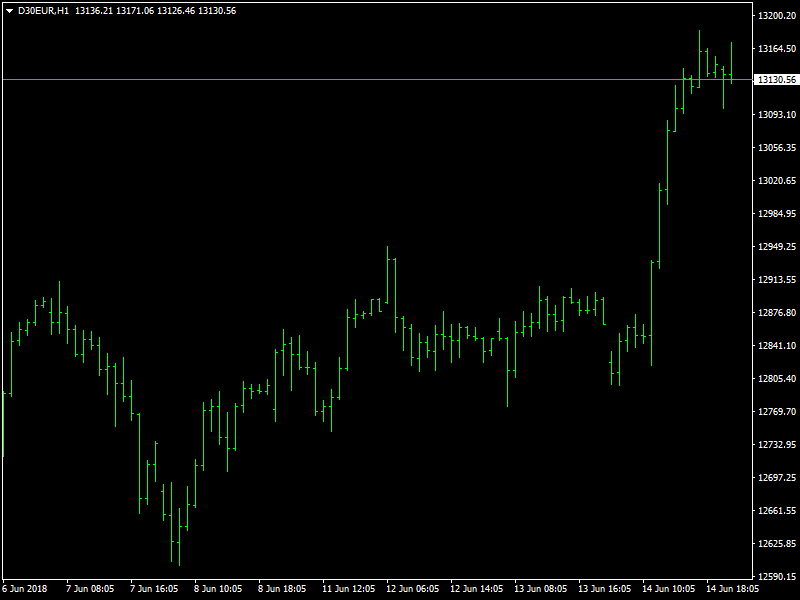

DAX Index Forecast – Index Rockets Higher as QE Tapering Likely to be Delayed

The DAX index rocketed higher as the ECB finally let the world know what it thinks about the QE program that is currently underway and also the state of the rate hikes that seemed to be in the pipeline. The bulls finally had a breakout session which pushed the index through the 13000 region and now it looks ominously bullish as we write this while on the other hand, the euro seems to be down in the dumps.

DAX Pushes Through 13000

There has been a lot of uncertainty surrounding the QE tapering and ending of the same over the last few weeks. The incoming data had been choppy which had placed in doubt whether the QE would indeed be ended. There was a hope in the market that the QE would end this year and that the rate hikes would begin at the beginning of 2019 but the silence of ECB in this matter had confused the markets with the underlying fear in the DAX and its investors being apparent for everyone.

This had led to some tight trading with a bearish bias over the last few weeks and it was only yesterday that the ECB made it clear that there would not be any rate hike till atleast the summer of 2019. This in turn means that the QE is likely to continue for much longer than what was originally expected and this was a boost to the DAX. It had been struggling to break through the 13000 region over the past couple of weeks but this rocket boost was enough for the index to easily scythe through the 13000 region and it now trades above the 13100 region as of this writing.

The bullishness in the markets is likely to continue for the short term as the investors and the traders digest the fact of the delay in the end of QE and the continued supply of additional funds from the ECB should help the index to continue to trade in a buoyant manner over the short term. The region around 13300 is likely to be the next target of the bulls.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance