DAX Index Fundamental Analysis – week of June 4, 2018

The DAX index had a difficult week in the week that is past but it managed to recover a bit towards the end and this holds out some hope for the bulls. The index was expected to start the week in a strong manner due to the developments in the Korean region but the confusion and uncertainty in the Eurozone came to dominate the week.

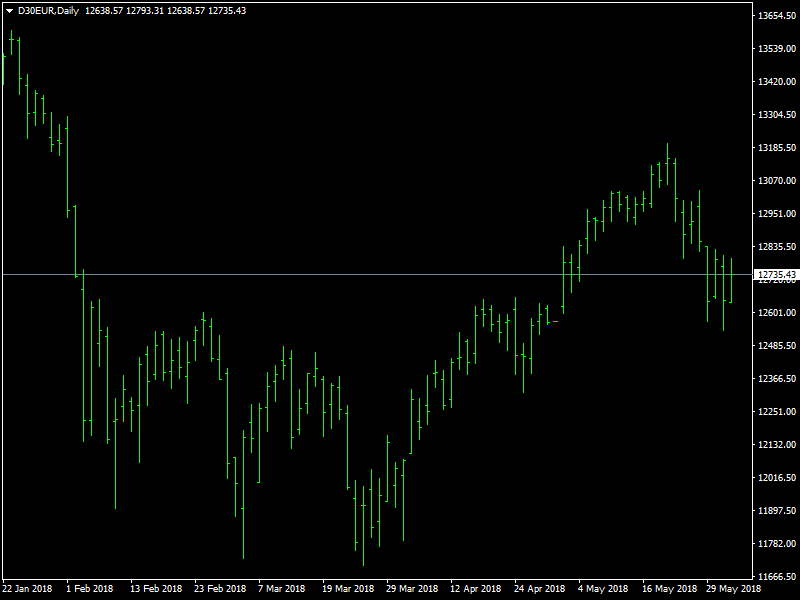

DAX Crashes Lower

There has been a lot of uncertainty in the Italian political circles and this has taken its toll on the markets. We saw all the markets in Europe go under the pump and the DAX was no exception. The index dropped from above the 12800 region to below the 12500 region for a brief while as the spread in the bonds in the Italian and German markets began to widen to alarming proportions. But towards the end of the week, the situation began to recover.

We also saw some serious bottom fishing from the traders and a combination of this and the fact that the situation in Italy came under control, was enough for the index to start moving higher towards the close of the week and the index managed to close the week above the 12700 region though we do not believe that the index is yet out of the woods and the upcoming week should be interesting.

The region around 12800 should serve as some serious resistance for the short term and it would be better for the traders to wait and see if and when there is going to be a break through that region in the coming week. There is not much by way of data except for a speech from Draghi but as usual, we expect the DAX to be driven more by the global factors and the factors within the Eurozone rather than anything specific to Germany which tends to have a stable and strong economy.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance