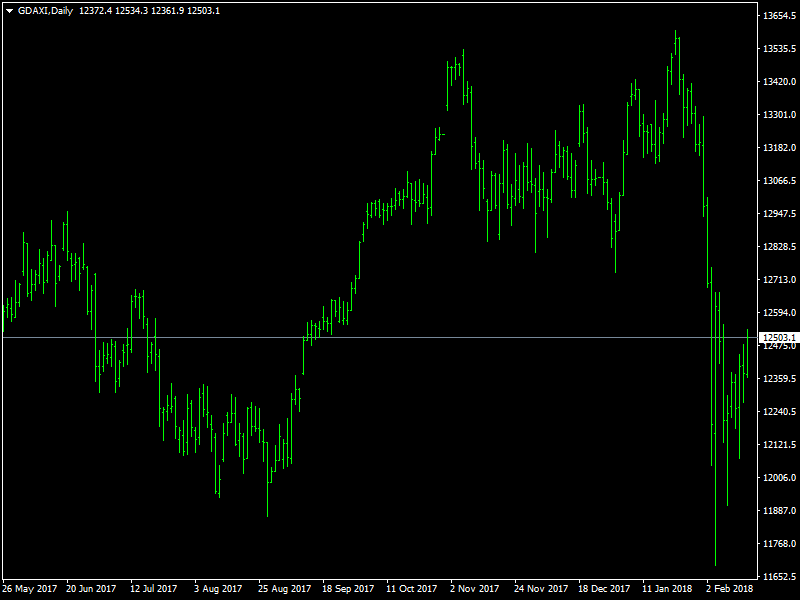

DAX Index Fundamental Analysis – week of February 19, 2018

It was a bullish week for the DAX index in the week passed but it is clear that it is not out of the woods as yet. Considering the size of the fall that we had seen in the market in the week before, the correction of the fall that was seen last week was of very small size and it is clear that the bears continue to be in control of the index and the bulls would have to see something change fundamentally to push the index higher.

DAX Likely to Remain Choppy

Last week, we did not have much fundamental data or economic news from Germany or the Eurozone and those data that did come in were largely on the lines of what the market was expecting. This failed to give the DAX any specific direction and it left the index to the whims and the fancies of the global stock markets and the risk sentiment in general. This risk sentiment did see a perk up during the course of last week and though it benefited the US stock indexes, the impact on the DAX was pretty much limited.

The reason is the overwhelming feeling that the end of the QE is near and if that does indeed end, we could see the funds being pumped into the European stock markets becoming lesser and lesser. This is likely to affect the buy side and push the indices lower and that is why we are seeing the traders and investors being reluctant to buy at this time as they see a further fall in the index as something that is quite possible. This feeling and uncertainty, along with the possibility of rate hikes beginning in the Eurozone by the ECB next year, is likely to keep the pressure on the stock markets for the short and medium term.

Looking ahead to the coming week, we do not expect too much change in the price action with consolidation with a bearish undertone likely to dominate the theme of the DAX in the short term. There are not many fundamental drivers around and in what can be seen as an irony, each piece of economic data that comes in as per expectations or better, is likely to only weaken the index more and more as these are likely to bring the end of the QE ever closer. So, expect the region between 12800 and 12300 to hold the price action for now.

This article was originally posted on FX Empire

More From FXEMPIRE:

Gold Price Futures (GC) Technical Analysis – Strengthens Over $1364.40, Weakens Under $1347.30

Crude Oil Price forecast for the week of February 19, 2018, Technical Analysis

Ethereum Price forecast for the week of February 19, 2018, Technical Analysis

FTSE 100 Price forecast for the week of February 19, 2018, Technical Analysis

S&P 500 Price forecast for the week of February 19, 2018, Technical Analysis

Yahoo Finance

Yahoo Finance