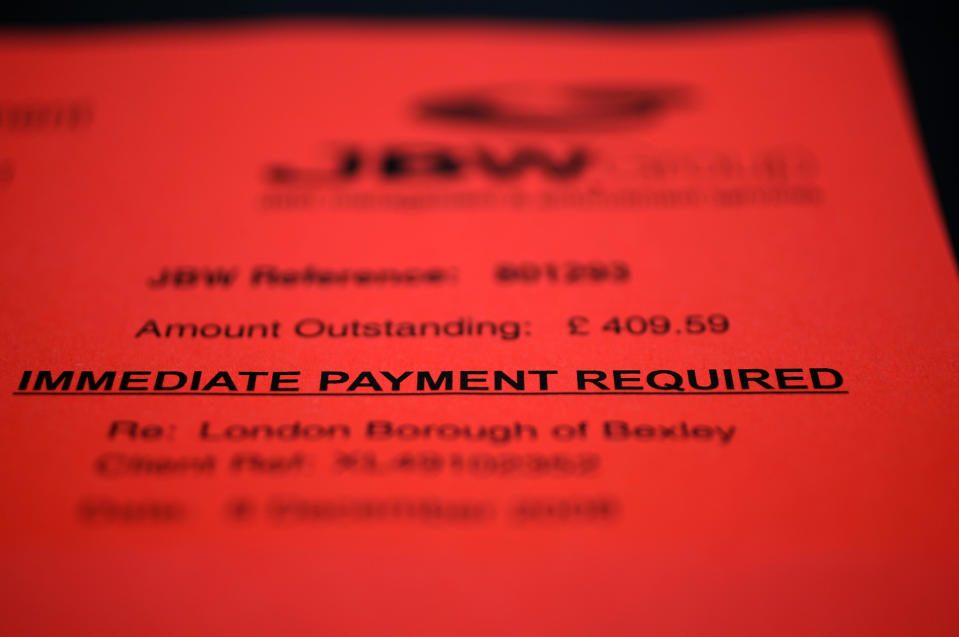

Debt trap: When you should worry and how to to control your spending

Are you struggling with debt? Let’s face it, millions of us are, but young people – the so-called millennials – are having the worst of it, according to the boss of the City watchdog.

Andrew Bailey, chief executive of the Financial Conduct Authority reckons young people are getting deeper in debt just to get by.

“We should not think this is reckless borrowing,” he said. “This is directed at essential living costs.”

High-cost credit

Like many other people I have at some time been forced to turn to high-cost credit to pay for essentials, such as food and heating.

MORE: Energy bills: price cap won’t save people’s lives

But for a generation, that occasional slip into the red seems to be turning into a way of life. Living in debt seems to be the only way they can get by.

Is that a good thing? Of course not. But that doesn’t mean that being in debt is always wrong.

In fact planned debt has become part of everyday life because it can help people achieve the things they want.

A mortgage is a planned debt which allows people to clamber onto the property ladder.

Using credit cards for convenience or to get rewards knowing you can afford to pay it all back at the end of the month is planned debt.

MORE: Around 775,000 people pay more tax than millionaires – are you one of them?

But shoving essentials on plastic because you have no other way to pay for it is unplanned debt.

And unplanned debt can quickly build up and get out of control. And then it becomes problem borrowing.

How much do you owe?

How much do you owe in unplanned debt? How quickly could you repay it? If you can’t clear it in a month or two, you could be heading for trouble.

I made a TV programme for the BBC last year with one millennial who told me she had no debt. But when we checked her statements, she owed around £3,000 on a credit card.

“Oh that doesn’t count,” she said. “Everyone has that.”

MORE: £500bn has gone missing from UK finances

That sort of attitude is part of the problem. It’s so easy to get credit – in fact it’s hard to avoid being bombarded by offers of loans or cards – that it seems normal to use it.

But that’s not the case. Credit is a tool which can be useful, but if it becomes unaffordable, it controls you, rather than the other way round.

Low interest rates

Today’s growing problem is partly because of low or frozen wages, but also because of low and attractive interest rates for borrowing.

The cost of credit has been low for years but when rates rise – and the Base Rate is rumoured to be set to rise in December – the cost of borrowing will increase.

And that could mean many people who right now are just about managing, will slip into difficulties.

MORE: Hammond plans ‘Budget giveaway to the young’ in tax threat to older workers

When debt becomes unaffordable, that’s when it can spiral out of your control.

All those millennials that are living in debt should heed the watchdog’s warning. If you don’t do something about it then your troubles could be only just starting.

How can you escape the debt trap?

There are two key things you must do to get control of debt.

First you need to get control of your spending, which means tightening your belt, finding bargains, and, ultimately, only spending what you can afford.

MORE: Cheap petrol and free Playstation: this week’s deals and discounts

Second you need to get a handle on your debt. That means cutting up your credit cards to stop the temptation to spend further and working out the best way to reduce your borrowing as quickly as possible.

Concentrate on paying off the high-interest debt first – usually credit cards – so that interest doesn’t mount up too much.

And if you need help coping with your debts, get it free from one of the debt charities such as Citizens Advice, StepChange or National Debtline.

Yahoo Finance

Yahoo Finance