DecisionPoint (DPSI) Q4 Earnings Miss, Revenues Increase Y/Y

DecisionPoint Systems DPSI reported fourth-quarter 2023 break-even against earnings of 11 cents per share a year ago. The Zacks Consensus Estimate was pegged at earnings of 6 cents per share.

Revenues increased 24.8% year over year to $30.5 million and topped the consensus mark by 13.8%.

For 2023, the company reported earnings of 47 cents per share compared with the year-ago figure of 54 cents. Revenues increased 18.7% year over year to $115.6 million.

The top line was driven by improving software and services segment revenues. The acquisition of MIS has boosted software and services mix with augmented presence in the retail category, particularly grocery and food service.

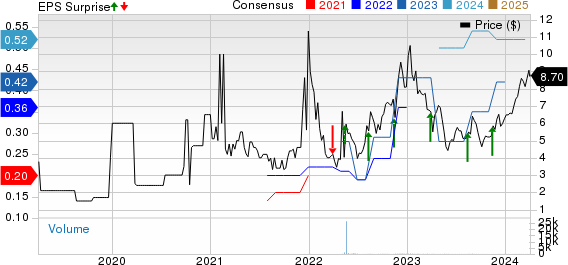

DecisionPoint Systems Inc. Price, Consensus and EPS Surprise

DecisionPoint Systems Inc. price-consensus-eps-surprise-chart | DecisionPoint Systems Inc. Quote

Quarter Details

Hardware revenues (53.1% of total revenues) declined 18.3% year over year to $16.2 million.

Software and Service revenues (47.2%) increased 207.5% year over year to $14.4 million.

Operating Details

DecisionPoint’s fourth-quarter gross profit increased 18.7% year over year to $7.5 million.

Adjusted EBITDA was $1.9 million, rising 8.4%.

Operating income came in at $0.72 million up 3.7% from the prior-year quarter.

Full-Year Details

Product revenues (63.6% of total revenues) declined 7.1% year over year to $73.5 million.

Service revenues (36.4%) increased 129.6% year over year to $42.1 million.

Balance Sheet and Cash Flow

As of Dec 31, 2023, DecisionPoint had cash and cash equivalents of $4.3 million compared with $7.6 million as of Dec 31, 2022. The company’s long-term debt was $3.6 million compared with $0.14 million as of Dec 31, 2022.

For 2023, cash flow from operations was $4.5 million compared with $12.3 million in 2022. The decline stemmed from fulfilment of payments for inventory purchases in the year.

Zacks Rank & Stocks to Consider

DecisionPoint carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

NVIDIA Corporation NVDA, currently sporting a Zacks Rank #1, delivered a trailing four-quarter average earnings surprise of 20.18%. In the last reported quarter, it delivered an earnings surprise of 13.41%.

NVIDIA is the world leader in visual computing technologies and the inventor of the graphic processing unit. Over the years, the company’s focus evolved from PC graphics to AI-based solutions that support high-performance computing, gaming and virtual reality platforms.

Pinterest PINS, carrying a Zacks Rank #2 (Buy) at present, delivered a trailing four-quarter average earnings surprise of 37.42%. In the last reported quarter, it delivered an earnings surprise of 3.92%.

Pinterest is increasingly establishing a unique value proposition to advertisers that could provide a competitive advantage in the long haul. Through various innovations, it continues to dramatically improve the advertising platform, which appears to be one of the best ad platforms for consumer discretionary brands looking for ways to reach customers and stretch smaller ad budgets.

AudioCodes Ltd. AUDC currently carries a Zacks Rank #2. It has a long-term earnings growth expectation of 24.8% and delivered an earnings surprise of 20.1%, on average, in the trailing four quarters.

AudioCodes offers advanced communications software, products, and productivity solutions for the digital workplace. It provides a broad range of innovative products, solutions and services that are used by large multi-national enterprises and leading tier-1 operators around the world. The company is headquartered in Lod, Israel.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

DecisionPoint Systems Inc. (DPSI) : Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance