Decoding Canadian Pacific Kansas City Ltd (CP): A Strategic SWOT Insight

Robust revenue growth with a 55% increase in Q1 2024, signaling strong market demand and operational efficiency.

Strategic expansion through the Kansas City Southern merger, enhancing CP's network connectivity and market reach.

Operating income surge by 38.6% in Q1 2024, reflecting effective cost management and operational leverage.

Comprehensive income more than doubled, indicating solid overall financial health and potential for reinvestment.

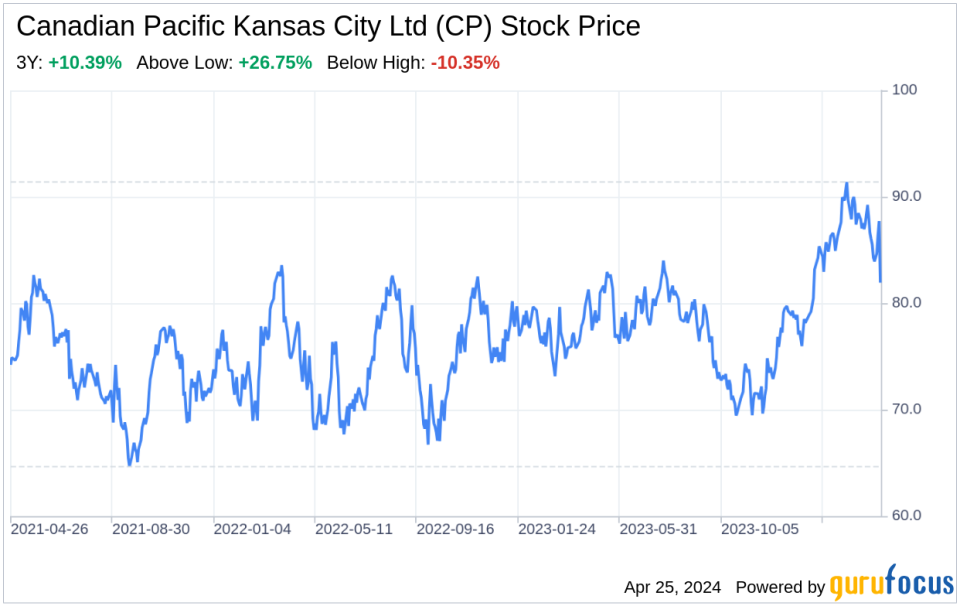

Canadian Pacific Kansas City Ltd (NYSE:CP), a leading Class-1 railroad operator, released its Q1 2024 financial results on April 24, 2024. The company showcased a significant revenue increase to $3,520 million, up from $2,266 million in the previous year, marking a 55% growth. This impressive performance is attributed to CP's strategic initiatives, including the transformative merger with Kansas City Southern, which expanded its network reach. Operating income also saw a substantial rise to $1,149 million, a 38.6% increase from $829 million in Q1 2023. The comprehensive income for the period stood at a robust $1,492 million, more than doubling from $783 million in the prior year, reflecting the company's strong financial health and potential for strategic reinvestment and growth.

Strengths

Expansive Network and Market Reach: CP's merger with Kansas City Southern has significantly bolstered its network, creating the first single-line railroad linking the U.S., Mexico, and Canada. This strategic move has not only expanded CP's market reach but also enhanced its competitive advantage in the industry. The company now boasts a network of approximately 20,000 miles, serving key business centers across North America, which is a testament to its operational strength and strategic foresight.

Financial Performance: CP's financial results for Q1 2024 reflect a strong performance, with a 55% increase in total revenues and a 38.6% increase in operating income. This financial robustness is underpinned by the company's ability to effectively manage costs and leverage operational efficiencies. The comprehensive income more than doubling indicates CP's solid overall financial health and positions it well for future growth and investment opportunities.

Weaknesses

Integration Risks: The integration of Kansas City Southern poses potential risks, including operational disruptions and integration costs that could impact CP's short-term financial performance. The complexity of merging systems, processes, and corporate cultures can lead to unforeseen challenges that require careful management to ensure a smooth transition and realization of synergies.

Interest Expense and Debt Levels: CP's net interest expense increased by 34% in Q1 2024, primarily due to debt incurred from the KCS acquisition. While this strategic move has expanded CP's operational capabilities, it has also led to higher debt levels, which could constrain financial flexibility and increase vulnerability to interest rate fluctuations.

Opportunities

Market Expansion: The merger with Kansas City Southern presents CP with significant opportunities to tap into new markets and customer segments. The expanded network enables CP to offer new single-line-haul services and cross-border freight options, potentially driving revenue growth and diversifying its customer base.

Operational Synergies: The integration of KCS offers CP the opportunity to realize operational synergies, such as cost savings from streamlined operations and increased efficiency. By leveraging the combined strengths of both companies, CP can enhance its service offerings and improve its competitive positioning in the market.

Threats

Regulatory and Legal Challenges: CP operates in a highly regulated industry, and the merger with KCS may attract increased regulatory scrutiny. Additionally, ongoing legal proceedings, such as the 2014 Tax Assessment litigation, could result in financial liabilities and affect CP's reputation and operations.

Market Competition and Economic Conditions: CP faces intense competition from other Class-1 railroads and transportation modes. Economic conditions, such as fluctuations in commodity prices and trade policies, can also impact freight volumes and CP's profitability. The company must continuously adapt to these external factors to maintain its market position.

In conclusion, Canadian Pacific Kansas City Ltd (NYSE:CP) has demonstrated strong financial performance in Q1 2024, underpinned by its strategic merger with Kansas City Southern. The company's expansive network and market reach, coupled with its robust revenue and income growth, position it well for future success. However, CP must navigate integration risks, manage its increased debt levels, and remain vigilant against regulatory challenges and competitive market forces. By capitalizing on its opportunities and addressing its threats, CP is poised to strengthen its foothold in the North American rail industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance