Decoding General Dynamics Corp (GD): A Strategic SWOT Insight

General Dynamics Corp showcases robust revenue growth across defense segments, with notable advancements in submarine and combat vehicle programs.

Technological innovation and strategic acquisitions bolster the Technologies segment, driving demand for IT services and C5ISR solutions.

Supply chain challenges and increased production costs impact Aerospace segment's efficiency, yet new aircraft deliveries are set to rise in 2024.

General Dynamics Corp's commitment to ethical business practices and human capital management strengthens its competitive edge and industry reputation.

On February 8, 2024, General Dynamics Corp (NYSE:GD), a leading aerospace and defense company, filed its 10-K report, revealing a comprehensive overview of its financial and operational performance for the fiscal year ended December 31, 2023. With a diverse portfolio in business aviation, ship construction and repair, combat vehicles, and technology services, GD continues to solidify its market position. The company reported consolidated revenue growth, driven by its defense segments, particularly in submarine construction and combat systems. Despite supply chain constraints impacting the Aerospace segment's large-cabin aircraft deliveries, GD anticipates an increase in new aircraft deliveries, including the G700, in 2024. The Technologies segment saw an uptick in demand for IT services, attributed to strategic acquisitions and a focus on innovative solutions. GD's commitment to ethical practices and human capital management remains a cornerstone of its success, ensuring a skilled and dedicated workforce. As we delve into the SWOT analysis, we'll explore GD's internal strengths and weaknesses, alongside external opportunities and threats, to provide a nuanced perspective on its strategic positioning and future outlook.

Strengths

Market Leadership in Defense and Aerospace: General Dynamics Corp (NYSE:GD) stands out with its strong market presence in the aerospace and defense industry. The company's diverse product offerings, including the Gulfstream business jets and advanced combat systems like the M1 Abrams tank, have cemented its reputation for quality and reliability. GD's Marine Systems segment, particularly noted for its nuclear-powered submarines, has seen increased revenue due to the Columbia-class submarine program, highlighting the company's expertise in high-stakes defense manufacturing.

Technological Innovation and R&D Investments: GD's commitment to research and development has led to significant technological advancements, particularly in the Technologies segment. The acquisition of a C5ISR solutions business and the development of Digital Accelerators, such as AI for mission applications and hybrid multi-cloud, position GD at the forefront of defense technology. These innovations not only enhance GD's product offerings but also provide a competitive edge in securing government contracts and partnerships.

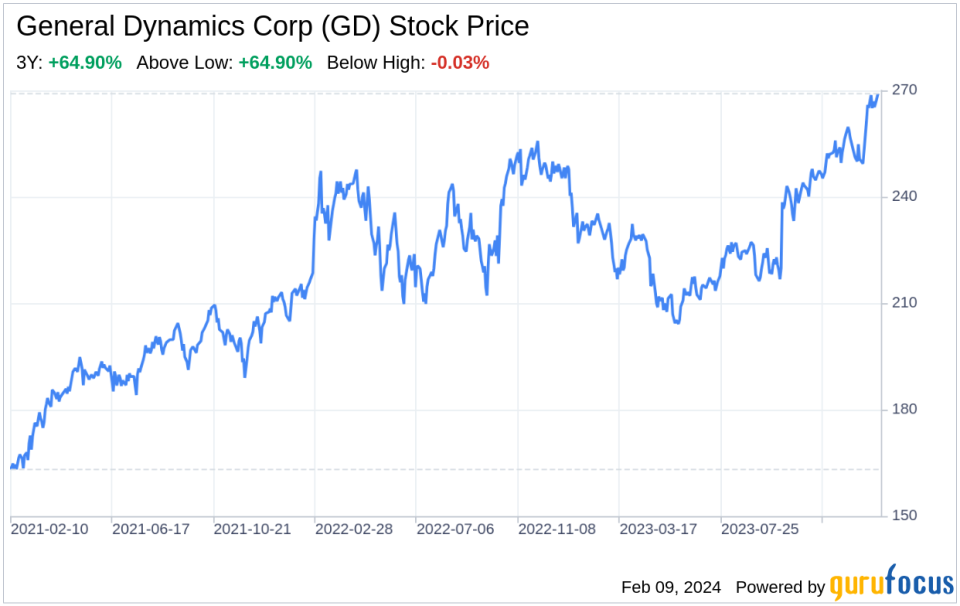

Robust Financial Performance: GD's financial health is a testament to its operational efficiency and strategic management. With an aggregate market value of voting common equity held by non-affiliates at $55.6 billion as of July 2, 2023, and a solid increase in consolidated revenue across its defense segments, GD demonstrates a strong balance sheet and revenue growth trajectory. This financial stability enables the company to invest in new projects, sustain innovation, and navigate market fluctuations effectively.

Weaknesses

Supply Chain Vulnerabilities: The 10-K filing reveals that GD's Aerospace segment has been impacted by supply chain challenges, which have paced the ability to ramp up production and led to out-of-sequence manufacturing. These issues have increased costs and decreased operational efficiency, indicating a need for GD to enhance its supply chain resilience and mitigate such vulnerabilities to maintain its market position.

Cost Pressures and Margin Compression: GD's Marine Systems segment experienced margin decreases due to supply chain impacts on the Virginia-class submarine schedule and cost growth on the DDG-51 program. Similarly, the Combat Systems segment saw lower-margin artillery facilities expansion work. These cost pressures suggest that GD must address operational inefficiencies and cost management to preserve profitability.

Dependence on Government Contracts: With approximately 70% of GD's revenue coming from the U.S. government, the company's financial performance is heavily reliant on government spending levels and defense appropriations. This dependence exposes GD to the risks associated with political uncertainties, budget constraints, and policy changes that could affect funding and contract awards.

Opportunities

Increased Defense Spending: Global geopolitical tensions and the evolving threat environment have led to increased demand for military equipment and technologies. GD's Combat Systems segment, in particular, stands to benefit from this trend, with opportunities to expand its international military vehicle sales and weapons systems production. The company's established track record and diverse offerings position it well to capitalize on this growing market demand.

Expansion into Emerging Technologies: The shift towards large-scale, integrated technology solutions in the defense sector presents significant opportunities for GD's Technologies segment. The company's investments in emerging technologies like AI, cyber, and 5G can drive growth and open new revenue streams. GD's ability to combine its technological expertise with an intimate knowledge of customer missions makes it a strong contender in this space.

Strategic Acquisitions and Partnerships: GD's history of strategic acquisitions, such as the C5ISR solutions business, has strengthened its market position and expanded its capabilities. Continuing this approach can enable GD to access new markets, enhance its product portfolio, and build synergies that drive long-term growth. Collaborations with other industry players can also lead to innovative solutions and a broader customer base.

Threats

Competitive Market Dynamics: The defense and aerospace sectors are highly competitive, with several key players vying for market share. GD's Aerospace segment, in particular, faces competition based on factors like aircraft performance, service quality, and price. To maintain its competitive advantage, GD must continue to innovate and deliver superior products and services that meet evolving customer needs.

Regulatory and

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance