Decoding Molina Healthcare Inc (MOH): A Strategic SWOT Insight

Comprehensive SWOT analysis based on the latest 10-Q SEC filing.

Financial performance highlights and strategic positioning of Molina Healthcare Inc.

Detailed examination of strengths, weaknesses, opportunities, and threats influencing MOH's market outlook.

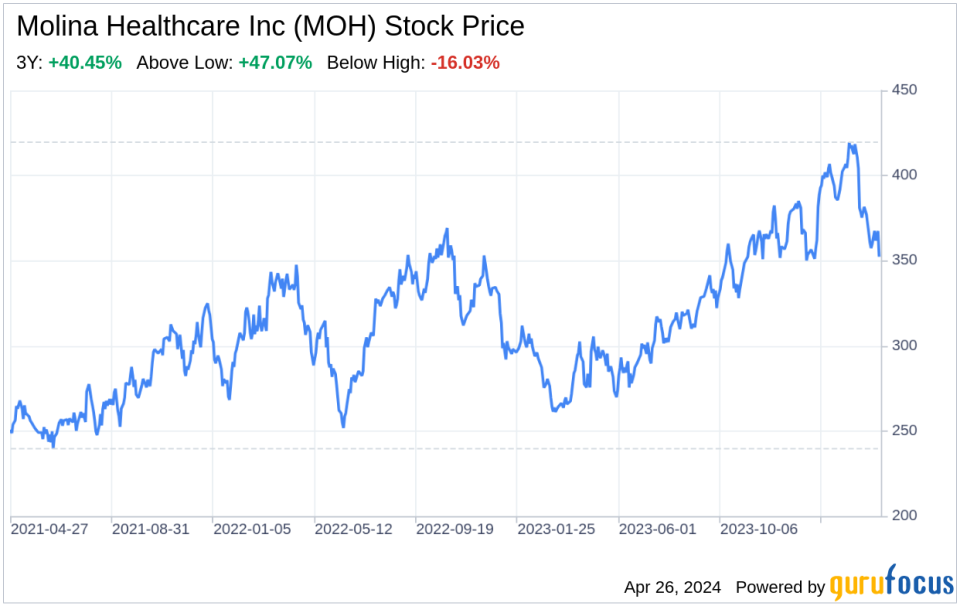

On April 25, 2024, Molina Healthcare Inc (NYSE:MOH) filed its 10-Q report with the SEC, providing a detailed account of its financial performance for the first quarter of the year. As a premier provider of Medicaid-related healthcare plans, MOH has demonstrated a robust financial trajectory with total revenue reaching $9,931 million, a significant increase from $8,149 million in the previous year. This financial overview sets the stage for a SWOT analysis that will delve into the company's competitive advantages, areas for improvement, market prospects, and potential challenges.

Strengths

Expansive Membership Growth and Revenue Increase: MOH's membership has seen a substantial uptick, growing to approximately 5.7 million members, a 9% increase from the previous year. This growth is reflected in the 21% increase in premium revenue, which soared to $9.5 billion. The company's strategic expansions, such as the commencement of the Iowa Medicaid contract and acquisitions like My Choice Wisconsin and Bright Health Medicare, have significantly contributed to this growth. The diversified membership base across Medicaid, Medicare, and Marketplace segments solidifies MOH's position in the healthcare market.

Robust Financial Performance: MOH's financial health is a testament to its operational efficiency. The company reported a net income of $301 million, with a diluted net income per share of $5.17. Investment income also saw a 52% increase, contributing to the company's strong bottom line. MOH's ability to manage its medical care costs effectively is evident in its consolidated medical care ratio (MCR) of 88.5%, which, despite a slight increase from the previous year, remains within a competitive range.

Strategic Acquisitions and Contract Wins: MOH's proactive approach to growth through strategic acquisitions and contract wins has been a driving force behind its expanding market share. The acquisition of Bright Health Medicare and the new contracts in Nebraska and California have allowed MOH to bolster its service offerings and reach. The company's success in securing a contract in six service regions in Michigan further demonstrates its competitive edge in winning significant state bids.

Weaknesses

Impact of Medicaid Redeterminations: MOH's performance is not without its challenges. The company has faced headwinds due to Medicaid redeterminations, which have impacted membership numbers and, consequently, premium revenues. This underscores the inherent volatility in government-sponsored healthcare programs, where policy changes can significantly affect the company's financials.

Dependence on Government Contracts: MOH's reliance on state and federal contracts for a substantial portion of its revenue stream introduces a degree of risk. Changes in government policies, budget constraints, or loss of contracts through competitive bidding processes can pose significant threats to the company's revenue and growth prospects.

Legal and Regulatory Challenges: The company is currently engaged in legal actions, such as the protest over the Virginia Department of Medical Assistance Services' decision not to award MOH a contract. These legal battles not only incur costs but also create uncertainty around future revenue streams and market presence.

Opportunities

Expansion into New Markets: MOH's recent contract wins and acquisitions have opened doors to new markets, presenting opportunities for further growth. The company's entry into the Nebraska Medicaid market and expansion in California and Michigan positions it to capture a larger share of the Medicaid and Medicare segments.

Demographic Trends Favoring Healthcare Services: The aging population and increasing prevalence of chronic diseases are likely to drive demand for Medicaid and Medicare services. MOH's established presence in these segments positions it well to capitalize on these demographic trends.

Technological Advancements and Innovation: MOH's investments in artificial intelligence (AI) and other technological initiatives offer opportunities to enhance operational efficiencies, improve patient outcomes, and reduce costs. Embracing innovation can also help MOH differentiate itself from competitors and offer value-added services to its members.

Threats

Competitive Pressure and Industry Consolidation: The healthcare industry is witnessing increasing competition and consolidation, which could threaten MOH's market position. Larger players with more resources could potentially outbid MOH for contracts or offer more competitive services.

Regulatory and Policy Changes: The healthcare sector is highly regulated, and changes in laws or regulations can have far-reaching impacts on MOH's operations. The end of the Public Health Emergency (PHE) and related policy shifts could affect coverage and reimbursement rates, posing financial risks.

Cybersecurity and Data Privacy Concerns: MOH, like other healthcare providers, faces the threat of cyber-attacks and data breaches. The recent incident involving a vendor, Change Healthcare, highlights the potential risks to member data and the importance of robust cybersecurity measures.

In conclusion, Molina Healthcare Inc (NYSE:MOH) exhibits a strong financial foundation and strategic market positioning, with significant strengths in membership growth, revenue generation, and contract acquisition. However, the company must navigate the challenges posed by Medicaid redeterminations, dependence on government contracts, and legal hurdles. Looking ahead, MOH has the opportunity to expand its market presence, leverage demographic trends, and innovate through technology. Yet, it must remain vigilant against competitive pressures, regulatory changes, and cybersecurity threats. The company's ability to capitalize on its strengths and opportunities while effectively managing its weaknesses and threats will be crucial in maintaining its competitive edge and ensuring long

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance