Decoding PEP & KO Post Q1 Earnings: Which Stock Stands Out?

The war between PepsiCo Inc. PEP and The Coca-Cola Company KO for the top spot is endless. While investors are always perplexed about choosing either of these stocks over the other, the two global soft drinks biggies have attracted investors for several reasons, including expansion efforts and shareholder returns.

PEP & KO – Statistics & Share

The beverage soft drinks industry has evolved in the recent years, with consumers looking for healthier alternatives, moving away from the initial charm of carbonated drinks. With this, the industry’s two heavyweights — Coca-Cola and PepsiCo, commanding market caps of $267.1 billion and $241.2 billion, respectively — have expanded their product portfolios to include juices, bottled water, functional beverages like sports and energy drinks, and coffee and tea.

Coca-Cola has retained its position as a market leader in the global non-alcoholic beverages industry, with more than 40% market share. With a key focus on non-alcoholic ready-to-drink beverages, Coca-Cola has expanded its portfolio over the years, comprising brands like Powerade, SmartWater, Minute Maid, BODYARMOR, Costa, Dasani, dogadan, FUZE TEA and fairlife.

Coming to its arch-rival, PepsiCo has slowly diluted its position in the beverage industry, expanding in the complimentary convenient food segment, including snacking brands like Frito-Lay, Lay’s Chips, Cheetos and a range of Quaker cereals. Then again, the company’s beverage range includes brands like Gatorade, Pepsi-Cola, Tropicana juices, Mountain Dew, 7UP and Mirinda, garnering a market share of around 20% in the soft drinks industry.

Based on market share and market cap, Coca-Cola commands a lead over its non-alcoholic beverage competitors, generating nearly 50% of the industry’s global sales. However, PepsiCo continues to claim the second place in the industry.

Although both soft drink behemoths are attractive long-term buys, with the first-quarter 2024 results of these companies reported in about two weeks, it is ideal to evaluate these stocks on the earnings ground.

Q1 Earnings Score Card & Outlook

Both PepsiCo and Coca-Cola posted strong results for first-quarter 2024, notching neck-to-neck earnings per share growth rates of 7.3% and 7%, respectively. These also reflect a positive earnings surprise of 5.9% for PepsiCo and 4.4% for Coca-Cola compared with the Zacks Consensus Estimate.

Meanwhile, revenues improved 2.3% year over year for PepsiCo and 3% for Coca-Cola, surpassing the Zacks Consensus Estimate. Revenue growth for both beverage behemoths mainly resulted from the recently implemented price increases across all markets.

Looking ahead, both companies have provided positive revenue and earnings outlooks, anticipating continued momentum in their businesses. PepsiCo expects at least 4% year-over-year organic revenue growth for 2024, with core constant-currency EPS growth of at least 8%. PEP anticipates 2024 core EPS to increase 7%, indicating continued gains from operational efficiencies.

Coca-Cola plans organic revenue growth of 8-9% for 2024, with comparable currency-neutral earnings per share estimated to increase 11-13% year over year. The company anticipates 2024 comparable earnings per share to improve 4-5%.

Earnings Estimates

From the earnings and outlook perspective, both PEP and KO have scored full marks. Additionally, analysts’ earnings expectations for both companies have moved higher following their results, indicating positive near-term prospects.

PepsiCo’s EPS estimates for 2024 moved up by a penny to $8.16 per share in the last 30 days. Notably, PEP’s 2024 revenues are projected to grow 3.4% year over year to $94.6 billion and EPS are expected to ascent 7.1% year over year to $8.16.

Then again, Coca-Cola’s EPS estimates for 2024 moved up by a penny to $2.82 in the past seven days. KO’s 2024 revenues are expected to increase 0.1% year over year to $45.8 billion and EPS is likely to advance 4.8% year over year to $2.82 per share.

Therefore, we can clearly see that PepsiCo and Coca-Cola have seen analysts raising estimates after their earnings releases. However, PepsiCo has higher expected growth rates for sales and earnings for this year. Consequently, PepsiCo currently has a Zacks Rank #2 (Buy). Meanwhile, Coca-Cola currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stock Performance

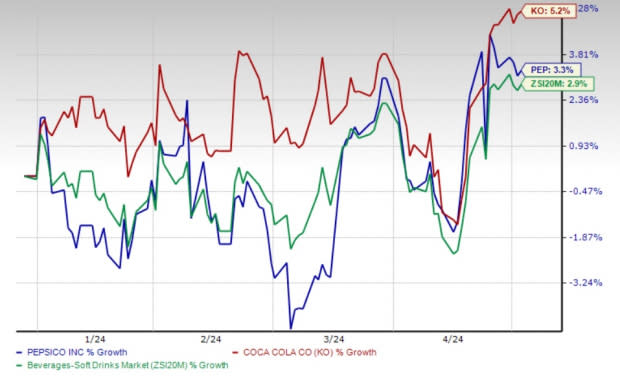

Following the earnings outcomes, we have seen upward share price revision trends for Coca-Cola and PepsiCo. Notably, the PepsiCo stock has rallied 2.5% after reporting positive earnings results on Apr 23, 2024. The Coca-Cola stock moved up 0.4% in the last two days after reporting earnings on Apr 30, 2024.

Image Source: Zacks Investment Research

Both companies have registered growth above the Zacks Beverage – Soft Drinks industry in the year-to-date period. Notably, PepsiCo and Coca-Cola have risen 3.3% and 5.2% year to date, respectively, compared with the industry’s growth of 2.9%.

Valuation

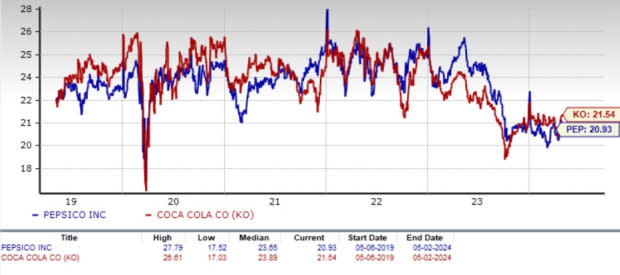

In the valuation chart below, we see that KO and PEP have similar forward price-to-earnings multiples. PepsiCo trades at 20.93X, which is below its 5-year median of 23.65X, and Coca-Cola is trading at 21.54X, also below its 5-year median of 23.88X. A lower trading multiple than its average indicates that these stocks have good scope for an upside.

Image Source: Zacks Investment Research

Meanwhile, the Zacks Beverage – Soft Drinks industry currently trades at a 20.98X forward price-to-earnings multiple, which is essentially above PepsiCo’s multiple and below Coca-Cola’s. Hence, PepsiCo looks relatively cheaper than the broader industry.

Conclusion

The earnings season is an exciting time to track and reevaluate the stocks in one’s portfolio. While the long-term fundamentals of both PepsiCo and Coca-Cola look promising, PepsiCo has an edge over Coca-Cola post their first-quarter results based on its positive estimate revisions, the Zacks Rank and cheaper valuation.

However, that does not mean that the KO stock has lost sheen. Looking fundamentally, Coca-Cola stands tall amid its non-alcoholic beverage peers. Ideally, PEP and KO are strong long-term plays, as the non-alcoholic beverage industry continues to enjoy strong consumer demand for on-to-go drinks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company (The) (KO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance