What is a deed of variation and how can it help reduce inheritance tax?

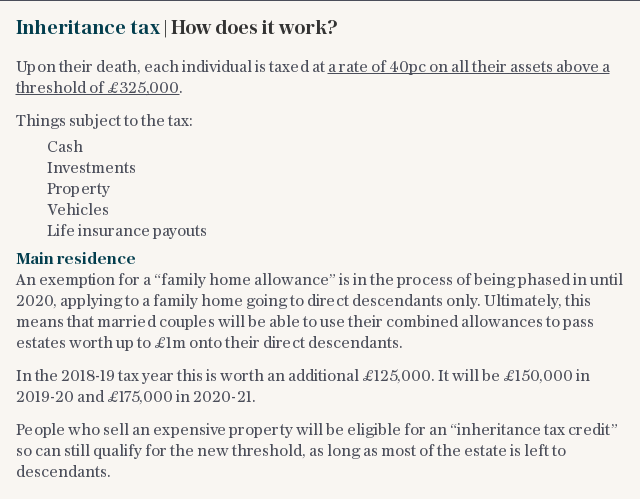

Poor estate planning could result in the Government taking a sizable bite out of the money you leave to your family. Estates liable for inheritance tax (IHT) must pay 40pc before the remainder can be passed on, leaving many of us with a sour taste in the mouth.

However, there is a way to beat the taxman from beyond the grave. A deed of variation (DOV) is a legal document that allows the beneficiaries of an estate – children, for example – to make changes to a will, in the name of the deceased, after their death.

This means that, if someone hasn’t written their will in the most tax-efficient way, if they have inadvertently left someone out of their will, or if they haven’t written a will at all, the beneficiaries are able to redirect the money they stand to inherit to other parties.

In the case that you are about to inherit a windfall that will take your own estate over £325,000 – the personal allowance above which 40pc IHT applies on your death – you can alter the deceased’s will so that money you stand to inherit passes directly to other beneficiaries, reducing or eliminating the amount of tax you would otherwise have to pay later.

For example, you may want to redirect some of the money you stand to inherit so it passes straight to your children, or put it into a discretionary trust for their benefit later on.

Reader Service: Ensure you get expert inheritance tax advice with our trusted partners St James Place

If you do not use a deed of variation and then decide after receiving the inheritance to gift some of it to your children, you could only do so tax free if you live another seven years.

If you were to die within seven years of that gift being made it would not qualify for exemption and tax would need to be paid. However, a DOV can effectively "skip a generation" and pass money in full straight to your children without the danger of tax being payable in the event of your death.

A variation can redirect money to a number of beneficiaries to dilute the amount of tax they will owe, or pass an inheritance directly to a charity, which can reduce the estate's IHT bill.

If 10pc of an overall estate is gifted to charity, the rate of IHT paid is reduced by 4 percentage points to 36pc.

What are the rules?

The most important thing to remember is that there is a two-year window. Any deed of variation must be drawn up within 24 months of the death of the deceased, and must be signed by all the executors and beneficiaries of the estate to be valid.

A DOV is separate from a grant of probate – the legal document that allows you to gather up and distribute the assets of the deceased – and can be obtained before or after probate is granted.

There are no formal documents to apply for, you can simply write a letter explaining the changes you wish to make. However, you must ensure the letter meets certain conditions – Her Majesty’s Revenues and Customs provides a checklist.

Provided everyone else involved agrees, you can redirect your inheritance to anyone you wish, even if they are not named in the deceased’s will.

Although you may be the one deciding what changes to make, through a DOV the changes are made in the name of the deceased as if they were making the changes themselves.

If a variation affects anyone under the age of 18, you will need court approval before making any changes.

What if there is no will?

When someone dies without leaving a will, their estate is passed on to their next of kin, usually a spouse or other immediate family member, in line with the so-called rules of intestacy.

Follow us for more money insights @MoneyTelegraph

For more money news sign up for our newsletter

However, the rules state that certain family members cannot inherit. Unmarried partners, step children, and other relatives and friends, irrespective of the role they played in the life of the deceased, will not be gifted anything.

A DOV can still be used if there is no will, allowing you to redirect money to other beneficiaries that would otherwise have been left with nothing.

Yahoo Finance

Yahoo Finance