Delfingen Industry And Two More Top Dividend Stocks On Euronext Paris

Amidst a backdrop of political uncertainty and fluctuating bond yields in France, investors are navigating a challenging yet potentially rewarding market landscape. In such times, dividend stocks like Delfingen Industry can offer a semblance of stability through regular income, making them an attractive option for those looking to mitigate risk while capitalizing on potential market recoveries.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Samse (ENXTPA:SAMS) | 9.14% | ★★★★★★ |

Rubis (ENXTPA:RUI) | 7.29% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.82% | ★★★★★★ |

Fleury Michon (ENXTPA:ALFLE) | 5.60% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 4.18% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.35% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.18% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 4.13% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.53% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 8.00% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Delfingen Industry

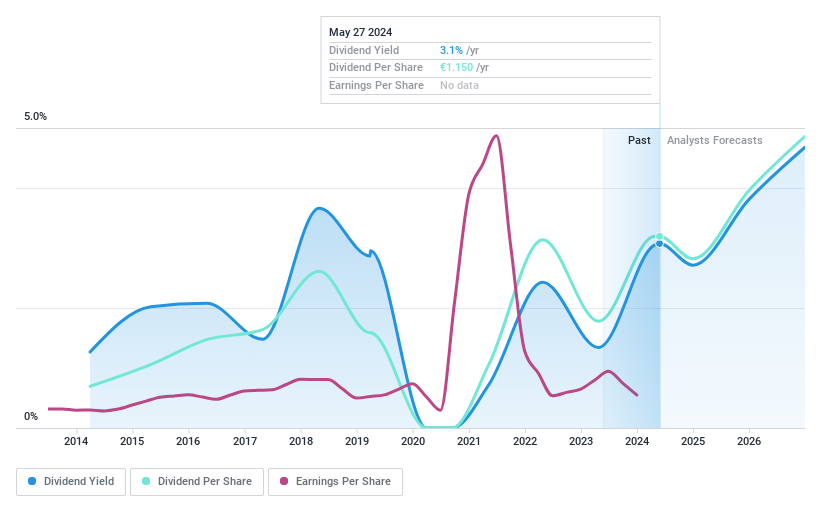

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Delfingen Industry S.A., a global provider of protection and routing systems for electrical networks and on-board fluid transfer solutions, primarily serves the industrial and automotive sectors, with a market capitalization of €95.70 million.

Operations: Delfingen Industry S.A. generates its revenue from various geographical mobility segments, with €223.03 million from Europa and Africa, €143.77 million from the Americas, and €60.76 million from Asia, alongside €51.40 million from broader industrial activities.

Dividend Yield: 3.1%

Delfingen Industry reported a sales increase to €456.7 million in 2023 from €417.1 million the previous year, though net income dropped to €6.9 million from €8.1 million. Despite this decline, dividends are well-covered with a payout ratio of 43.6% and an even lower cash payout ratio of 9.7%. However, the company's dividend history has been volatile over the past decade, and its current yield of 3.14% is below the top quartile in France’s dividend market at 5.6%.

Groupe Guillin

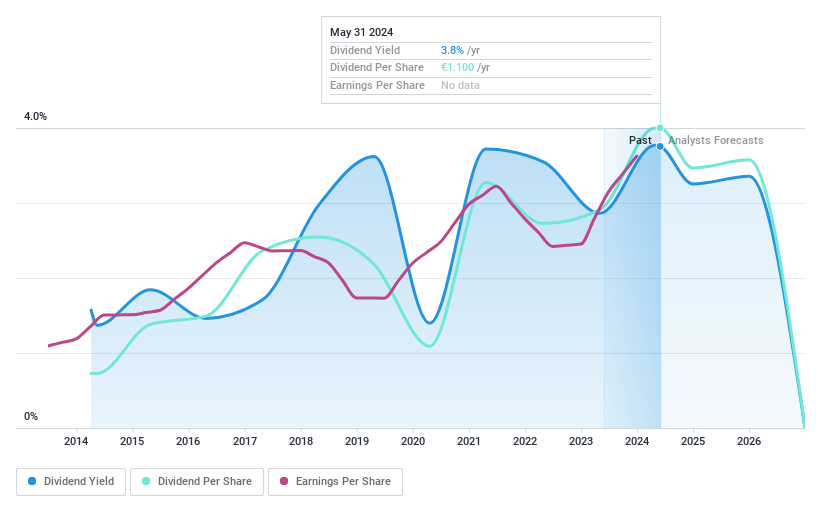

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe Guillin S.A. is a company based in France that specializes in the production and international sale of food packaging products, with a market capitalization of approximately €513.92 million.

Operations: Groupe Guillin S.A. generates revenue primarily through its Material Sector, which brought in €48.24 million, and its Packaging Sector, contributing €837.39 million.

Dividend Yield: 4%

Groupe Guillin S.A. experienced a notable increase in net income to €75.43 million in 2023, up from €50.99 million, reflecting a 47.9% growth year-over-year despite a slight sales decline to €885.86 million from €898.47 million. The company's dividend sustainability appears mixed; while its low cash payout ratio of 18.5% and earnings coverage ratio of 27% suggest dividends are well-covered, the historical volatility and unreliability in dividend payments over the past decade present concerns, with its current yield at 3.96%, below the French market’s top quartile of 5.6%.

TF1

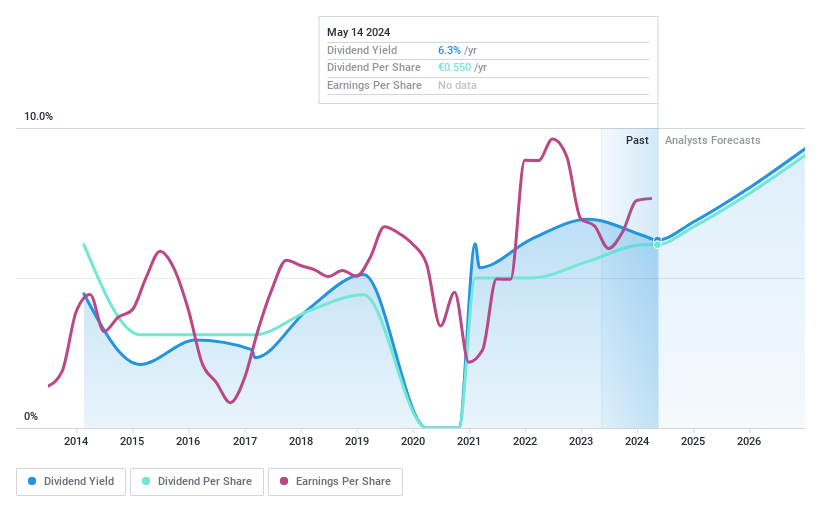

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TF1 SA operates in broadcasting, studios and entertainment, and digital sectors both in France and globally, with a market capitalization of approximately €1.57 billion.

Operations: TF1 SA generates revenue through its Newen Studios segment at €385.70 million and its combined Media and Digital segment at €2.01 billion.

Dividend Yield: 7.4%

TF1's dividend history shows instability, with significant fluctuations over the past decade and no growth in dividend payments. Despite this, dividends are sustainably covered by both earnings and cash flows, with a payout ratio of 59.9% and a cash payout ratio of 48.3%. Recently, TF1 reported a slight increase in Q1 2024 earnings to €29.7 million from €28.1 million year-over-year, indicating some financial resilience despite its unpredictable dividends. The current yield stands at 7.38%, placing it well within the top quartile of French dividend payers.

Get an in-depth perspective on TF1's performance by reading our dividend report here.

Upon reviewing our latest valuation report, TF1's share price might be too pessimistic.

Where To Now?

Navigate through the entire inventory of 33 Top Euronext Paris Dividend Stocks here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ALDEL ENXTPA:ALGIL and ENXTPA:TFI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance