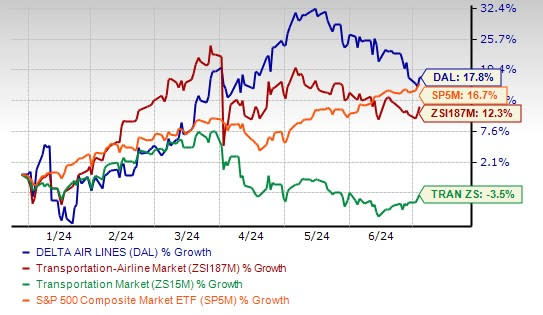

Delta Air (DAL) Up 17.8% Year to Date: More Upside Ahead?

Delta Air Lines’ DAL shares have gained 17.8% on a year-to-date basis compared with the industry’s 12.3% growth. The S&P 500 composite index rose 16.7% in the same time frame, while the Zacks Transportation sector declined 3.5%. The Atlanta-based company currently has a market capitalization of $30.58 billion.

Upbeat passenger volumes, owing to the buoyant air travel demand scenario, are the primary growth driver for DAL. The airline operator, presently carrying a Zacks Rank #3 (Hold), boasts an impressive track record of beating estimates in each of the trailing four quarters, the average surprise being 12.72%.

Can DAL Retain the Momentum?

The Zacks Consensus Estimate for DAL’s 2024 earnings is pegged at $6.59 per share, which indicates an improvement of 5.44% from 2023’s actuals. The same for revenues stands at $61.07 billion, which implies a 5.2% increase from the prior year's actual.

The consensus mark for 2025 earnings is pegged at $7.49 per share, indicating 13.72% growth from the 2024 estimate. The same for revenues is $62.21 billion, which indicates a rise of 1.87% from the 2024 estimate.

With people taking to the skies in large numbers, passenger revenues are high. As evidenced, Delta posted a significant year-over-year increase (15%) in revenues for 2023. The increase in the top line was driven by a 22% rise in passenger revenues (accounting for 84.3% of the top line). The ongoing summer season is expected to provide a further boost to passenger revenues.

Delta’s liquidity position is encouraging. The airline ended the first quarter of 2024 with cash and cash equivalents of $4.46 billion, which is much higher than the current debt level of $2.81 billion. This implies that the company has sufficient cash to meet its current debt obligations. DAL's efforts to repay its debts are encouraging too. The company’s times interest earned ratio of 8.7 compares favorably with the industry’s ratio of 3.6.

Image Source: Zacks Investment Research

Delta’s management recently announced a 50% hike in its quarterly dividend payout. This was the first dividend increase announced by DAL since its resumption of quarterly dividend payments last year following the COVID-induced hiatus. Under the CARES Act, airlines were prohibited from paying dividends or buying back shares till Sep 30, 2022.

Delta boasts an impressive VGM Score of B. VGM Score helps to identify stocks with the most attractive value, the best growth and the most promising momentum.

Despite the above-mentioned positives, one must be mindful of high fuel and labor costs which pose major challenges for DAL.

Stocks to Consider

Investors interested in the transportation sector may consider SkyWest SKYW and Kirby Corporation KEX.

SkyWest currently carries a Zacks Rank #2 (Buy) and has an expected earnings growth rate of 787% for the current year.

SKYW has an impressive earnings surprise history. Its earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 128%. Shares of SkyWest have increased 58.5% year to date.

KEX, too, carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Kirby has an expected earnings growth rate of 42.5% for the current year.

The company has an encouraging track record with respect to the earnings surprise, having surpassed the Zacks Consensus Estimate in each of the trailing four quarters. The average beat is 10.3%. Shares of Kirby have climbed 55% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Kirby Corporation (KEX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance