Can Demand & Online Strength Aid Crocs (CROX) Amid Inflation?

Crocs, Inc. CROX has been benefiting from solid consumer demand, as well as strength in the Crocs and HEYDUDE brands. This led to the top and bottom lines surpassing the Zacks Consensus Estimate for the eighth straight quarter in the first quarter of 2022. Also, sales and earnings improved year over year. The top line witnessed growth across all regions and channels.

The company has been making significant progress in expanding digital and omnichannel capabilities. We note that digital sales advanced 20.3% year over year and accounted for 32.8% of revenues in the first quarter. Increased focus on the Crocs mobile app and global social platforms aided digital sales. Within digital, India, South Korea and Australia regions witnessed double-digit increases from the year-ago period. Gains from strategic collaborations, influencer campaigns, and digital and social marketing efforts remained upsides.

Driven by these factors, management updated the guidance for 2022 and issued a second-quarter view. For 2022, revenues related to the HEYDUDE buyout are likely to be $750-$800 million on a reported basis, up from $620-$670 stated earlier. The company expects revenue growth (excluding HEYDUDE) of more than 20% for 2022. Consolidated revenues are projected to be $3.5 billion, suggesting year-over-year growth of 52-55%. Adjusted earnings are envisioned to be $10.05-$10.65 per share, up from the prior stated $9.7-$10.25. The adjusted operating margin is anticipated to be 26-27% compared with the aforementioned 26%.

For second-quarter 2022, revenues are projected to grow 43-49% to $918-$957 million. In the prior-year quarter, it reported revenues of $641 million. The adjusted operating margin is estimated at 26%, including air freight expenses of $50 million.

Additionally, an uptrend in the Zacks Consensus Estimate echoes the same sentiment. The Zacks Consensus Estimate for CROX’s 2022 sales and EPS suggests growth of 52.6% and 26.9%, respectively, from the year-ago period’s reported numbers. Earnings estimates for the current financial year have increased 4% to $10.56 over the past 60 days.

The company’s latest buyout of HEYDUDE, which sells light-weight, casual shoes and sandals for men, women and children, is likely to add value to its fast-growing footwear business. This is the second high-growth, highly profitable brand added to the Crocs portfolio. Crocs believes that HEYDUDE’s consumer-insight-driven casual, comfortable and light-weight products perfectly fit its existing portfolio. The acquisition is likely to diversify Crocs’ brand portfolio and add to its digital penetration, as HEYDUDE already has a strong online presence.

The acquisition is expected to be immediately accretive to Crocs’ revenues, operating margins and earnings. It expects HEYDUDE to deliver revenues of $620-$670 million on a reported basis, beginning Feb 17, 2022. Management expects the HEYDUDE brand to reach $1 billion in revenues by 2024.

Hurdles On the Path

Crocs is currently grappling with the ongoing inflation, supply-chain headwinds and adverse impacts of the war in Ukraine. The supply-chain disruptions have been challenging for manufacturers and have significantly hampered the mobility of products across the globe.

The company notes that global inflation, contributing to incremental freight costs, particularly air freight, will continue through the first half of 2022 and 2022. It expects air freight costs of $75 million to hurt the gross margin in the first half of 2022.

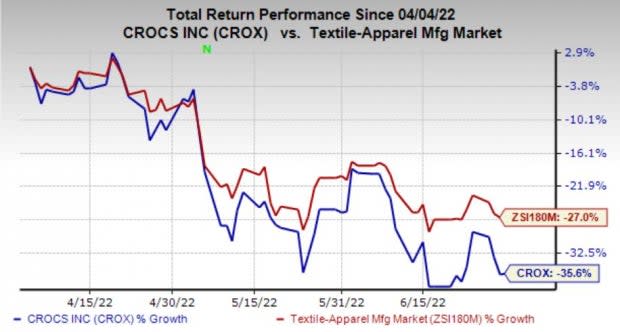

Image Source: Zacks Investment Research

Consequently, shares of CROX have lost 35.6% in the past three months compared with the industry’s decline of 27%.

Wrapping Up

Despite supply-chain headwinds and rising inflation, this Zacks Rank #3 (Hold) stock is likely to get back on track in the near term on the back of solid demand, brand strength and robust digital business. Also, a long-term earnings growth rate of 15% reflects its inherent strength.

Stocks to Consider

Some better-ranked stocks from the same industry are Delta Apparel DLA, Oxford Industries OXM and GIII Apparel Group GIII.

Oxford Industries, which is an apparel company, designs, sources, markets and distributes products bearing the trademarks of its owned and licensed brands. It currently flaunts a Zacks Rank #1 (Strong Buy). OXM has a trailing four-quarter earnings surprise of 99.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Oxford Industries’ current financial year’s sales and earnings suggests growth of 10.9% and 7.1%, respectively, from the year-ago period's reported numbers.

Delta Apparel, a manufacturer of knitwear products, currently sports a Zacks Rank #1. DLA has a trailing four-quarter earnings surprise of 95.5%, on average.

The Zacks Consensus Estimate for Delta Apparel's current financial year’s sales and earnings per share suggests growth of 11.9% and 10.1%, respectively, from the year-ago period's reported numbers.

GIII Apparel, a manufacturer, designer and distributor of apparel and accessories, presently has a Zacks Rank #2 (Buy). GIII has a trailing four-quarter earnings surprise of 160.6%, on average.

The Zacks Consensus Estimate for GIII Apparel’s current financial-year sales and earnings suggests growth of 8.7% and 5.2% from the year-ago period’s reported numbers, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Crocs, Inc. (CROX) : Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Oxford Industries, Inc. (OXM) : Free Stock Analysis Report

Delta Apparel, Inc. (DLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance