Departing directors and aggressive investors mean trouble for Ted Baker

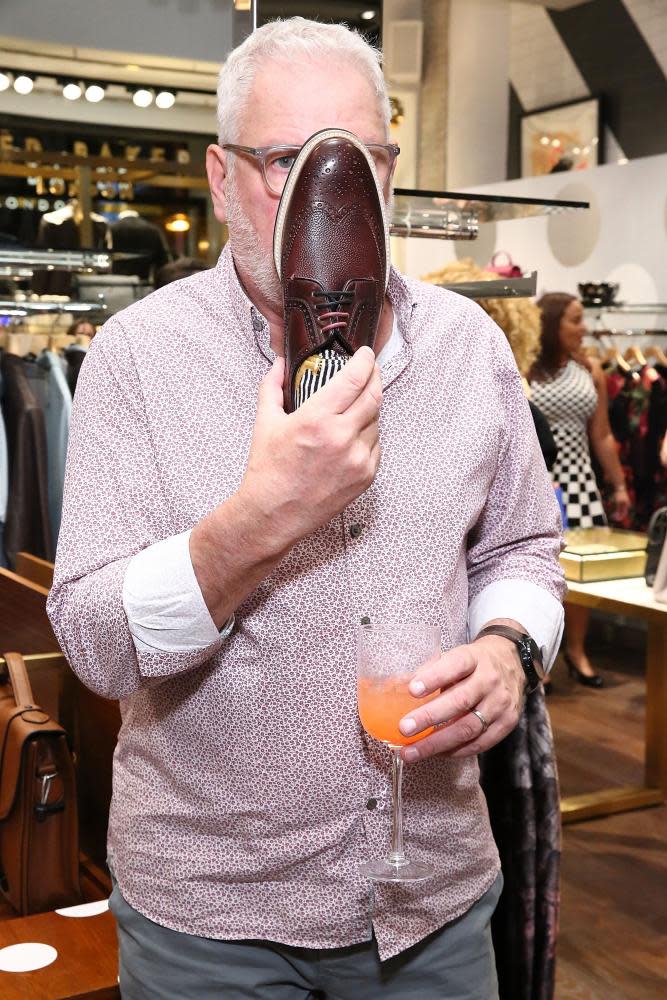

Ted Baker has been a jack-the-lad character in the City for the past 30 years. The story goes that “Ted”, the presumed alter ego of company founder Ray Kelvin, got the idea for a global brand “while fishing” in 1987. And he never looked back.

UK consumers were drawn to his quirky sense of humour and style, and wanted to buy his sexy dresses and dapper suits. One store in Glasgow became two, with a listing in the late 1990s leading to global stardom and product spinoffs ranging from homewares to perfume and sunglasses.

But now Ted is in trouble. Kelvin is gone – forced out after being accused of presiding over a regime of “forced hugs” and harassment, which he denies – and last week the chairman and chief executive quit too after a dramatic plunge in profits. Now a City investor whose nickname is “the Rottweiler” is on Ted’s case.

So where did it all go wrong? The brand was once an unusually reliable British growth story, cracking the difficult US market and appealing almost equally to both men and women. It has 200 shops and department store concessions in the UK and more than 350 others dotted around the world.

The company, which had been Kelvin’s fiefdom, is now rudderless. Its chairman, David Bernstein, has quit and chief executive Lindsay Page – the founder’s long-time lieutenant, who stepped up when he left – is also going. The situation is made worse by other senior departures, including retail director Chris Browne and womenswear boss Catherine Scorey.

Those who have followed Ted Baker’s fortunes closely say the brand was misfiring at home before the complaints about Kelvin were revealed in the Observer last year. Sales in its established UK and European stores began falling in 2017 and sales of this year’s spring and summer womenswear collections – which 64-year-old Kelvin had overseen – were particularly bad. A new design team then took over but its winter ranges are judged to have missed the mark in important areas such as coats.

John Stevenson, a retail analyst at Peel Hunt, said: “It was not a case of Ray left and suddenly the wheels fell off. This was absolutely happening under his watch. The whole team had been there for decades and so there was not much injection of new blood to change their thinking.”

Ted Baker is also accused of failing to adapt quickly enough to the vogue for casual dressing, sticking with its formula of graphic floral prints and dressy office- and occasionwear.

Emily Salter, a retail analyst at GlobalData, said: “The brand has a very distinctive style that has not necessarily been keeping up with the latest fashions, such as Scandi minimalism.” It would not be able to make a radical shift towards casual dressing, given its focus on tailoring, but she suggested more subtle changes on price and range could work: “They could attract shoppers from Karen Millen and Coast, which are now only trading online. Some people are not willing to buy expensive occasionwear from a website.”

A senior fashion industry insider said the departure of Kelvin only accelerated the brand’s difficulties, as he left both a power vacuum and a creative vacuum. “The business was Ray. Ted was his alter ego and for a long time they have done everything brilliantly. If you take Ray out, you take the essence of the business out. I don’t think Ray could have stopped it, but perhaps it wouldn’t have collapsed as it quickly as it has.”

At a time when cheap online fashion brands such as Boohoo and PrettyLittleThing are riding high, Ted Baker’s prices – with most dresses and suit trousers priced at over £100 and jackets at over £200 – look dangerously out of kilter. Another criticism is that a brand famed for inventive marketing campaigns – which included a Guy Ritchie-produced film – has not capitalised on social media.

The dire trading means Ted Baker could be close to maxing out its £180m of borrowings and may have to raise funds by selling new shares or assets. Its London HQ is on the market, as the company thinks a sale and leaseback deal could raise £60m.

Last week, in what was the company’s fourth profit warning of the year, the retailer warned it could make as little as £5m this year, which is a tenth of 2018’s haul. The profits collapse has had a dramatic impact on the company’s stock market value, with the shares – which were changing hands for £21 in January – now worth less than £4.

The low share price is now attracting opportunistic investors. Last week, Toscafund – whose founder, Martin Hughes, is nicknamed the “Rottweiler” for his tenacity and strongarm tactics with target companies – doubled its stake in the company to nearly 12%. The multimillion-pound gamble is a bet on the brand, which many investors hope can weather this crisis. Ted Baker is now very closely held, with Kelvin owning 35% and more than a quarter of the rest of the shares split between three investors – Schroders, Threadneedle and Toscafund.

People say there is nothing toxic about the brand itself. It’s just simply lost its way

John Stevenson, analyst

It’s not clear if these players would be willing to back a takeover. But any buyer would have to have a management team ready to parachute in, and a clear turnaround plan after a period of massive upheaval. One experienced dealmaker says a lot depends on whether investors believe the retail sector will have a better year in 2020: “If things are going to improve, then it looks cheap.”

Hughes likes to invest in companies “in times of trouble” and “provide advisory support”. His presence could add to pressure for swift change. While his shareholder activism has mostly gone on behind closed doors, he’s not afraid of open conflict.

Stevenson says investors are prepared to give the company time: “People say there is nothing toxic about the brand itself. It’s just simply lost its way. The business has historically generated a lot of profit. The attraction is the potential for a turnaround. Even after all the problems there’s still a solid underlying business. People are not anti the brand.”

One former employee said: “It is definitely redeemable. I think the City underestimates how tough this market is. The volatility has hit everyone and it was Ted’s turn.”

But the fashion industry insider believes turning Ted Baker around in the public eye will be very tricky without the inspiration of its founder. With all retailers under pressure from low consumer confidence and rising costs, there is little room for mistakes: “In this environment it will be bloody hard.”

Yahoo Finance

Yahoo Finance