Design Software Stocks Q2 Highlights: Autodesk (NASDAQ:ADSK)

As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the design software industry, including Autodesk (NASDAQ:ADSK) and its peers.

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

The 7 design software stocks we track reported a slower Q2. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Inflation progressed towards the Fed's 2% goal recently, leading the Fed to reduce its policy rate by 50bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be debating whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

In light of this news, design software stocks have held steady with share prices up 3.6% on average since the latest earnings results.

Autodesk (NASDAQ:ADSK)

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk (NASDAQ:ADSK) makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

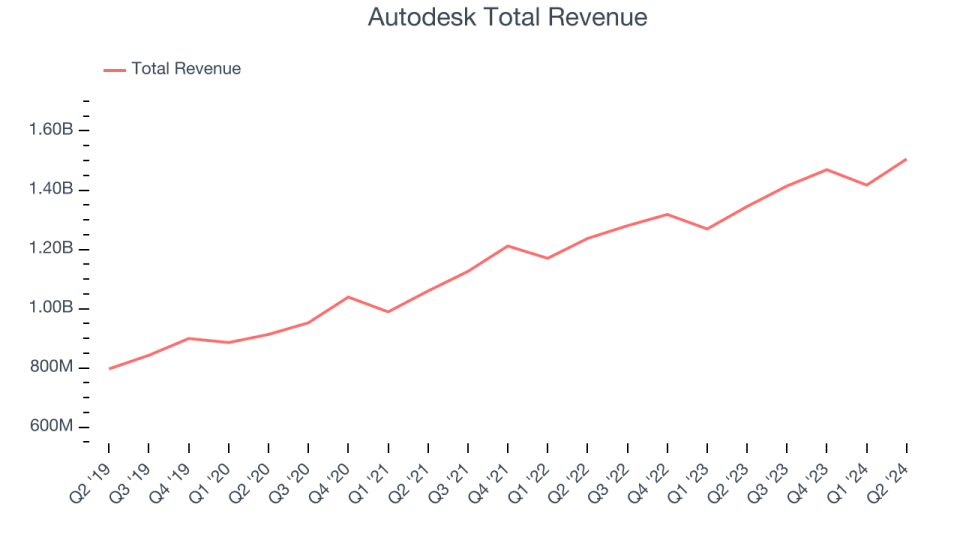

Autodesk reported revenues of $1.51 billion, up 11.9% year on year. This print exceeded analysts’ expectations by 1.5%. Despite the top-line beat, it was still a slower quarter for the company with a miss of analysts’ billings and ARR (annual recurring revenue) estimates.

"Autodesk continues to generate strong and sustained momentum both in absolute terms and relative to peers. Our success is fueled by our ability to capitalize on the attractive long term-growth trends we're seeing, including increases in global reconstruction and infrastructure. This is supported by our focused strategy to deliver more valuable and connected solutions for our customers, and by the proven durability of our business," said Andrew Anagnost, Autodesk president and CEO.

Autodesk scored the highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 5.1% since reporting and currently trades at $271.16.

Is now the time to buy Autodesk? Access our full analysis of the earnings results here, it’s free.

Best Q2: Cadence (NASDAQ:CDNS)

With the name chosen to reflect the idea of a repeating pattern or rhythm in electronic design, Cadence Design Systems (NASDAQ:CDNS) offers a software-as-a-service platform for semiconductor engineering and design.

Cadence reported revenues of $1.06 billion, up 8.6% year on year, outperforming analysts’ expectations by 1.7%. The business performed better than its peers, but it was unfortunately a mixed quarter with a solid beat of analysts’ billings estimates but a decline in its gross margin.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 7.2% since reporting. It currently trades at $266.76.

Is now the time to buy Cadence? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: PTC (NASDAQ:PTC)

Used to design the Airbus A380 and Boeing 787 Dreamliner commercial airplanes, PTC’s (NASDAQ:PTC) software-as-service platform helps engineers and designers create and test products before manufacturing.

PTC reported revenues of $518.6 million, down 4.4% year on year, falling short of analysts’ expectations by 2.8%. It was a softer quarter as it posted a miss of analysts’ billings estimates and a decline in its gross margin.

PTC delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. The stock is flat since the results and currently trades at $178.80.

Read our full analysis of PTC’s results here.

Unity (NYSE:U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $449.3 million, down 15.8% year on year. This result beat analysts’ expectations by 1.7%. More broadly, it was a slower quarter as it recorded a miss of analysts’ billings estimates.

Unity had the slowest revenue growth among its peers. The stock is up 51% since reporting and currently trades at $21.69.

Read our full, actionable report on Unity here, it’s free.

ANSYS (NASDAQ:ANSS)

Used to help design the Mars Rover, Ansys (NASDAQ:ANSS) offers a software-as-a-service platform that enables simulation for engineering and design.

ANSYS reported revenues of $594.1 million, up 19.6% year on year. This number topped analysts’ expectations by 6.9%. Zooming out, it was a slower quarter as it logged a miss of analysts’ average contract value estimates and a decline in its gross margin.

ANSYS achieved the biggest analyst estimates beat among its peers. The stock is flat since reporting and currently trades at $314.68.

Read our full, actionable report on ANSYS here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.