'The most destructive own goal:' A decade on from the Irish bank guarantee

This time 10 years ago during the onset of the credit crisis, it was already far too late. Though the Irish government was about two days out from committing what one expert would later call “the most destructive own goal in history,” everything had already been set in motion.

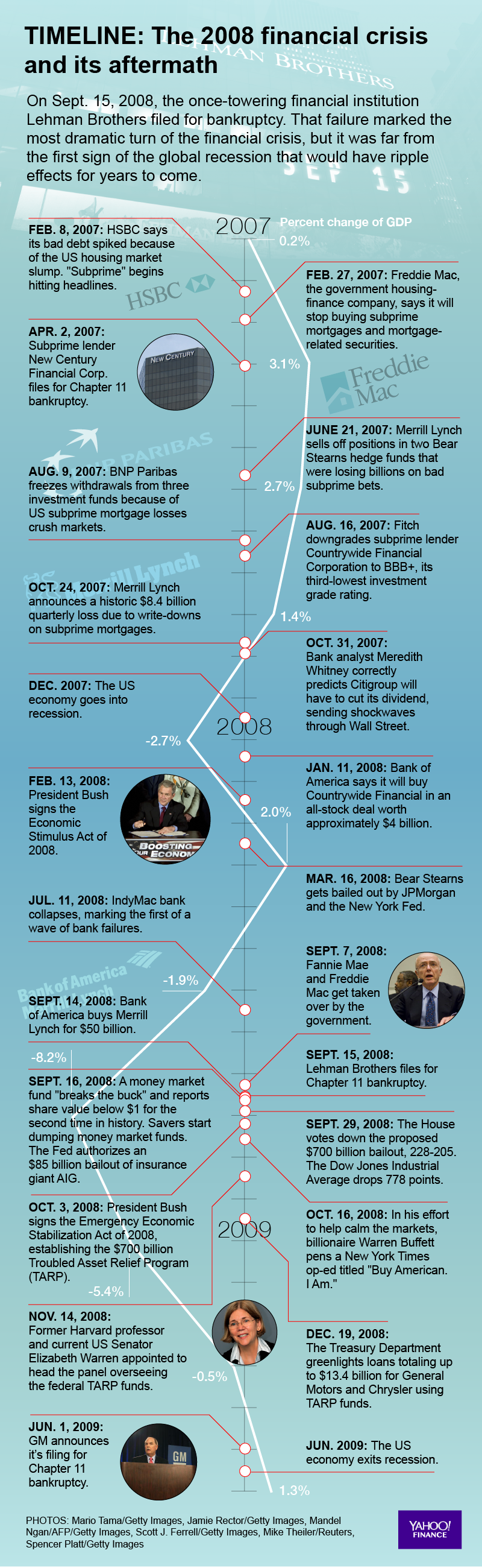

That own goal was the Irish bank guarantee, a blanket commitment that covered six institutions, including the state’s three biggest banks. It was a “blanket” guarantee because it underwrote almost everything—outstanding liabilities, such as deposits, loans, and all types of bonds, would be paid in full by the Irish government, no matter what occurred as the banking crisis continued to unfurl. Lehman Brothers had collapsed just two weeks prior.

At the time, it was thought that the government of a small peripheral country on the edge of Europe with a population of less than 5 million people could technically be left footing the bill for up to €440bn (£390bn) in liabilities. Though it was intended to prevent a collapse of the Irish banking system, a decade later, pretty much everyone agreed that it was a very bad move—a singularly fateful decision that, to a large extent, preordained the 2010 bailout of the country.

“It should have been introduced with much more forethought, but it was made necessary by the fact that the Irish government at the time had utterly and completely mismanaged the early stages of the financial crisis,” said Constantin Gurdgiev, an adjunct professor of finance at Trinity College Dublin, to Yahoo Finance UK.

READ MORE: The five best performing asset classes since the collapse of Lehman Brothers

The 280-word guarantee had few stipulations. It was not contingent on reform in the Irish banks, for instance. But the biggest criticism of the move centres around the decision to guarantee Anglo Irish Bank, a non-systemic institution that dealt almost entirely with business and commercial borrowings. It was non-systemic because its collapse would not have had the same effect as a breakdown of the two main retail banks, Bank of Ireland and AIB.

“They should have closed Anglo there and then by moving deposits out and shutting everything else down. That didn’t happen,” said Gurdgiev. Anglo would later be nationalised by the Irish government, and, in 2011, was forced to wind down anyway.

It would take a few days—and in some cases, weeks, months, and years—for the most censorious criticism of the decision to emerge. But it was almost immediately denounced by Ireland’s European neighbours. Britain felt that the unilateral move undercut its own banks, since Ireland was now one of the safest places in the world to house your money.

“It was also a massive dumping of risk onto everyone else,” Gurdgiev notes. “For all their failings, leaders in other European countries would have been well aware of the almost unlimited downsides of something like a blanket guarantee.”

For one thing, it put them under pressure to offer similar levels of security to borrowers in their own countries. But it was also a kind of canary in a coal mine, because it exposed the structural weaknesses in the European banking system. “Nobody likes that,” Gurdgiev said. “But the fact is that the European banking system had no other defensive measures to offer Ireland.”

The lessons from the bank guarantee are now detached from Ireland, Gurdgiev suggests. “They have more to do with the structure of the European monetary union, the lack of enforcement of regulations of the banking sector, and the lack of will and capacity to address the kinds of issues that were exposed by the crisis.”

Have those lessons been learned? Not according to Gurdgiev. “There hasn’t been enough change in policy or a change in rank that would give us any confidence that we’re not going to end up one night, in some not-too-distant future, with another disaster like the bank guarantee,” he surmises.

Yahoo Finance

Yahoo Finance