Deutsche Bank (DB) Incurs Q3 Loss as Revenues Fall, Costs Up

Marred by significant restructuring costs, Deutsche Bank DB reported third-quarter 2019 net loss of €832 million ($925.8 million) against net income of €229 million in the year-ago quarter. Also, the German lender incurred loss before taxes of €687 million ($764.4 million).

Third-quarter results were affected by rise in expenses. Lower revenues and higher provisions were other undermining factors. However, strong capital position and net inflows were tailwinds.

Revenues Decline, Expenses and Provisions Rise

The bank generated net revenues of €5.23 billion ($5.8 billion), down 15% year over year. Lower revenues across most of the segments, exit from Equities Sales & Trading and a challenging market environment, led to this downside.

Net revenues at the Corporate Bank (“CB”) division of €1.32 billion ($1.5 billion) rose 6% from the year-ago quarter. Higher revenues in global transaction banking along with commercial banking led to the rise.

The Investment Bank segment’s net revenues totaled €1.65 billion ($1.8 billion), down 5% year over year. Lower revenues from fixed income and currency sales & trading resulted in the decline.

Private Bank reported net revenues of €2.05 billion ($2.3 billion), down 3%. The fall primarily stemmed from lower revenues from businesses within Germany and wealth management unit.

Asset Management segment generated net revenues of €543 million ($604.2 million), down 4% year over year, mainly due to impact of lower interest rates.

Corporate & Other unit reported negative net revenues of €76 million ($84.6 million) against net revenues of €54 million a year ago.

Also, the Capital Release unit reported negative net revenues of €223 million ($248.1 million) against net revenues of €459 million.

Provision for credit losses increased 95% from the year-ago quarter to €175 million ($194.7 million). The rise resulted largely from higher provisions in the CB unit as the bank prepares itself for forecasted weaker macroeconomic conditions.

Non-interest expenses of €5.78 billion ($6.4 billion) were up 4% from the prior-year quarter. Excluding restructuring-related charges, the bank reported adjusted costs of €5.2 billion ($5.8 billion), down 4%.

Deutsche Bank’s Common Equity Tier 1 capital ratio (fully loaded) came in at 13.4% as of Sep 30, 2019, compared with 14% as of Sep 30, 2018. Leverage ratio, on an adjusted fully-loaded basis, was 3.9%, down from 4% in the prior-year quarter.

Risk-weighted assets declined €3 billion in the September quarter to €343.9 billion ($382.7 million) sequentially.

Our Viewpoint

Deutsche Bank’s third-quarter results were largely affected by the costs related to its major overhaul. Also, persistent rise in provisions and lower revenues were key headwinds. Nevertheless, capital position remained decent.

Deutsche Bank’s restructuring efforts aimed to boost revenues and drive improvement across all the business segments look encouraging. However, it is really difficult to determine how much the bank will gain, considering the lingering headwinds. Moreover, dismal revenue performance is a concern.

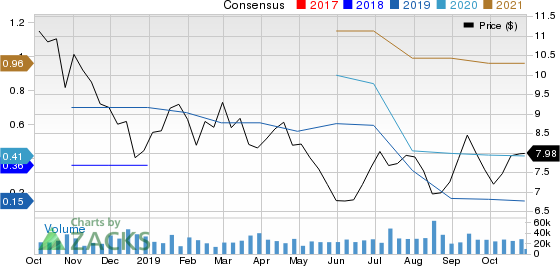

Deutsche Bank Aktiengesellschaft Price and Consensus

Deutsche Bank Aktiengesellschaft price-consensus-chart | Deutsche Bank Aktiengesellschaft Quote

Deutsche Bank currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Foreign Banks

UBS Group AG UBS reported third-quarter 2019 net profit attributable to shareholders of $1.05 billion, down nearly 16% from the prior-year quarter.

Barclays BCS reported third-quarter 2019 net loss attributable to ordinary equity holders of £292 million ($360 million). This reflects a decline from net income attributable to ordinary equity holders of £1.05 billion ($1.37 billion) recorded in the year-ago quarter.

Among other foreign banks, Itau Unibanco Holding S.A. ITUB will release September quarter numbers on Nov 4.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Deutsche Bank Aktiengesellschaft (DB) : Free Stock Analysis Report

Itau Unibanco Holding S.A. (ITUB) : Free Stock Analysis Report

Barclays PLC (BCS) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance