Deutsche Bank (DB) Q4 Earnings Improve Y/Y on Higher Revenues

Deutsche Bank DB reported fourth-quarter 2021 net income of €315 million ($360 million) compared with the year-ago quarter’s €189 million. Also, the German lender reported a profit before taxes of €82 million ($93.7 million) compared with €175 million in the year-ago quarter.

The bank delivered its best result in ten years. Fourth-quarter results benefited from higher net revenues and flat provisions for credit losses. Also, a strong capital position was a tailwind. However, an increase in provision for credit losses was a major offsetting factor.

In 2021, Deutsche Bank reported a net income of €2.51 billion ($2.87 billion) compared with €624 million in the prior year.

Revenues Rise, Costs Flare Up & Provisions Stable

In 2021, DB reported net revenues of €25.41 billion ($29.04 billion), up 6% year over year.

The bank generated net revenues of €5.90 billion ($6.74 billion) in the fourth quarter, up 8% year over year. This upside primarily resulted from higher revenues in all the segments, other than Corporate & Other.

Provision for credit losses came in at €254 million ($288.04 million), almost flat with the fourth-quarter 2020 figure, which recorded €251 million.

Non-interest expenses of €5.56 billion ($6.36 billion) rose 11% from the prior-year quarter’s level, including €456 million as transformation charges. These were steered majorly by a 46% rise in restructuring and severance expenses. Adjusted costs excluding transformation charges and reimbursable expenses related to Prime Finance were down 1% year over year to €19.3 billion ($22.1 billion).

Segmental Performances

Net revenues of €1.35 billion ($1.54 billion) at the Corporate Bank division were up 10% year over year. Deutsche Bank delivered the highest revenues of any quarter since the formation of the Corporate Bank unit in 2019, as an easing of interest rate headwinds and business volume growth favorably impacted the same.

Investment Bank’s net revenues totaled €1.91 billion ($2.18 billion), up 1% year over year. This highlights growth in Origination & Advisory revenues, offset by a decline in Fixed Income & Currencies revenues.

Private Bank reported net revenues of €2.04 billion ($2.33 billion), up 4% year over year. Higher revenues (excluding adjustments) from Private Bank Germany and the International Private Bank revenues led to this upside.

Asset Management generated record net revenues of €789 million ($901.8 million), up 32% year over year, mainly aided by increased management fees. Net asset inflows during the quarter were €15 billion ($17 billion).

Corporate & Other reported negative net revenues of €199 million ($227.5 million) compared with the negative net revenues of €161 million reported in the prior-year period.

Capital Release reported net revenues of €5 million ($5.7 million) against negative net revenues of €65 million recorded in the year-ago quarter.

Mixed Capital Position

Leverage ratio on an adjusted fully-loaded basis was 4.9%, up from the year-ago quarter’s 4.7%.

However, Deutsche Bank’s Common Equity Tier 1 (CET1) capital ratio (fully loaded) came in at 13.2% as of Dec 31, 2021, down from the year-ago quarter’s 13.6%. Risk-weighted assets were €28 billion ($31.8 billion) at the end of 2021, ahead of the year-end 2022 target of €32 billion ($36.3 billion). The same compared unfavorably with €34 billion ($38.6 billion) reported in the year-ago quarter.

Capital Deployment

On Jan 26, 2022, Deutsche Bank announced that it will provide total capital distributions worth € 700 million. This represents the first step toward the bank’s previously announced commitment to return €5 billion of capital to its shareholders over time. Management also decided to initiate a share repurchase program of €300 million, to be completed in the first half of 2022, and plans to propose a cash dividend of 20 cents per share for the financial year 2021.

Our Viewpoint

Deutsche Bank reported decent fourth-quarter results. DB was successful in increasing revenues with its initiatives. Also, its capital position remained decent. The German lender’s restructuring efforts, aimed to boost revenues and drive improvement across all the business segments, look encouraging. However, an increased expense base was a major drag.

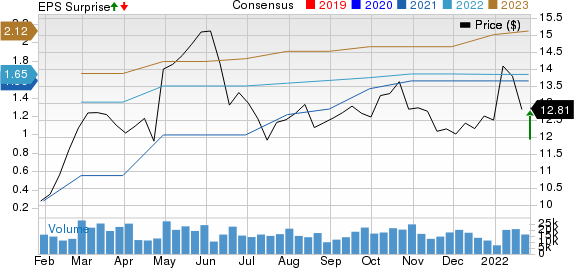

Deutsche Bank Aktiengesellschaft Price, Consensus and EPS Surprise

Deutsche Bank Aktiengesellschaft price-consensus-eps-surprise-chart | Deutsche Bank Aktiengesellschaft Quote

Deutsche Bank currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

First Republic Bank’s FRC fourth-quarter 2021 earnings per share of $2.02 surpassed the Zacks Consensus Estimate of $1.91. Additionally, the bottom line improved 26.3% from the year-ago quarter’s level.

FRC’s quarterly results were supported by a higher net interest income and non-interest income. Moreover, First Republic’s balance-sheet position was strong in the quarter. However, higher expenses and elevated net loan charge-offs were the offsetting factors.

Citigroup Inc. C delivered an earnings surprise of 5.04% in fourth-quarter 2021. Income from continuing operations per share of $1.46 outpaced the Zacks Consensus Estimate of $1.39. However, the reported figure declined 24% from the prior-year quarter’s level.

Citigroup’s investment banking revenues jumped in the quarter under review, driven by equity underwriting and growth in advisory revenues. However, fixed-income revenues were down due to declining rates and spread products.

U.S. Bancorp USB reported fourth-quarter 2021 earnings per share of $1.07, which missed the Zacks Consensus Estimate of $1.11. Results, however, compare favorably with the prior-year quarter’s figure of 95 cents.

Though lower revenues and escalating expenses were disappointing factors, credit quality was a tailwind. Growth in loan and deposit balance and a strong capital position were also encouraging factors. Moreover, U.S. Bancorp closed the acquisition of San Francisco-based fintech firm TravelBank, which offers technology-driven cost and travel management solutions.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

Deutsche Bank Aktiengesellschaft (DB) : Free Stock Analysis Report

U.S. Bancorp (USB) : Free Stock Analysis Report

First Republic Bank (FRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance