DEUTSCHE BANK: There is no need to fear helicopter money

REUTERS/Yuya Shino

Central banks across the globe are facing big problems. Widely accepted methods of stimulating growth and inflation, like ultra-low interest rates, are struggling to do that.

In Europe for example, inflation is completely flat, with only a few nations managing to find any meaningful price growth. That has led to calls for more unconventional monetary policy decisions, including the potential use of so-called helicopter money.

The term was first coined by American economist Milton Friedman in the '60s, and the basic principle is that central banks create new cash and give it directly to people to spend on whatever they want.

Here's the quote from Friedman's book The Optimum Quantity of Money:

Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community.

There have been serious concerns about both the possible inflationary effects of helicopter money, and its legality, and because of that – as Business Insider's Ben Moshinsky pointed out earlier this month — in recent years, helicopter money has "remained as more a thought experiment than a viable policy."

But according to analysts at Deutsche Bank, there's no need to fear the unknown when it comes to helicopter money, because we've been there before.

In a note by George Saravelos, Daniel Brehon and Robin Winkler, Deutsche argues that helicopter money has been widely used in the past, and as a result putting it into practice would be "less unconventional than you think." Here's Deutsche (emphasis ours):

The starting point of any discussion on the institutional constraints of monetary financing should be that in contrast to negative rates, it has been widely used in the past.

Monetary financing has been used in the developed world. During the two world wars governments harnessed their central banks in funding their military expenses.

The note goes on to point out that monetary financing — the economic term for helicopter money — was used broadly during the Great Depression in the late 1920s, and was hugely effective. This was particularly true, Deutsche Bank says, in Japan.

Here's Deutsche once more (emphasis ours):

Less cited are the curative powers of monetary financing in Great Depression Era Japan and Canada. Finance minister Takahashi Korekiyo is often referred to as “Japan’s Keynes” for his monetary and fiscal innovations during the 1930s. While he is best known for leaving the gold standard and devaluing the yen, his monetary financing policy also helped Japan escape the Great Depression with minimal economic damage compared to Western peers.

One of the key problems cited by opponents of helicopter money is that it can be hugely inflationary.

That fear is particularly true in Germany, which has been scarred by its experience of hyperinflation in the 1920s and is generally more cautious when it comes to programs of printing money and buying bonds.

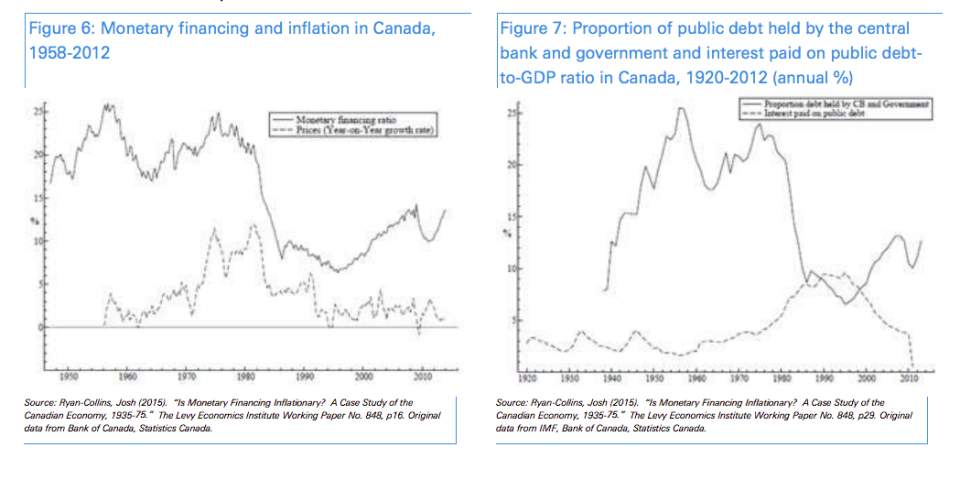

However, Deutsche's analysts argue — citing economist Josh Ryan-Collins — that not only has monetary financing been widely used in the past, its effects have also been largely positive. Here's the key quote from the analysts, using Ryan-Collins' example of Canada (emphasis ours):

Ryan-Collins’ empirical work suggests monetary financing, in addition to mitigating the worst effects of the Great Depression during the late-30s, did not have adverse inflationary effects during the post-war era. He argues that monetary financing was a standard part of the central bank toolkit until the 1970s monetarists revolution and that “the 1935-70 period saw the Canadian economy recover quickly from the Great Depression, weather the Second World War, make a rapid transition from war to peace, and then enjoy a 25-year period of relatively stable and high growth with rapid industrialization.”

And here are the charts to show just that:

REUTERS/Yuya ShinoDeutsche Bank concludes that helicopter money, "the ultimate form of monetary policy has a strong historical precedent, reasonable legislative flexibility and can prove substantially more powerful than traditional monetary or fiscal policy."

NOW WATCH: Here's why SoulCycle might be in big trouble

See Also:

Yahoo Finance

Yahoo Finance