DEUTSCHE BANK: Here's how helicopter money could send stocks flying

Spc. Lloyd Villanueva/US Army

The introduction of helicopter money — directly dropping cash into the economy — in Europe would give shares in the continent's biggest companies a boost, according to the latest research from analysts at Deutsche Bank.

In their weekly European Equity Strategy note, stock analysts led by Sebastian Raedler argue that if central banks on the continent, or further afield, decide to introduce so-called monetary financing, it will boost stocks by helping to support growth and bump up inflation expectations.

The term helicopter money was first coined by American economist Milton Friedman in the 1960s. The basic principle is that central banks create new cash and give it directly to people to spend on whatever they want.

Here's the quote from Friedman that coined the phrase: "Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community."

For decades, helicopter money has remained as more a thought experiment than a viable policy. But, with negative rates and chronic low growth confounding central banks, the idea is picking up credibility, with Deutsche the latest bank to suggest that it could have legs as a means of stimulating the economy.

Here is the key quote from the team at Deutsche (emphasis ours):

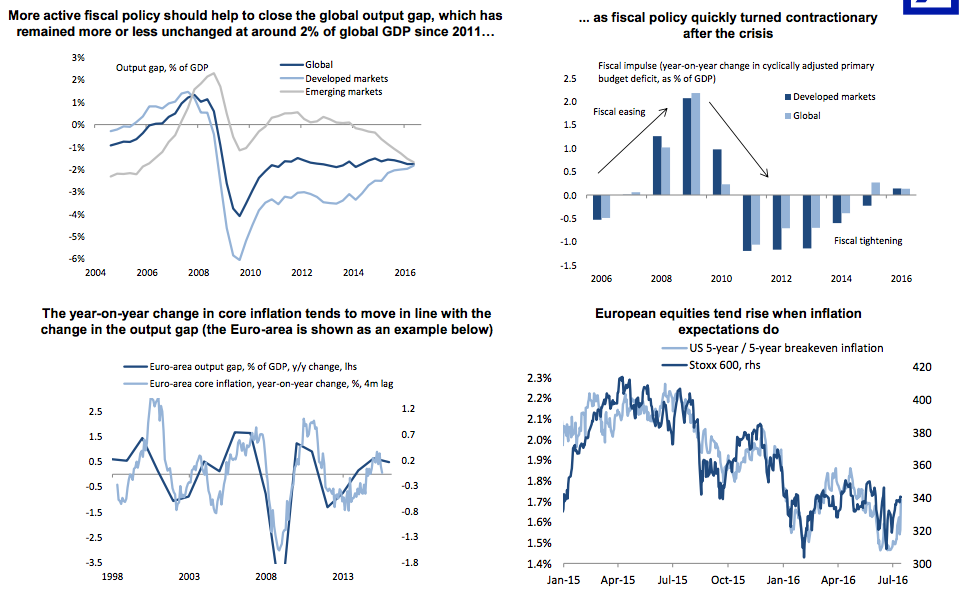

"After years of tight fiscal / easy monetary policy in the developed world, there is hope among investors that both Japan and the UK might be close to embarking on central bank-financed fiscal easing. We believe that such monetary financing (or helicopter money) could be a significant positive for equity markets, as it has the potential to support growth, helps to close the global output gap (which has effectively been stagnant at around 2% of global GDP for the past five years) and push up inflation expectations, a key driver of the equity market."

Deutsche Bank's team also include four key charts, illustrating just why they forecast a strong gain in stocks if helicopter money were to happen. Take a look below:

Spc. Lloyd Villanueva/US Army

Deutsche's argument is corroborated by the recent moves in markets. Since the UK voted to leave the European Union, an event that initially caused markets to crash, stocks have rallied.

Much of that has been down to the belief that central banks are preparing fresh monetary stimulus as a way to fight against the uncertainty Britain's vote to leave has caused, and to try and boost generally sluggish growth in much of the developed world.

While backing for bringing out the helicopters is on the rise, it seems pretty unlikely that it will make an appearance in central bank policy in the immediate future. "We are not convinced that the adoption of monetary financing is imminent," Raedler and his team note. ECB president Mario Draghi has totally ruled out the possibility of helicopter money, and Bank of England governor Mark Carney has said he believes it can lead to a "compounded Ponzi scheme." Haruhiko Kuroda, the governor of the Bank of Japan — which is thought to be closest to bringing in the helicopters — said in a BBC interview aired last week that he is sceptical of the policy.

NOW WATCH: MALCOLM GLADWELL: ‘Anyone who gives a single dollar to Princeton has completely lost their mind'

See Also:

Deutsche Bank's CEO just said something that should frighten the bank's employees

Deutsche Bank's profits nosedived from €800 million to just €20 million

SEE ALSO: Japan may be en route to a 'soft' form of helicopter money

DON'T MISS: MORGAN STANLEY: Helicopter money may be the next step for Britain

Yahoo Finance

Yahoo Finance