What's driving Deutsche Bank's huge jobs cull and what investors think

Investors and analysts have reacted cautiously to Deutsche Bank’s (DBK.DE) sweeping turnaround plan, saying the changes are long overdue but risks remain.

Late on Sunday, Deutsche Bank announced plans to cut 18,000 jobs, spin out €74bn (£65.3bn, $81.75bn) of risky assets into a new “bad bank,” axe its global equity trading business, and trim down other parts of the business. It will instead focus on corporate banking and retail operations.

READ MORE: Deutsche Bank to axe 18,000 jobs and exit stock trading

CEO Christian Sewing said in a letter to staff that the plans were “a fundamental rebuilding” of the bank that would “make Deutsche Bank a leading bank once again.”

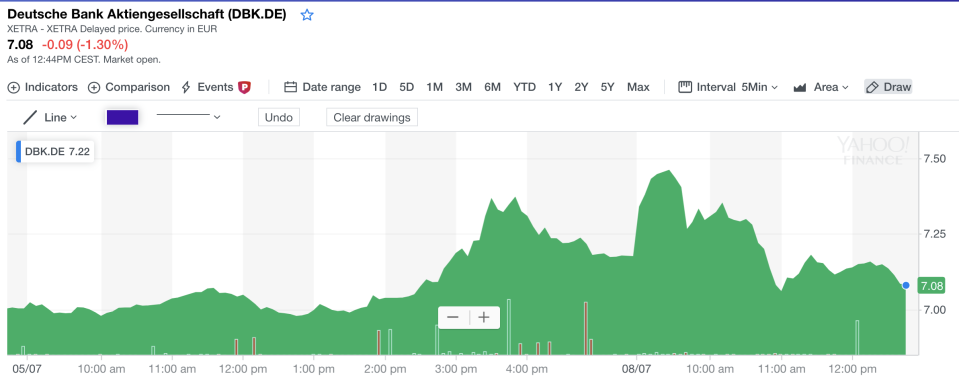

Shares in Deutsche Bank rose as much as 5% at market open in Germany on Monday. However, the share price was down by 1.3% at 12pm UK time as the initial optimism subsided.

Questions remain about details of the cuts and how Deutsche Bank plans to grow revenue during such an extensive overhaul.

“Cutting costs by one quarter, while growing revenues by 10% over four years in the current market environment, and while undergoing massive restructuring, could be seen as challenging by some,” UBS analyst Daniele Brupbacher wrote in a note to clients.

‘Not half-baked’

Deutsche Bank has been struggling with an underperforming business and share price since the financial crisis. The bank spent heavily on building up a large investment bank in the years leading up to 2008. This helped to grow revenues during the years of booming finance.

But the financial crash put many corporates off the risky bets that Deutsche Bank specialised in. New regulation introduced post-crisis also made it much more expensive for Deutsche Bank to sell and hold the kind of structured products it excelled at. And a decade of low interest rates hit revenues as there was less opportunity to sell products around rate rises or cuts.

All of this meant Deutsche Bank has been left with a costly investment banking and trading operation that brings in too little revenue. Other banks have faced similar problems: Royal Bank of Scotland pulled out of investment banking after the financial crisis and Barclays has recently come under pressure to cut back its investment bank to improve performance.

READ MORE: London Deutsche Bank staff 'crying' after huge jobs cull

However, the scale of the problem was worse at Deutsche Bank. 2018 marked the banks first net profit since 2014 and even then chief executive Christian Sewing said the bank was “nowhere near where we want it to be.”

Successive CEOs had launched reforms aimed at trying to turnaround performance but they were plasters on a gaping wound.

“They should have pulled the plug sooner to save shareholders,” said Bill Blain, a strategist at Shard Capital. “No investment bank will succeed if the staff feel the management’s heart is not in it and that’s been a problem at Deutsche Bank for years.”

Rather than trying to fix the loss making equities business and investment bank as past CEOs have, Christian Sewing has taken the nuclear option and simply axing underperforming divisions.

The new plans are “for the first time not half-baked but a real strategic shift,” JP Morgan banking analyst Kian Abouhossein wrote in a note. He called the overhaul “bold,” while UBS’ Brupbacher called them “radical.”

Michael Hewson, the chief market analyst at CMC Markets, said in a note on Friday that changes, which were heavily leaked in the press, were “long overdue.”

‘Structural challenges remain’

However, “further questions need to be answered,” Abouhossein wrote. He flagged questions about Deutsche Bank’s ability to push through the overhauls outlined successfully given its poor recent track record on reforms. He also said there are questions about employee motivation amid such sweeping cuts and “revenue growth details and rationale, where DB has disappointed in the past.”

“The bank doesn’t really make much money anywhere else,” Hewson said in a note to clients on Friday.

Deutsche Bank management think they can grow revenues by investing in digital, which it hopes will spur growth things like wealth management while also cutting costs.

READ MORE: 'Dramatic decrease' in finance jobs as Deutsche Bank swings axe

“Deutsche Bank indicated that it will undertake a restructuring of its infrastructure functions, which include back office systems and processes that support all business divisions,” Abouhossein said. “These functions will become leaner, more innovative and more digital.”

But competitors have already been doing this for years, leaving Deutsche Bank with a gulf to make up in terms of investment.

Its core market Germany is also teetering on recession, suggesting the bank will struggle to see growth there.

“Structural challenges remain,” Goldman Sachs analyst Jernej Omahen and team wrote. “The central issue – an absence of a high return platform – remains.”

Deutsche Bank is set to give banking analysts and key investors a more detailed presentation on the turnaround plans later on Monday.

————

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

'Dramatic decrease' in finance jobs as Deutsche Bank swings axe

Investor anger at Sainsbury's boss pay after Asda deal collapse

'Grave concern' as low emission car sales fall for first time in 26 months

Yahoo Finance

Yahoo Finance