Deutsche Bank's (DB) Q1 Earnings and Revenues Increase Y/Y

Deutsche Bank’s DB first-quarter 2021 net income of €1.04 billion ($1.25 billion) rose substantially from the year-ago quarter’s €66 million. Also, the German lender reported profit before taxes of €1.59 billion ($1.91 billion) compared with $206 million in the year-ago quarter.

First-quarter results benefited from higher net revenues and a decline in expenses. Also, strong capital position was a tailwind. Further, a decline in provision for credit losses was a positive factor.

Revenues Rise, Costs & Provisions Decline

The bank generated net revenues of €7.23 billion ($8.71 billion) in the first quarter, up 14% year over year. The upside was primarily due to higher revenues from investment bank and asset management units.

Provision for credit losses was €69 million ($83.17 million), down 86% from $506 million reported in the year-ago quarter.

Non-interest expenses of €5.57 billion ($6.71 billion) were down 1% from the prior-year quarter due to lower restructuring expenses. Excluding transformation-related charges, the bank reported adjusted costs of €4.7 billion ($5.66 billion), down 4%.

Segmental Performance

Net revenues at the Corporate Bank division of €1.31 billion ($1.58 billion) declined 1% from the year-ago quarter. Lower revenues in institutional client services led to the downside.

Investment Bank’s net revenues totaled €3.1 billion ($3.74 billion), up 32% year over year. Higher revenues from fixed income, particularly debt origination business, along with rise in origination and advisory, resulted in the jump.

Private Bank reported net revenues of €2.18 billion ($2.63 billion), almost stable year over year. Higher revenues from Private Bank Germany were offset by International Private Bank revenues.

Asset Management generated net revenues of €637 million ($767.78 million), up 23% year over year, mainly due to a favorable change in the fair value of guarantees and higher performance fees. Net asset inflows during the quarter were €1 billion ($1.2 billion).

Corporate & Other reported negative net revenues of €74 million ($89.19 million) against net revenues of €43 million a year ago.

Capital Release reported net revenues of €81 million ($97.63 million) compared with negative net revenues of €57 million a year ago, reflecting the impact of hedging costs, funding charges and de-risking costs.

Capital Position

Deutsche Bank’s Common Equity Tier 1 capital ratio (fully loaded) came in at 13.7% as of Mar 31, 2021, up from 12.8% in the year-ago quarter. Leverage ratio, on an adjusted fully-loaded basis, was 4.6%, up from 4%.

Risk-weighted assets increased €1 billion in the first quarter to €330 billion ($397.75 billion) sequentially.

Our Viewpoint

Deutsche Bank reported decent first-quarter results. The company was successful in trimming costs and increasing revenues with its initiatives. Also, its capital position remained decent. The German lender’s restructuring efforts, aimed to boost revenues and drive improvement across all the business segments, look encouraging.

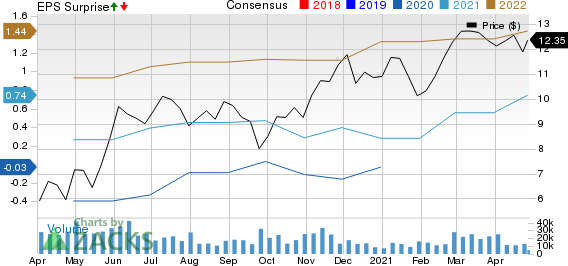

Deutsche Bank Aktiengesellschaft Price, Consensus and EPS Surprise

Deutsche Bank Aktiengesellschaft price-consensus-eps-surprise-chart | Deutsche Bank Aktiengesellschaft Quote

Deutsche Bank currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

UBS Group AG UBS reported first-quarter 2021 net profit attributable to shareholders of $1.82 billion, up 14% from $1.60 million in the prior-year quarter.

ICICI Bank’s IBN fourth-quarter fiscal 2021 (ended Mar 31) net income was INR44.03 billion ($602 million), up substantially from INR12.21 billion ($167 million) in the prior-year quarter.

HSBC Holdings HSBC reported first-quarter 2021 pre-tax profit of $5.8 billion, up 79% from the prior-year quarter.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UBS Group AG (UBS) : Free Stock Analysis Report

ICICI Bank Limited (IBN) : Free Stock Analysis Report

Deutsche Bank Aktiengesellschaft (DB) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance