DHI Group Inc (DHX) Q1 2024 Earnings: Misses Revenue and Net Income Estimates

Revenue: Reported at $36.0 million, a decrease of 7% year-over-year, falling short of estimates of $36.36 million.

Net Loss: Recorded a net loss of $1.5 million, compared to net income of $0.5 million in the previous year, significantly above the estimated net loss of $0.37 million.

Earnings Per Share (EPS): Reported a negative EPS of $0.03, below the estimated EPS of $0.03.

Adjusted EBITDA: Increased to $8.6 million, up 6% year-over-year, with an Adjusted EBITDA Margin improvement to 24% from 21%.

Cash Flow: Cash flow from operations rose to $2.1 million from $0.0 million in the year-ago quarter.

Bookings: Total bookings decreased by 9% year-over-year to $48.8 million.

Debt Position: Ended the quarter with total debt of $41.0 million, down from $46.0 million in the year-ago quarter.

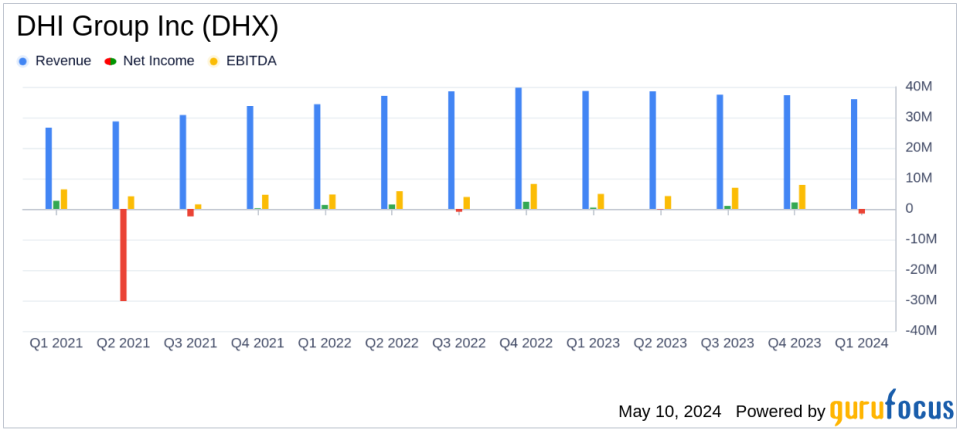

DHI Group Inc (NYSE:DHX) released its 8-K filing on May 8, 2024, revealing the financial outcomes for the first quarter ended March 31, 2024. The company, a leading provider of AI-powered career marketplaces focusing on technology roles, reported a decline in revenue and a shift to a net loss compared to the previous year.

Financial Performance Overview

For Q1 2024, DHI Group reported total revenue of $36.0 million, a decrease of 7% year-over-year from $38.62 million. This figure fell slightly below the analyst estimates of $36.36 million. The company also experienced a net loss of $1.5 million, or $0.03 per diluted share, contrasting sharply with a net income of $0.5 million, or $0.01 per diluted share, in the same quarter last year. This performance did not meet the estimated earnings per share of $0.03 and was significantly off from the estimated net income of -$0.37 million.

Operational Highlights and Challenges

DHI's bookings decreased by 9% to $48.8 million. The company faced challenges due to a slump in hiring demand, which was particularly evident last year. However, there were signs of recovery with an increase in tech job postings in the first quarter. Despite these challenges, DHI Group saw a positive movement in its Adjusted EBITDA, which increased by 6% to $8.6 million, and Adjusted EBITDA Margin improved to 24% from 21% year-over-year.

Management Commentary

Art Zeile, President and CEO of DHI Group, commented on the results, noting, "While we suffered from a slump in hiring demand last year, the first three months of 2024 have been more promising, with tech job postings increasing from a low point of 142,000 in December to 191,000 in March as reported by CompTIA." He also highlighted the long-term growth trend in tech employment driven by digital transformation and generative AI.

Raime Leeby, CFO of DHI Group, reiterated the 2024 full-year guidance, expecting revenue to decline in the low single-digit percentage range but aiming to maintain an Adjusted EBITDA margin of 24% for the full year.

Financial Statements Insight

The income statement details reveal that while operating income improved to $1.969 million from $573,000 year-over-year, the net income was adversely impacted by higher income tax expense and an impairment of investment. The balance sheet shows a slight decrease in cash from $4.206 million at the end of the previous quarter to $3.240 million, with total assets at $231.903 million.

Looking Ahead

Despite the current challenges, DHI Group is optimistic about the recovery in tech hiring and its impact on future performance. The company's strategic focus on enhancing its AI-driven platforms and extensive technologist profiles positions it well to capitalize on the evolving market demands.

For detailed financial figures and further information, readers are encouraged to view the full earnings release here.

Explore the complete 8-K earnings release (here) from DHI Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance