Dialight's(LON:DIA) Share Price Is Down 56% Over The Past Five Years.

Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. To wit, the Dialight plc (LON:DIA) share price managed to fall 56% over five long years. That's an unpleasant experience for long term holders. The good news is that the stock is up 2.2% in the last week.

Check out our latest analysis for Dialight

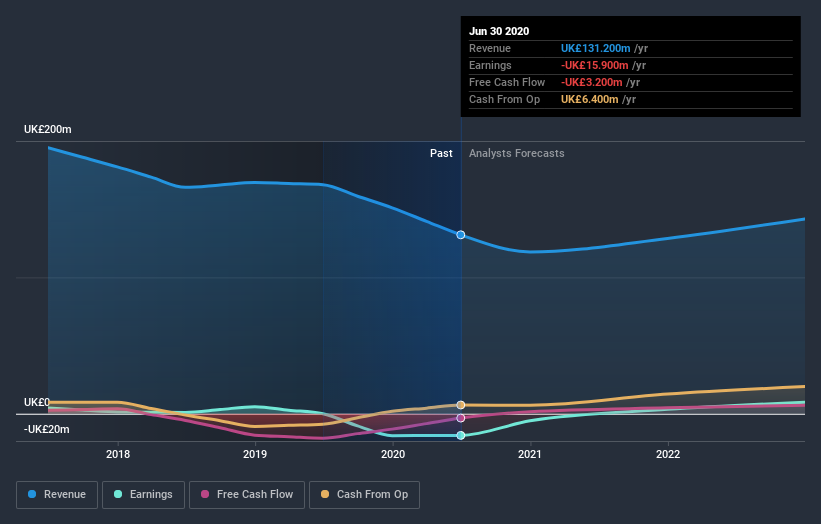

Dialight wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years Dialight saw its revenue shrink by 2.6% per year. While far from catastrophic that is not good. The share price decline of 9% compound, over five years, is understandable given the company is losing money, and revenue is moving in the wrong direction. We don't think anyone is rushing to buy this stock. Not that many investors like to invest in companies that are losing money and not growing revenue.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Dialight's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Dialight shareholders are up 36% for the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 9% endured over half a decade. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Dialight better, we need to consider many other factors. For instance, we've identified 1 warning sign for Dialight that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance