Diamond Offshore (DO) Q3 Earnings Top, Rig Utilization Rises

Diamond Offshore Drilling, Inc. DO incurred third-quarter 2019 adjusted loss of 67 cents per share, narrower than the Zacks Consensus Estimate by a penny. However, it was wider than the year-ago loss of 26 cents.

Moreover, total revenues amounted to $254 million, down from $286.3 million in the year-ago quarter. The figure beat the Zacks Consensus Estimate of $247 million.

The better-than-expected results were primarily aided by higher rig utilization, and the startup of Ocean Apex and Ocean Endeavor. The positives were partially offset by lower average day rates and higher operating expenses.

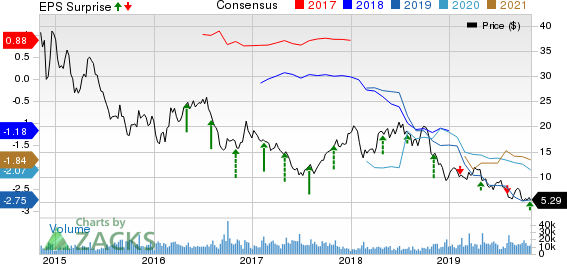

Diamond Offshore Drilling, Inc. Price, Consensus and EPS Surprise

Diamond Offshore Drilling, Inc. price-consensus-eps-surprise-chart | Diamond Offshore Drilling, Inc. Quote

Operational Performance

In the quarter under review, the company began operations of two premier moored rigs, Ocean Apex and Ocean Endeavor, which boosted the results. Ocean Endeavor was brought back from cold-stacked state.

The rigs recorded an average day rate of $253,000, lower than $333,000 in the prior year. Operational efficiency in the reported quarter was 96.6% compared with 97% in the year-ago period. However, rig utilization jumped to 65% from 54% a year earlier.

In the third quarter, Contract Drilling revenues dropped 13.7% year over year to approximately $242.3 million.

Total operating expenses in the quarter were recorded at $326.9 million, higher than $304.4 million in the year-ago quarter, primarily due to higher contract drilling costs.

Backlog

Notably, as of Oct 1, 2019, the company had a total contracted backlog of $1.8 billion. It secured around $90 million of additional backlog in the quarter under review.

Financials

As of Sep 30, 2019, Diamond Offshore had approximately $209.1 million in cash and cash equivalents, while long-term debt totaled $1,975.3 million. The debt-to-capitalization ratio was 37.4%.

Guidance

For the fourth quarter, the firm anticipates contract drilling revenues in the range of $235-$245 million. Contract drilling expenses for the final quarter of 2019 is expected between $195 million and $205 million. G&A expense through the quarter is expected to be around $17 million.

Moreover, its capital budget guidance for the full year is estimated in the range of $360-$380 million. The figure is expected to significantly decline in the next year.

Zacks Rank and Stocks to Consider

Currently, Diamond Offshore has a Zacks Rank #3 (Hold). Some better-ranked players in the energy space are Pembina Pipeline Corp. PBA, Matrix Service Company MTRX and Exterran Corporation EXTN. While Pembina sports a Zacks Rank #1 (Strong Buy), Matrix Service and Exterran hold a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Pembina’s 2019 earnings per share are expected to rise 21.5% year over year.

Matrix Service’s 2019 earnings per share are expected to rise 58.4% year over year.

Exterran’s top line for the current year is expected to rise around 5% year over year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.5% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Matrix Service Company (MTRX) : Free Stock Analysis Report

Diamond Offshore Drilling, Inc. (DO) : Free Stock Analysis Report

Pembina Pipeline Corp. (PBA) : Free Stock Analysis Report

Exterran Corporation (EXTN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance