Dianomi plc's (LON:DNM) Popularity With Investors Under Threat As Stock Sinks 34%

The Dianomi plc (LON:DNM) share price has fared very poorly over the last month, falling by a substantial 34%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 72% loss during that time.

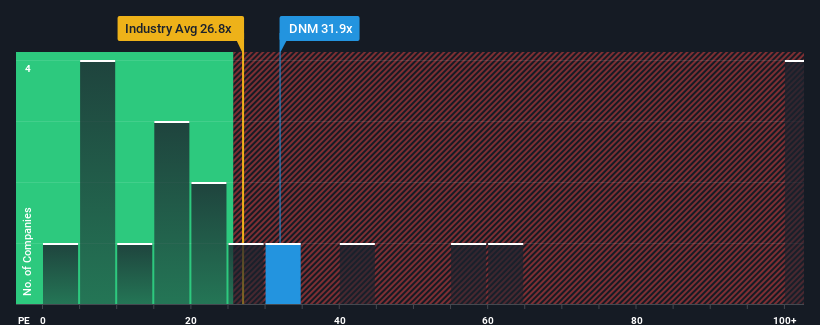

Although its price has dipped substantially, given close to half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") below 14x, you may still consider Dianomi as a stock to avoid entirely with its 31.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

We'd have to say that with no tangible growth over the last year, Dianomi's earnings have been unimpressive. One possibility is that the P/E is high because investors think the benign earnings growth will improve to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Dianomi

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Dianomi will help you shine a light on its historical performance.

Is There Enough Growth For Dianomi?

Dianomi's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. So it seems apparent to us that the company has struggled to grow earnings meaningfully over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.2% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that Dianomi is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Dianomi's P/E?

A significant share price dive has done very little to deflate Dianomi's very lofty P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Dianomi currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You need to take note of risks, for example - Dianomi has 2 warning signs (and 1 which is significant) we think you should know about.

You might be able to find a better investment than Dianomi. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance