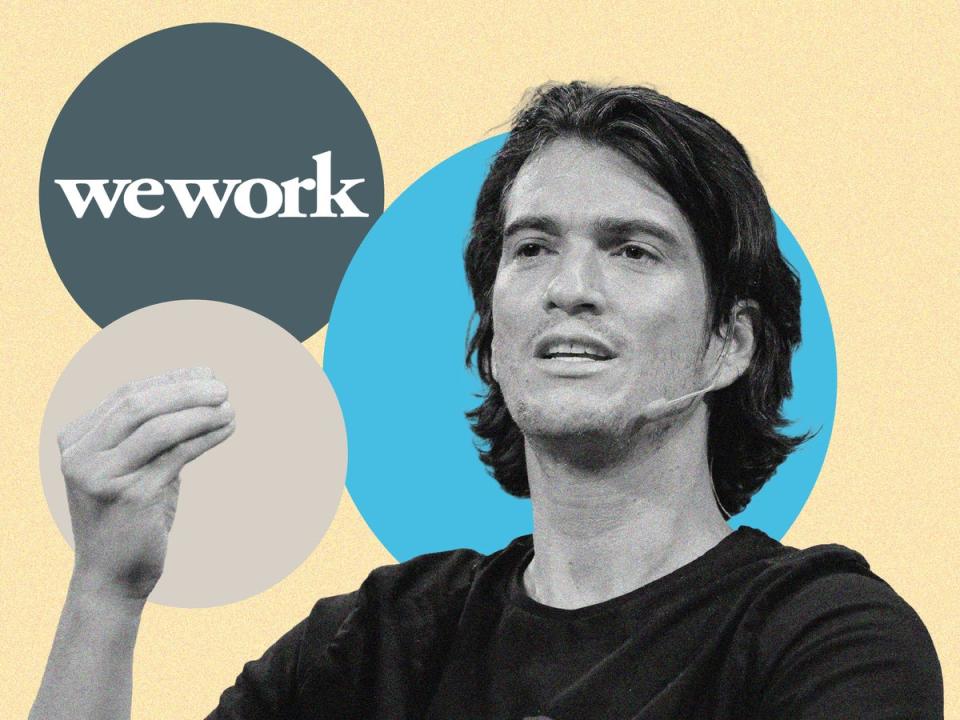

How did Adam Neumann fail up by $350m after flaming out at WeWork? Minority and female entrepreneurs have an idea

Arion Long recalls meeting Adam Neumann when she attended the WeWork creator awards in 2017 while seeking seed money for her organic menstrual product startup Femly.

The six foot five Mr Neumann was at once relatable and larger than life, she says.

After the meeting, WeWork put on one of its legendary booze-fuelled parties, with liquor and cheeseburgers “on tap”.

Ms Long told The Independent she had been inspired by Mr Neumann’s initial success.

But after toiling for years to attract the seed money that would grow her business, last week’s news that Mr Neumann had received $350m for his new real estate venture Flow was a kick in the guts.

“To watch the rise of WeWork and all of the public scandal surrounding his exit, I was extremely surprised to see the $350m investment in Flow,” the Baltimore-based businesswoman told The Independent.

“I just wish that I saw that level of support being placed on minority founders like myself.”

Ms Long founded Femly after being diagnosed with a tumour which she believes was caused by chemicals contained in women’s reproductive care products.

While in the process of growing Femly as an organic, eco-friendly alternative, she lost her daughter to stillbirth.

She’s learned through dozens of meetings with venture capitalists and while vying for seed capital in Shark Tank-like pitch competitions that the playing field is far from even.

“As a black woman, the way that I have to navigate this space is very different. I have to think down to details like am I going to wear my wedding ring? Am I going to straighten my hair or put on red lipstick? Put on a dress, put on a suit or wear my Gucci handbag?

“Every step that I take is very intentional,” she told The Independent.

The New York Times revealed last week that Silicon Valley venture capital firm Andreessen Horowitz had invested $350m in Mr Neumann’s latest real estate venture Flow, putting its valuation at more than $1bn.

Mr Neumann is reportedly seeking to transform the residential rental market in a similar mould to how WeWork tried to revolutionise office spaces.

He has purchased more than 3,000 apartment units in Miami, Fort Lauderdale, Atlanta and Nashville with plans to “overhaul the housing rental market”.

Details about the new venture are scarce: the website simply states: “Live life in Flow”, and that it is launching in 2023. The business is yet to generate any revenue.

The investment came soon after Mr Neumann raised $70m for a separate startup Flowcarbon, a blockchain-enabled carbon credit trading platform.

The near half-billion combined investment in the scandal-plagued founder sparked a furious backlash among some in the investing community.

“This is disgusting,” Kate Brodock, a general partner at the W Fund which aims to help female-led startups, tweeted.

“Firms like this perpetuate over and over again a traditional system that favours a small, homogenous set of founders,” she said.

For Ms Long, it simply confirmed an inherent bias in how venture capital is doled out.

“Black women are the ones that thrive in culture. Most of pop culture, entertainment culture, business culture, beauty and wellness is made off the backs of black women. And yet we’re not funded,” she told The Independent.

“I’m not angry at Adam. I just want the same type of grace to flow my way.”

In WeCrashed, the Apple TV drama that delved into the stratospheric rise and equally precipitous fall of Mr Neumann, the WeWork co-founder was portrayed by Jared Leto as a messianic figure who appeared uniquely ill-suited to running a large corporation.

In the ‘based on a true story’ retelling, Mr Neumann oversaw the unravelling of WeWork’s attempts to go public as it was beset by a booze-fuelled frat boy culture, drug taking and demeaning treatment towards staff.

WeWork’s 2019 IPO failed, 2,400 staff were laid off, and tens of billions in investor money was lost, while Mr Neumann exited the firm with a half-billion dollar payout.

Far from ruining Mr Neumann’s reputation, it appears to have only enhanced the mythology surrounding the unconventional 43-year-old businessman, who grew up on a kibbutz in Israel.

Leslie Feinzaig, founder and managing director of the venture fund Graham & Walker, told The Independent she wasn’t surprised that Mr Neumann had bounced back, but was taken aback by the size of the investment.

“My first thought was what the hell is he building? How the hell did he close for $350m for a company that hasn’t even launched? What is underneath it? I don’t think we know,” she said.

At a time of great economic uncertainty, when many companies were firing staff or shutting down entirely, Mr Neumann appeared to be operating in a “different reality”.

“This guy showed extremely questionable judgment in his last endeavour, at a scale that most of us can only imagine.”

Andresseen Horowitz’s investment in Flow dwarfed the total amount of funding that went to black-founded startups in the in the second quarter of this year, according to analysis by Crunchbase.

Just $324m went to new ventures started by people of colour, down from $1.2bn the previous quarter.

And female-founded startups raised $1.47bn in venture funding in the first three months of 2022, according to Pitchbook, and accounted for just two per cent of total investments in 2021.

Ms Feinzaig said that America was built on giving second chances to entrepreneurs, but they didn’t seem to be distributed equally.

This glorification of founders as super heroes who could solve any earthly problem arguably began with Apple co-founder Steve Jobs, and has gathered in steam with the likes of Elon Musk and Mark Zuckerburg.

Ms Feinzaig said she had seen female founders flame out without getting the kind of second chance that Mr Neuman received.

“I wish some of these women had the chance to fail up,” she told The Independent.

Henri Pierre-Jacques, managing partner of investment firm Harlem Capital, told The Independent that venture capital funding was often based on “pattern recognition” - where a founder went to college, what they look like, who they know.

“We use resumes to quickly assess someone and that assessment is largely school and jobs. This is no different in (venture capitalism).”

He said WeCrashed appeared to have glorified toxic work culture, while Mr Neumann had reemerged “like nothing ever happened”.

“We can’t expect the bad part of startup culture of narcissism, workaholism, sexism, racism, fraud, to stop if we keep backing the same people,” he wrote on a viral Linkedin post.

Andreessen Horowitz and Flow did not respond to requests for comment. Mr Neumann could not be reached.

In a glowing blog post announcing the $350m investment in Flow, Andreessen Horowitz co-founder Marc Andreessen called Mr Neumann a “visionary leader”.

Mr Andreessen acknowledged the WeWork founder’s rocky past, but suggested that would help him succeed this time around.

“For Adam, the successes and lessons are plenty and we are excited to go on this journey with him and his colleagues building the future of living,” Mr Andreessen added.

Correction: An earlier version of the story incorrectly said Mr Neumann had received a $1.7bn exit payout from WeWork.

Yahoo Finance

Yahoo Finance