Did Changing Sentiment Drive BEST's (NYSE:BEST) Share Price Down By 40%?

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the BEST Inc. (NYSE:BEST) share price slid 40% over twelve months. That contrasts poorly with the market return of 1.6%. BEST hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Unfortunately the share price momentum is still quite negative, with prices down 8.3% in thirty days. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

Check out our latest analysis for BEST

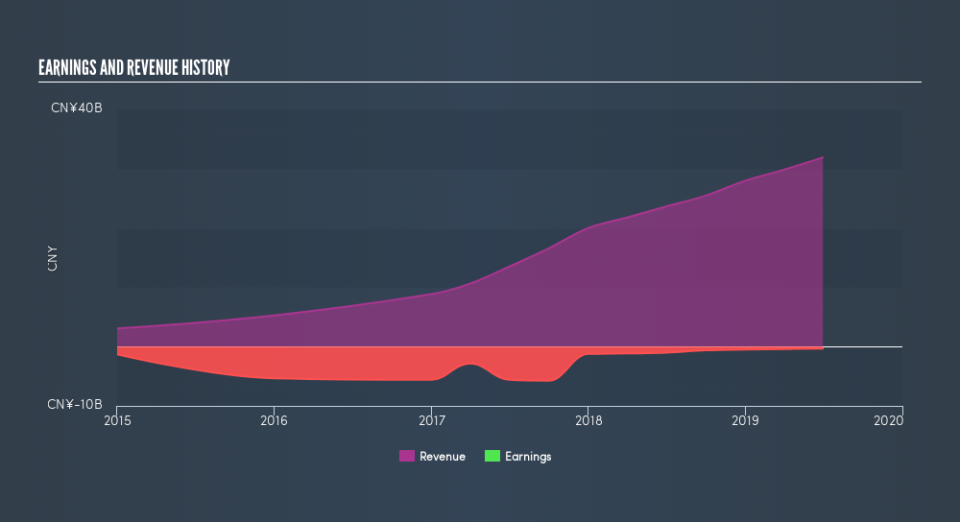

Given that BEST didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year BEST saw its revenue grow by 35%. That's definitely a respectable growth rate. Unfortunately that wasn't good enough to stop the share price dropping 40%. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

BEST is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for BEST in this interactive graph of future profit estimates.

A Different Perspective

While BEST shareholders are down 40% for the year, the market itself is up 1.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 8.6% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like BEST better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance