Did Changing Sentiment Drive Cambria Africa's (LON:CMB) Share Price Down A Painful 78%?

Cambria Africa plc (LON:CMB) shareholders should be happy to see the share price up 23% in the last month. But that hardly compensates for the shocking decline over the last twelve months. Indeed, the share price is down a whopping 78% in the last year. Arguably, the recent bounce is to be expected after such a bad drop. Only time will tell if the company can sustain the turnaround.

Check out our latest analysis for Cambria Africa

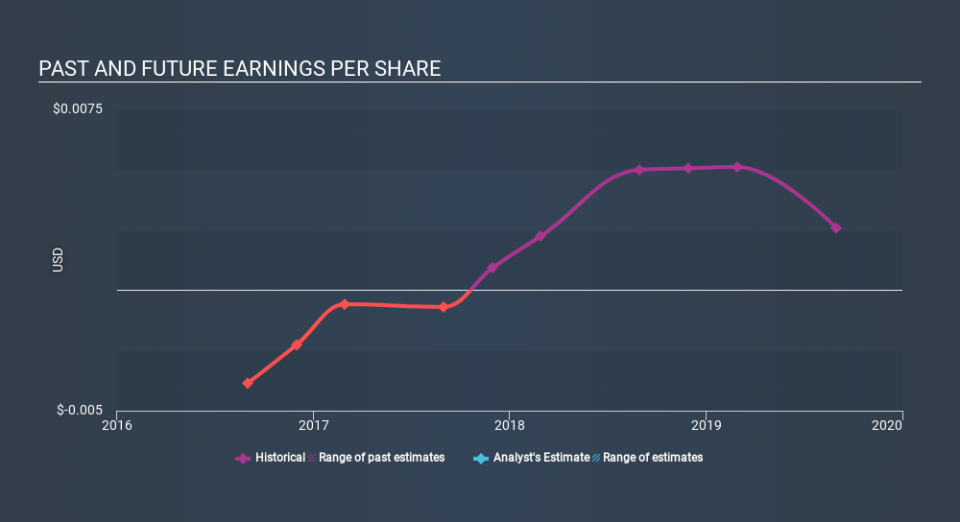

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unfortunately Cambria Africa reported an EPS drop of 48% for the last year. The share price decline of 78% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders are more nervous about the business. The P/E ratio of 1.28 also points to the negative market sentiment.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Cambria Africa's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Cambria Africa shares, which performed worse than the market, costing holders 78%. The market shed around 11%, no doubt weighing on the stock price. Shareholders have lost 38% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Cambria Africa better, we need to consider many other factors. Take risks, for example - Cambria Africa has 4 warning signs (and 2 which can't be ignored) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance