Did Changing Sentiment Drive Express's (NYSE:EXPR) Share Price Down A Painful 78%?

It is a pleasure to report that the Express, Inc. (NYSE:EXPR) is up 37% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Indeed, the share price is down a whopping 78% in that time. So we don't gain too much confidence from the recent recovery. The million dollar question is whether the company can justify a long term recovery.

See our latest analysis for Express

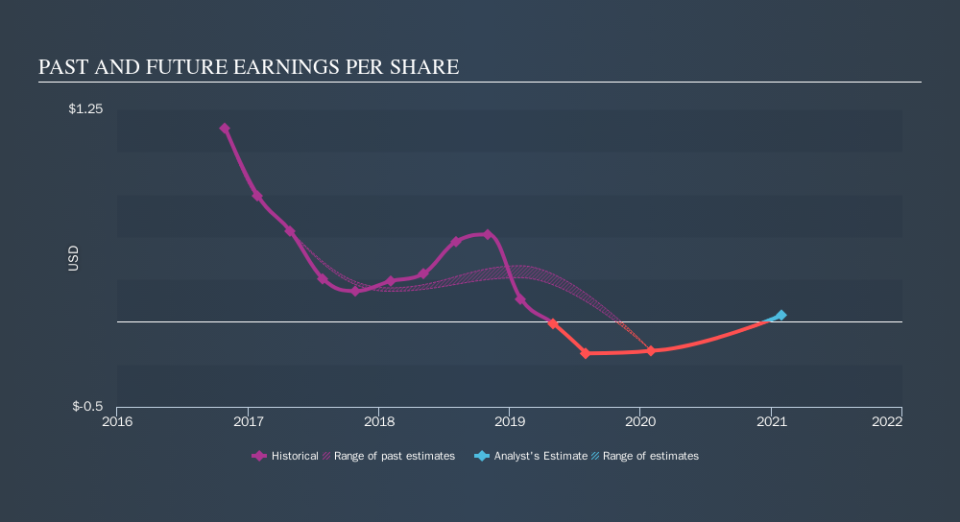

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

In the last half decade Express saw its share price fall as its EPS declined below zero. At present it's hard to make valid comparisons between EPS and the share price. But we would generally expect a lower price, given the situation.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on Express's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 15% in the last year, Express shareholders lost 62%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 26% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Express may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance