Did Changing Sentiment Drive FullSix's (BIT:FUL) Share Price Down A Worrying 68%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

FullSix S.p.A. (BIT:FUL) shareholders should be happy to see the share price up 10% in the last month. But that is little comfort to those holding over the last half decade, sitting on a big loss. In that time the share price has delivered a rude shock to holders, who find themselves down 68% after a long stretch. So we're not so sure if the recent bounce should be celebrated. But it could be that the fall was overdone.

See our latest analysis for FullSix

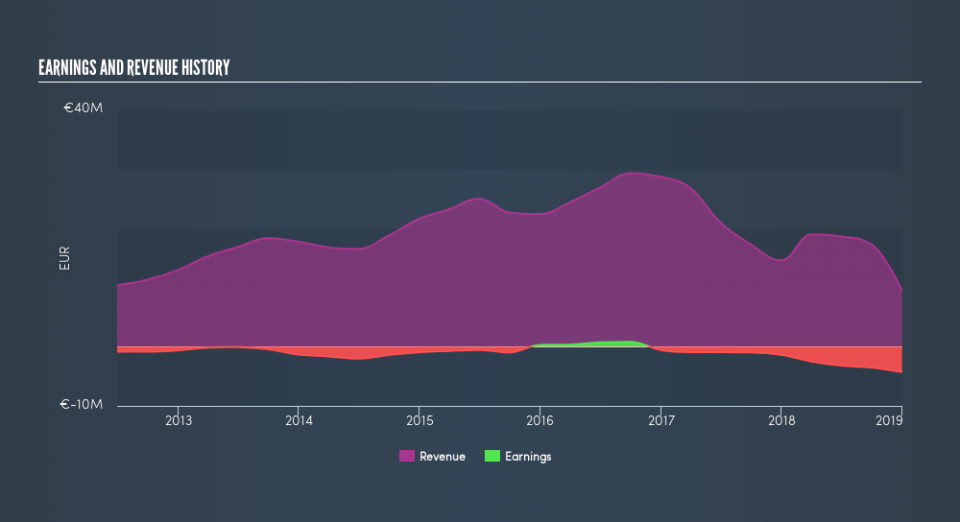

Because FullSix is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years FullSix saw its revenue shrink by 2.9% per year. That's not what investors generally want to see. The share price decline of 20% compound, over five years, is understandable given the company is losing money, and revenue is moving in the wrong direction. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Not that many investors like to invest in companies that are losing money and not growing revenue.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market lost about 6.9% in the twelve months, FullSix shareholders did even worse, losing 19%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. However, the loss over the last year isn't as bad as the 20% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. You could get a better understanding of FullSix's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course FullSix may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance