Did Changing Sentiment Drive Hornby's (LON:HRN) Share Price Down A Worrying 70%?

Statistically speaking, long term investing is a profitable endeavour. But no-one is immune from buying too high. For example the Hornby PLC (LON:HRN) share price dropped 70% over five years. That's not a lot of fun for true believers. Furthermore, it's down 12% in about a quarter. That's not much fun for holders. However, one could argue that the price has been influenced by the general market, which is down 23% in the same timeframe.

View our latest analysis for Hornby

Hornby wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years Hornby saw its revenue shrink by 13% per year. That puts it in an unattractive cohort, to put it mildly. Arguably, the market has responded appropriately to this business performance by sending the share price down 21% (annualized) in the same time period. It's fair to say most investors don't like to invest in loss making companies with falling revenue. This looks like a really risky stock to buy, at a glance.

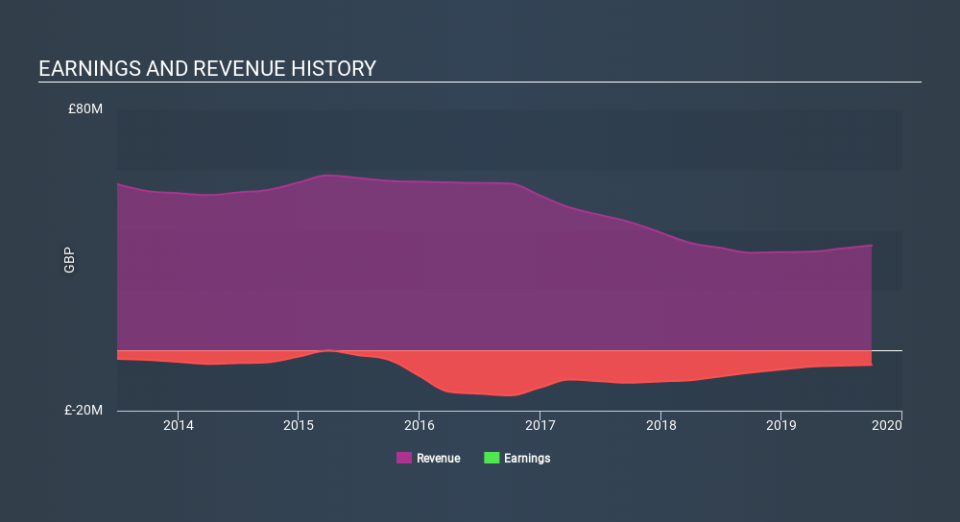

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While it's certainly disappointing to see that Hornby shares lost 9.5% throughout the year, that wasn't as bad as the market loss of 15%. What is more upsetting is the 21% per annum loss investors have suffered over the last half decade. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Hornby is showing 4 warning signs in our investment analysis , and 1 of those is concerning...

Hornby is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance