Did Changing Sentiment Drive Rosslyn Data Technologies' (LON:RDT) Share Price Down A Painful 70%?

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. For example, we sympathize with anyone who was caught holding Rosslyn Data Technologies plc (LON:RDT) during the five years that saw its share price drop a whopping 70%. And it's not just long term holders hurting, because the stock is down 45% in the last year. Shareholders have had an even rougher run lately, with the share price down 36% in the last 90 days. Of course, this share price action may well have been influenced by the 25% decline in the broader market, throughout the period.

View our latest analysis for Rosslyn Data Technologies

Rosslyn Data Technologies wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over five years, Rosslyn Data Technologies grew its revenue at 22% per year. That's well above most other pre-profit companies. So it's not at all clear to us why the share price sunk 22% throughout that time. It could be that the stock was over-hyped before. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

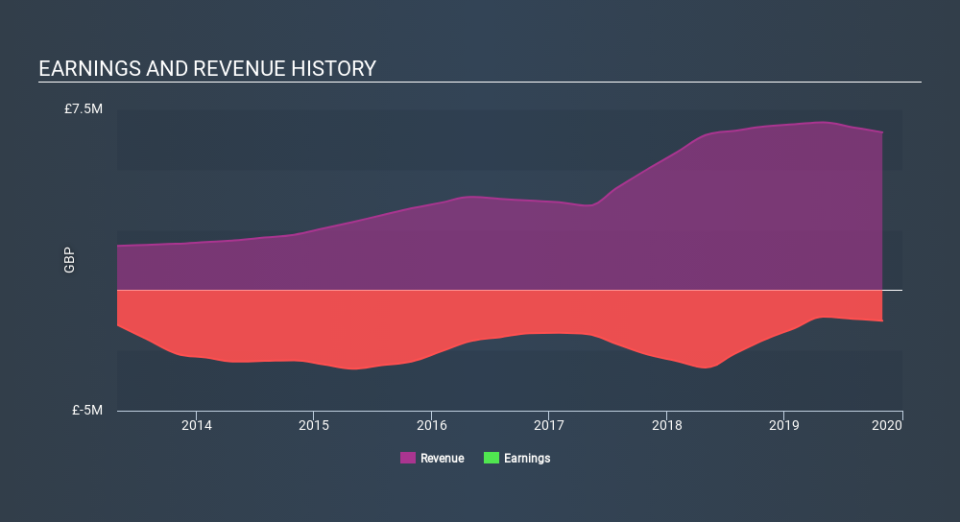

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 17% in the twelve months, Rosslyn Data Technologies shareholders did even worse, losing 45%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 22% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Rosslyn Data Technologies has 5 warning signs (and 2 which are concerning) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance